Question: neeed step solution Exercise 11.5 (Forced Savings) Consider a two-period model of a small open endowment economy populated by households with preferences given by C

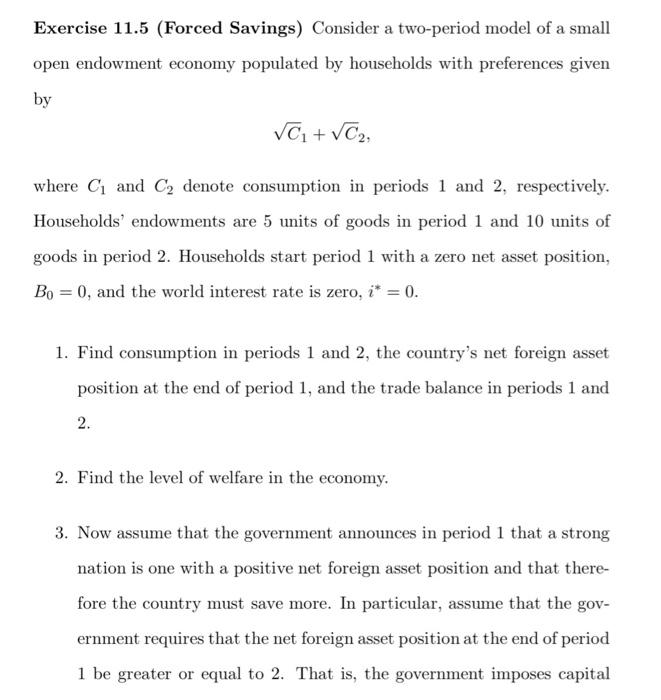

Exercise 11.5 (Forced Savings) Consider a two-period model of a small open endowment economy populated by households with preferences given by C + C2, where C and C denote consumption in periods 1 and 2, respectively. Households' endowments are 5 units of goods in period 1 and 10 units of goods in period 2. Households start period 1 with a zero net asset position, Bo = 0, and the world interest rate is zero, i* = 0. 1. Find consumption in periods 1 and 2, the country's net foreign asset position at the end of period 1, and the trade balance in periods 1 and 2. 2. Find the level of welfare in the economy. 3. Now assume that the government announces in period 1 that a strong nation is one with a positive net foreign asset position and that there- fore the country must save more. In particular, assume that the gov- ernment requires that the net foreign asset position at the end of period 1 be greater or equal to 2. That is, the government imposes capital controls of the form B2 2. Find the domestic interest rate that supports this allocation. 4. Find the level of welfare under capital controls and compare it to the level of welfare under free capital mobility. Provide intuition. Exercise 11.5 (Forced Savings) Consider a two-period model of a small open endowment economy populated by households with preferences given by C + C2, where C and C denote consumption in periods 1 and 2, respectively. Households' endowments are 5 units of goods in period 1 and 10 units of goods in period 2. Households start period 1 with a zero net asset position, Bo = 0, and the world interest rate is zero, i* = 0. 1. Find consumption in periods 1 and 2, the country's net foreign asset position at the end of period 1, and the trade balance in periods 1 and 2. 2. Find the level of welfare in the economy. 3. Now assume that the government announces in period 1 that a strong nation is one with a positive net foreign asset position and that there- fore the country must save more. In particular, assume that the gov- ernment requires that the net foreign asset position at the end of period 1 be greater or equal to 2. That is, the government imposes capital controls of the form B2 2. Find the domestic interest rate that supports this allocation. 4. Find the level of welfare under capital controls and compare it to the level of welfare under free capital mobility. Provide intuition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts