Question: needs. Why Study Problems Select Study Problems are available in MyLab Finance. The xl icon indicates problems in Excel format available in MyLab Finance. Mytab

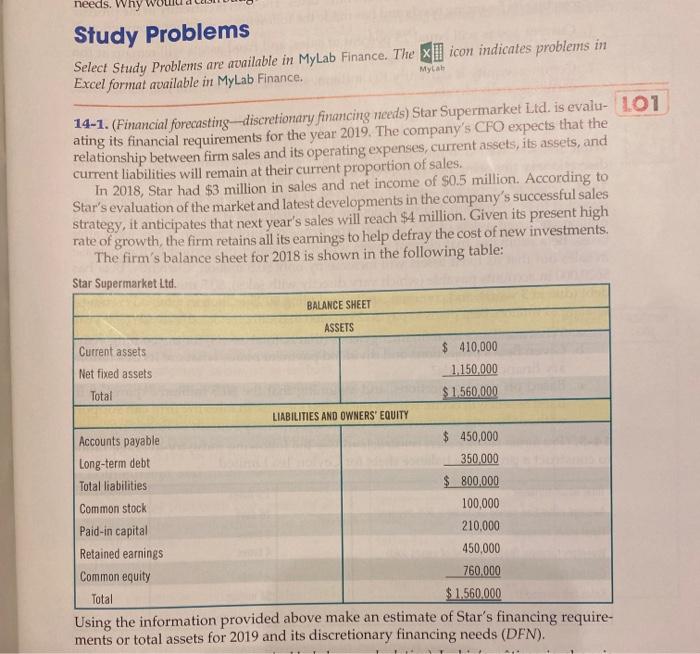

needs. Why Study Problems Select Study Problems are available in MyLab Finance. The xl icon indicates problems in Excel format available in MyLab Finance. Mytab 14-1. (Financial forecasting-discretionary financing needs) Star Supermarket Ltd. is evalu- 101 ating its financial requirements for the year 2019. The company's CFO expects that the relationship between firm sales and its operating expenses, current assets, its assets, and current liabilities will remain at their current proportion of sales. In 2018, Star had $3 million in sales and net income of $0.5 million. According to Star's evaluation of the market and latest developments in the company's successful sales strategy, it anticipates that next year's sales will reach $4 million. Given its present high rate of growth, the firm retains all its earnings to help defray the cost of new investments The firm's balance sheet for 2018 is shown in the following table: Star Supermarket Ltd. BALANCE SHEET ASSETS Current assets $ 410,000 Net fixed assets 1.150.000 Total $ 1.560.000 LIABILITIES AND OWNERS' EQUITY Accounts payable $ 450,000 Long-term debt 350.000 Total liabilities $ 800,000 Common stock 100.000 Paid-in capital 210,000 Retained earnings 450.000 Common equity 760,000 Total $1.560.000 Using the information provided above make an estimate of Star's financing require- ments or total assets for 2019 and its discretionary financing needs (DFN). needs. Why Study Problems Select Study Problems are available in MyLab Finance. The xl icon indicates problems in Excel format available in MyLab Finance. Mytab 14-1. (Financial forecasting-discretionary financing needs) Star Supermarket Ltd. is evalu- 101 ating its financial requirements for the year 2019. The company's CFO expects that the relationship between firm sales and its operating expenses, current assets, its assets, and current liabilities will remain at their current proportion of sales. In 2018, Star had $3 million in sales and net income of $0.5 million. According to Star's evaluation of the market and latest developments in the company's successful sales strategy, it anticipates that next year's sales will reach $4 million. Given its present high rate of growth, the firm retains all its earnings to help defray the cost of new investments The firm's balance sheet for 2018 is shown in the following table: Star Supermarket Ltd. BALANCE SHEET ASSETS Current assets $ 410,000 Net fixed assets 1.150.000 Total $ 1.560.000 LIABILITIES AND OWNERS' EQUITY Accounts payable $ 450,000 Long-term debt 350.000 Total liabilities $ 800,000 Common stock 100.000 Paid-in capital 210,000 Retained earnings 450.000 Common equity 760,000 Total $1.560.000 Using the information provided above make an estimate of Star's financing require- ments or total assets for 2019 and its discretionary financing needs (DFN)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts