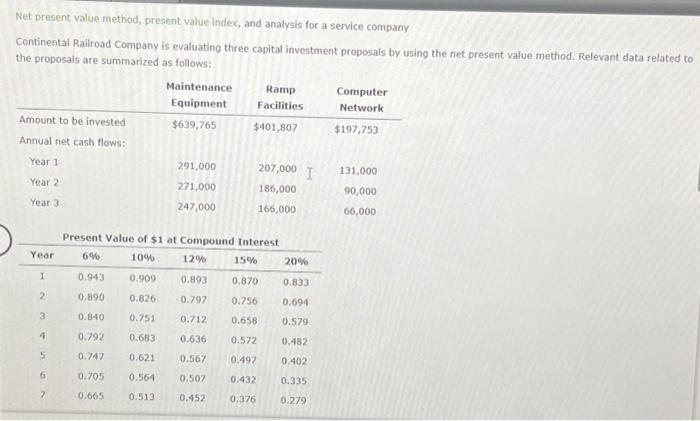

Question: Net present value method, present value index, and analysis for a service company Continental Railroad Company is evaluating three capital investment proposals by using the

Net present value method, present value index, and analysis for a service company Continental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows: Net present value method, present value index, and analysis for a service company Continental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts