Question: Net Pay and Deductions Province: Manitoba ( current year ) Elizabeth's weekly gross pay is $ 3 8 0 . 4 5 . Her net

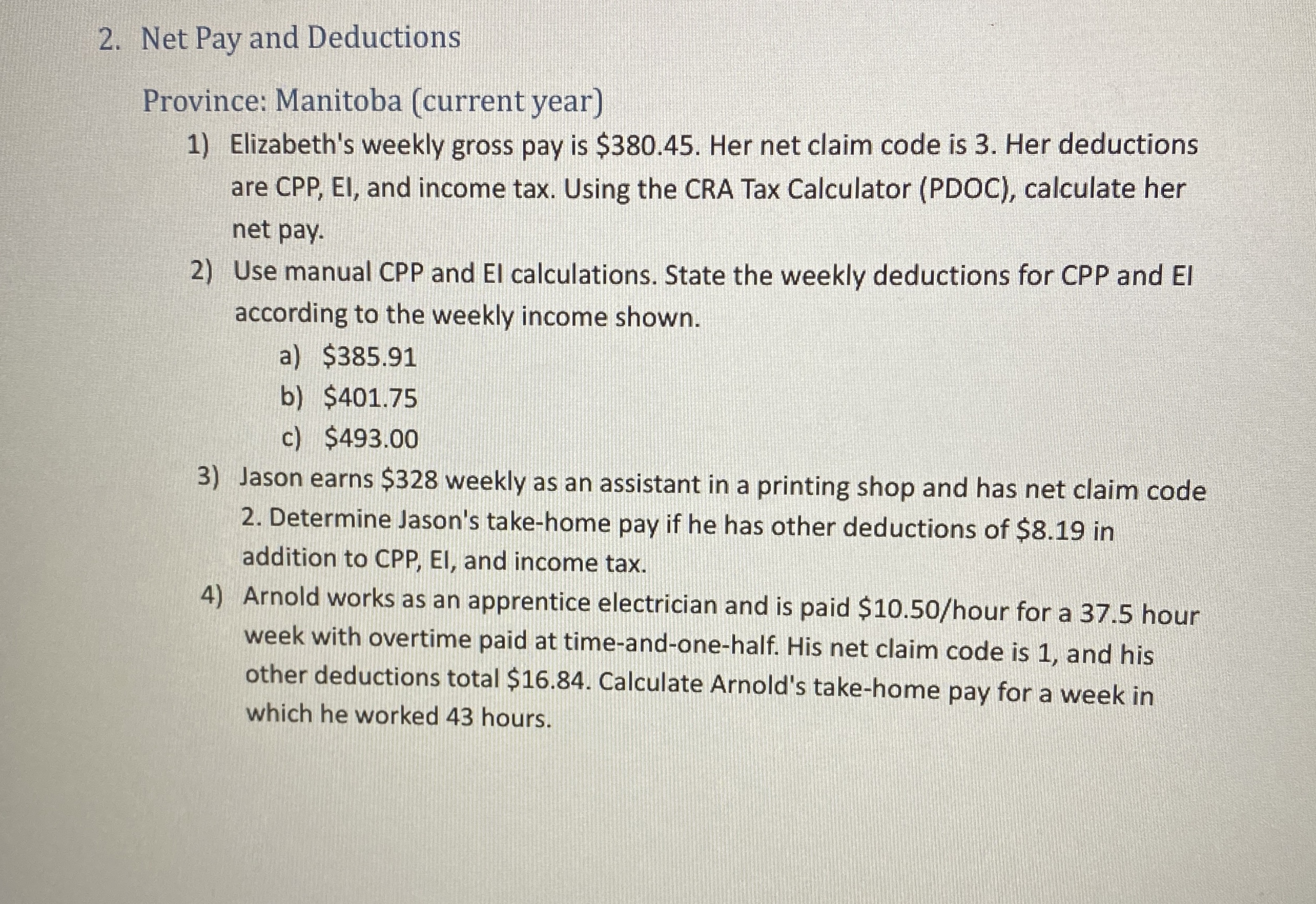

Net Pay and Deductions

Province: Manitoba current year

Elizabeth's weekly gross pay is $ Her net claim code is Her deductions are CPP EI and income tax. Using the CRA Tax Calculator PDOC calculate her net pay.

Use manual CPP and El calculations. State the weekly deductions for CPP and EI according to the weekly income shown.

a $

b $

c $

Jason earns $ weekly as an assistant in a printing shop and has net claim code Determine Jason's takehome pay if he has other deductions of $ in addition to CPP EI and income tax.

Arnold works as an apprentice electrician and is paid $hour for a hour week with overtime paid at timeandonehalf. His net claim code is and his other deductions total $ Calculate Arnold's takehome pay for a week in which he worked hours.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock