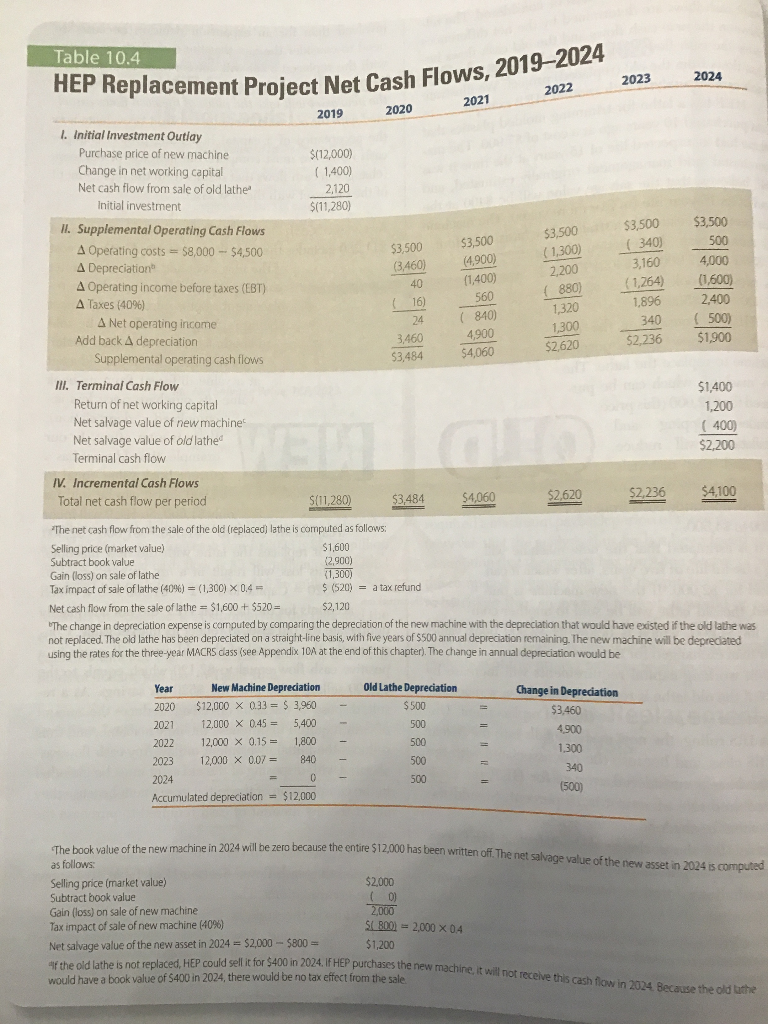

Question: Needs to be set up in a cash flow spreadsheet 2023 2024 t Net Cash Flows, 2019-2024 2022 2020 2021 Table 10.4 HEP Replacement Project

Needs to be set up in a cash flow spreadsheet

2023 2024 t Net Cash Flows, 2019-2024 2022 2020 2021 Table 10.4 HEP Replacement Project Net Cash 2019 1. Initial Investment Outlay Purchase price of new machine $(12,000) Change in net working capital ( 1,400) Net cash flow from sale of old lathe 2,120 Initial investment $(11,280) II. Supplemental Operating Cash Flows Operating costs = 58,000 - $4,500 $3,500 A Depreciation A Operating income before taxes (EBT) 40 A Taxes (40%) A Net operating income Add back A depreciation 3,460 $3.484 Supplemental operating cash flows $3,500 (3,460) $3,500 (4,900) (1,400) 560 (1,300) 2,200 $3,500 (340) 3,160 (1,264) 1,896 340 $2.236 $3,500 500 4,000 (1,600) 2.400 (500) $1,900 ( 16) (880) 1,320 1.300 (840) 4,900 620 $4,060 III. Terminal Cash Flow Return of net working capital Net salvage value of new machine Net salvage value of old lathed Terminal cash flow IV. Incremental Cash Flows Total net cash flow per period $1,400 1,200 (400) $2,200 S(11,280) $3,484 $4,060 $4,100 $2,620 $2,236 The net cash flow from the sale of the old (replaced) lathe is computed as follows: Selling price (market value) $1,600 Subtract book value 12,900) Gain (loss) on sale of lathe 11,300) Tax impact of sale of lathe (40%) = (1,300) X 0.4 $ (520) = a tax refund Net cash flow from the sale of lathe = $1,600 + $520 $2,120 The change in depreciation expense is computed by comparing the depreciation of the new machine with the depreciation that would have existed if the old lathe was not replaced. The old lathe has been depreciated on a straight-line basis, with five years of $500 annual depreciation remaining. The new machine will be depreciated using the rates for the three-year MACRS dass (see Appendix 10A at the end of this chapter). The change in annual depreciation would be Old Lathe Depreciation $500 500 New Machine Depreciation 2020 $12,000 X 0.33 = $ 3,950 2021 12.000 X 0.45 = 5,400 2022 12,000 X 0.15 = 1,800 2023 12,000 X 0.07 = 840 2024 Accumulated depreciation = $12,000 Change in Depreciation $3,460 4900 1,300 340 (500) will be zero because the entire $12,000 has been written off. The net salvage value of the new asset in 2024 is computed The book value of the new machine in 2024 will be zero because the entire $12,000 has been written as follows: Selling price (market value) $2,000 Subtract book value ( 0) Gain (loss) on sale of new machine 2,000 Tax impact of sale of new machine (40%) SC8001 = 2,000 X 04 Net salvage value of the new asset in 2024 = $2,000 - $800 $1,200 the old lathe is not replaced, HEP could sell it for $400 in 2024. IF HEP purchases would have a book value of $400 in 2024, there would be no tax effect from the sale for an in 2024. IF HEP purchases the new machine. It will not receive this cash flow in 2024 Because the old the abandoned before production starts on the second year of inventory. The machinery would be resold at the book value at the end of the 1st year. The fixed cost is $400,000 per year and the variable cost are 35% of revenue. The tax rate is at 40%. Project 4 This project is over the course of 6 years. You will need an investment of $3 million in Year 0, $1 million for equipment, and $2 million for inventory for year 1 production. Depreciation is accelerated based on IRS tables for computers from page 440/441 in your textbook, and salvage value will be $100,000. Total inventory produced will be 90,000 units, and sales are expected to be 15,000 units per year. Prices are expected to be sold to the retailers at $40. There is a 35% chance the Economy worsens after year 2, then sales are estimated to be 35% less than the previous year each year, prices will fall by 15% less than the previous year each year, and the remaining inventory at year 5 will become obsolete and destroyed. The fixed cost of creating is $200,000 per year and the variable cost is 35% of revenue. The estimated tax rate is 40%. 2023 2024 t Net Cash Flows, 2019-2024 2022 2020 2021 Table 10.4 HEP Replacement Project Net Cash 2019 1. Initial Investment Outlay Purchase price of new machine $(12,000) Change in net working capital ( 1,400) Net cash flow from sale of old lathe 2,120 Initial investment $(11,280) II. Supplemental Operating Cash Flows Operating costs = 58,000 - $4,500 $3,500 A Depreciation A Operating income before taxes (EBT) 40 A Taxes (40%) A Net operating income Add back A depreciation 3,460 $3.484 Supplemental operating cash flows $3,500 (3,460) $3,500 (4,900) (1,400) 560 (1,300) 2,200 $3,500 (340) 3,160 (1,264) 1,896 340 $2.236 $3,500 500 4,000 (1,600) 2.400 (500) $1,900 ( 16) (880) 1,320 1.300 (840) 4,900 620 $4,060 III. Terminal Cash Flow Return of net working capital Net salvage value of new machine Net salvage value of old lathed Terminal cash flow IV. Incremental Cash Flows Total net cash flow per period $1,400 1,200 (400) $2,200 S(11,280) $3,484 $4,060 $4,100 $2,620 $2,236 The net cash flow from the sale of the old (replaced) lathe is computed as follows: Selling price (market value) $1,600 Subtract book value 12,900) Gain (loss) on sale of lathe 11,300) Tax impact of sale of lathe (40%) = (1,300) X 0.4 $ (520) = a tax refund Net cash flow from the sale of lathe = $1,600 + $520 $2,120 The change in depreciation expense is computed by comparing the depreciation of the new machine with the depreciation that would have existed if the old lathe was not replaced. The old lathe has been depreciated on a straight-line basis, with five years of $500 annual depreciation remaining. The new machine will be depreciated using the rates for the three-year MACRS dass (see Appendix 10A at the end of this chapter). The change in annual depreciation would be Old Lathe Depreciation $500 500 New Machine Depreciation 2020 $12,000 X 0.33 = $ 3,950 2021 12.000 X 0.45 = 5,400 2022 12,000 X 0.15 = 1,800 2023 12,000 X 0.07 = 840 2024 Accumulated depreciation = $12,000 Change in Depreciation $3,460 4900 1,300 340 (500) will be zero because the entire $12,000 has been written off. The net salvage value of the new asset in 2024 is computed The book value of the new machine in 2024 will be zero because the entire $12,000 has been written as follows: Selling price (market value) $2,000 Subtract book value ( 0) Gain (loss) on sale of new machine 2,000 Tax impact of sale of new machine (40%) SC8001 = 2,000 X 04 Net salvage value of the new asset in 2024 = $2,000 - $800 $1,200 the old lathe is not replaced, HEP could sell it for $400 in 2024. IF HEP purchases would have a book value of $400 in 2024, there would be no tax effect from the sale for an in 2024. IF HEP purchases the new machine. It will not receive this cash flow in 2024 Because the old the abandoned before production starts on the second year of inventory. The machinery would be resold at the book value at the end of the 1st year. The fixed cost is $400,000 per year and the variable cost are 35% of revenue. The tax rate is at 40%. Project 4 This project is over the course of 6 years. You will need an investment of $3 million in Year 0, $1 million for equipment, and $2 million for inventory for year 1 production. Depreciation is accelerated based on IRS tables for computers from page 440/441 in your textbook, and salvage value will be $100,000. Total inventory produced will be 90,000 units, and sales are expected to be 15,000 units per year. Prices are expected to be sold to the retailers at $40. There is a 35% chance the Economy worsens after year 2, then sales are estimated to be 35% less than the previous year each year, prices will fall by 15% less than the previous year each year, and the remaining inventory at year 5 will become obsolete and destroyed. The fixed cost of creating is $200,000 per year and the variable cost is 35% of revenue. The estimated tax rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts