Question: UI 115K Study Problems Select Study Problems are available in MyLab Finance. The X Excel format available in MyLab Finance. icon indicates problems in MyLab

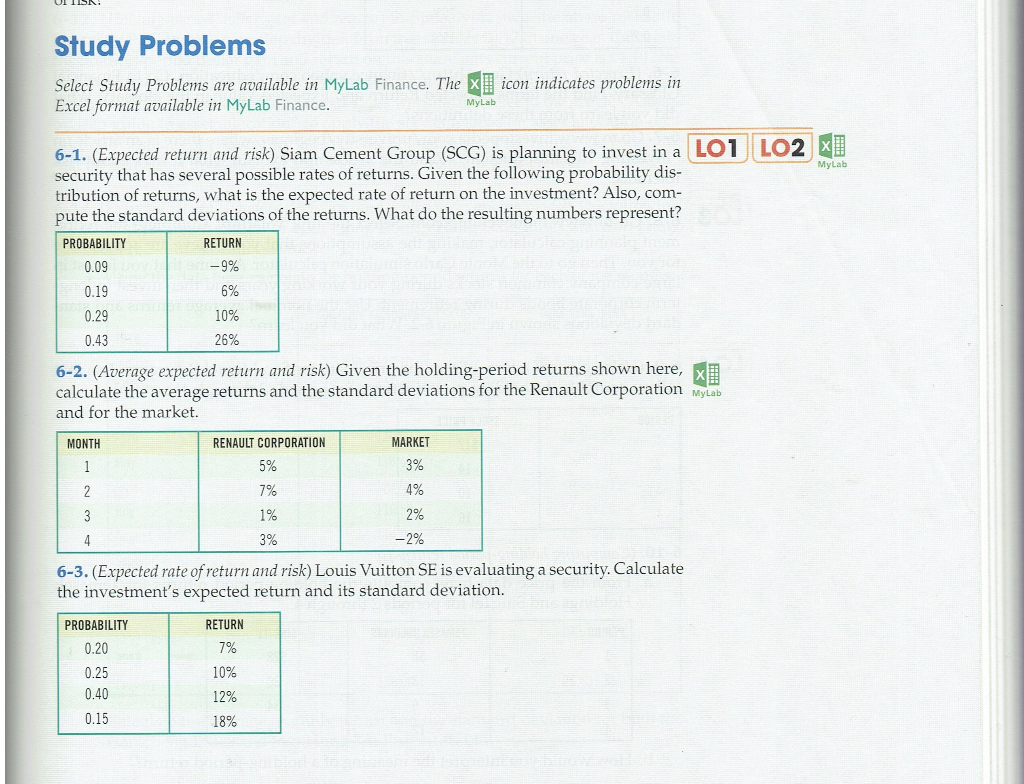

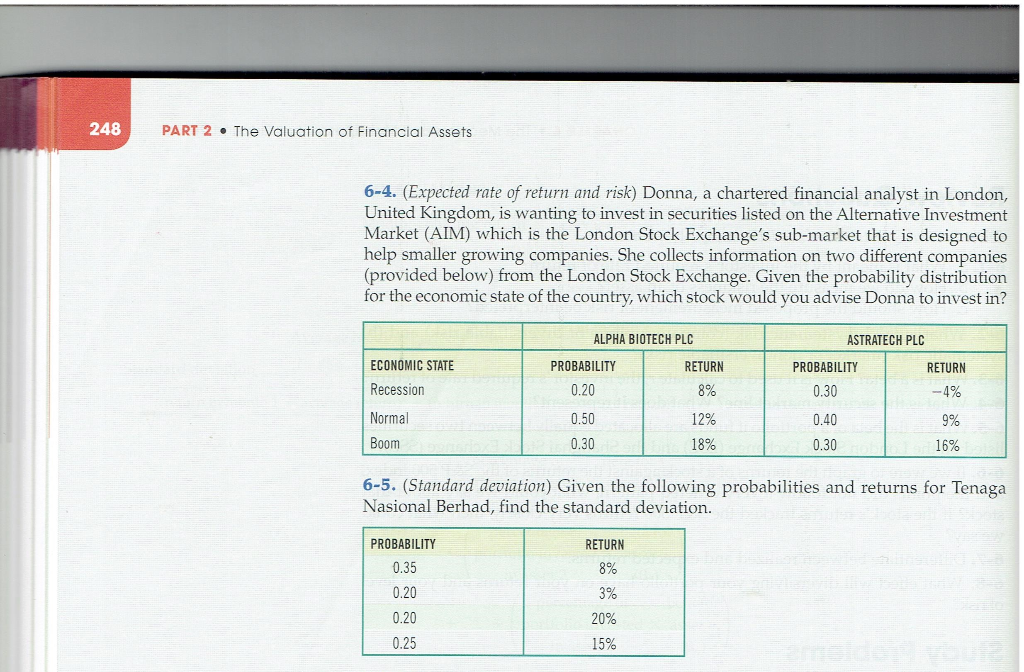

UI 115K Study Problems Select Study Problems are available in MyLab Finance. The X Excel format available in MyLab Finance. icon indicates problems in MyLab 6-1. (Expected return and risk) Siam Cement Group (SCG) is planning to invest in a a LOL LO2 x) security that has several possible rates of returns. Given the following probability dis- tribution of returns, what is the expected rate of return on the investment? Also, com- pute the standard deviations of the returns. What do the resulting numbers represent? PROBABILITY RETURN 0.09 -9% 6% 0.29 10% 0.43 26% 0.19 6-2. (Average expected return and risk) Given the holding-period returns shown here, calculate the average returns and the standard deviations for the Renault Corporation MyLab and for the market. MONTH RENAULT CORPORATION MARKET 5% 3% 4% 2% 3% -2% 6-3. (Expected rate of return and risk) Louis Vuitton SE is evaluating a security. Calculate the investment's expected return and its standard deviation. PROBABILITY RETURN 0.20 7% 10% 0.25 0.40 0.15 12% 18% 248 PART 2 The Valuation of Financial Assets 6-4. (Expected rate of return and risk) Donna, a chartered financial analyst in London, United Kingdom, is wanting to invest in securities listed on the Alternative Investment Market (AIM) which is the London Stock Exchange's sub-market that is designed to help smaller growing companies. She collects information on two different companies (provided below) from the London Stock Exchange. Given the probability distribution for the economic state of the country, which stock would you advise Donna to invest in? ALPHA BIOTECH PLC ASTRATECH PLC RETURN PROBABILITY 0.20 PROBABILITY 0.30 RETURN -4% ECONOMIC STATE Recession Normal Boom 0.50 12% 18% 0.40 0.30 9% 16% 0.30 6-5. (Standard deviation) Given the following probabilities and returns for Tenaga Nasional Berhad, find the standard deviation. RETURN 8% PROBABILITY 0.35 0.20 0.20 0.25 3% 20% 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts