Question: nent: Chapter 17 Assignment Score: 0.00% 5 Problem 17-02 (MM Model with Corporate Taxes) Save Submit Assignment for Grading Question 2 of 5 Check My

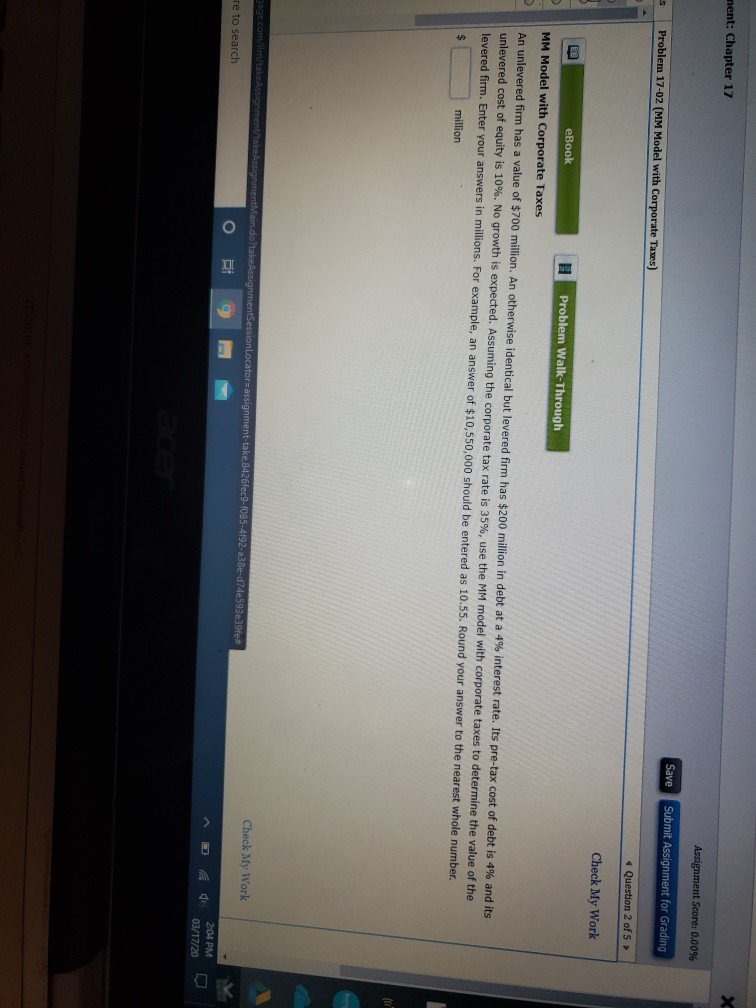

nent: Chapter 17 Assignment Score: 0.00% 5 Problem 17-02 (MM Model with Corporate Taxes) Save Submit Assignment for Grading Question 2 of 5 Check My Work eBook Problem Walk-Through MM Model with Corporate Taxes An unlevered firm has a value of $700 million. An otherwise identical but levered firm has $200 million in debt at a 4% interest rate. Its pre-tax cost of debt is 4% and its unlevered cost of equity is 10%. No growth is expected. Assuming the corporate tax rate is 35%, use the MM model with corporate taxes to determine the value of the levered firm. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to the nearest whole number. million goge.com /takeAssignment takessgnment Main do?takeAssignmentSession Locator=assignment-take, 8426fec9-1085-4192-a38e-d74e593e39fe re to search Check My Work di 204 PM 03/17/20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts