Question: Net Present Value Analysis for Chipotle - I am having trouble figuring this out! This study of Chipotle requires NPV analysis, there is the reported

Net Present Value Analysis for Chipotle - I am having trouble figuring this out!

This study of Chipotle requires NPV analysis, there is the reported 2019 figures and a proforma statement with both default projections and projections of a new strategy ive created.

I need assistance to construct the following:

1. NPV Table

2. Cost of the strategy

3. Clearly articulate subsequent pro forma cash flows for NPV analysis

4. Analyze NPV

5. EPS/EBIT table/analysis

Using the following rough financials:

| Reported | Pro Forma | Pro Forma | Pro Forma | Pro Forma | Pro Forma | Pro Forma | ||

| 2019 (Actual) | 2020 (Est.) | 20 New Strategy | 2021 (Est.) | 21 New Strategy | 2022(Est.) | 22 New Strategy | ||

| Statement of Income: | ||||||||

| Revenue | $5,586,369 | $5,728,104 | $5,600,101 | $6,219,011 | $6,086,991 | $6,864,110 | $7,150,110 |

| Total operating expenses | 5,142,411 | 5,299,511 | 5,356,311 | 5,688,196 | 5,761,193 | 6,124,891 | 6,354,891 |

| Net income | $350,158 | $367,125 | $269,968 | $475,411 | $309,411 | $615,912 | $728,142 |

| EPS Diluted | $12.38 | $13.40 | $10.40 | $19.83 | $14.89 | $26.30 | $19.10 |

*the last column appears to cut off but the 2022 new strategy # is 7,150,110

I appreciate any help/guidance.

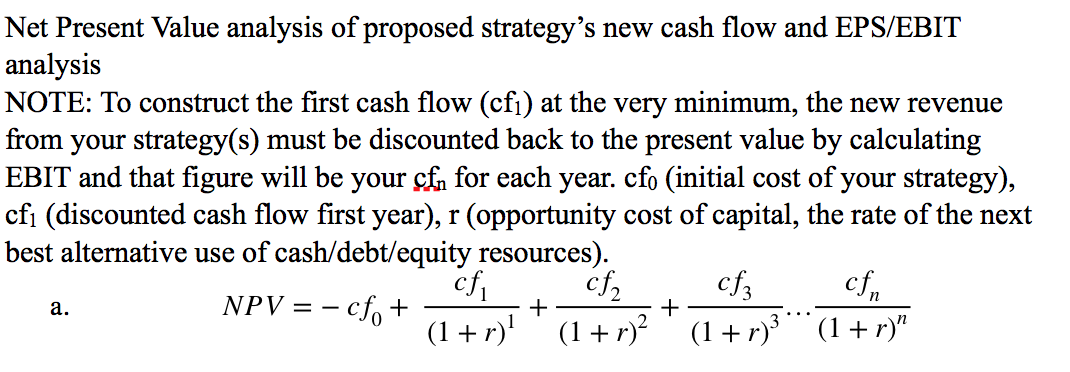

Net Present Value analysis of proposed strategy's new cash flow and EPS/EBIT analysis NOTE: To construct the first cash flow (cf) at the very minimum, the new revenue from your strategy(s) must be discounted back to the present value by calculating EBIT and that figure will be your cfn for each year. cfo (initial cost of your strategy), cfi (discounted cash flow first year), r (opportunity cost of capital, the rate of the next best alternative use of cash/debt/equity resources). a. NDU_oficficf2cf3 cin NPV ==cfo+ (1+11+ (1 + r)2 + (1 + 1)3 *** (1 + r)" Net Present Value analysis of proposed strategy's new cash flow and EPS/EBIT analysis NOTE: To construct the first cash flow (cf) at the very minimum, the new revenue from your strategy(s) must be discounted back to the present value by calculating EBIT and that figure will be your cfn for each year. cfo (initial cost of your strategy), cfi (discounted cash flow first year), r (opportunity cost of capital, the rate of the next best alternative use of cash/debt/equity resources). a. NDU_oficficf2cf3 cin NPV ==cfo+ (1+11+ (1 + r)2 + (1 + 1)3 *** (1 + r)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts