Question: Net Present Value Problems: You have identified the formulation for a new chemical that improves carpet cleaning dramatically. You haven't actually made any yet, but

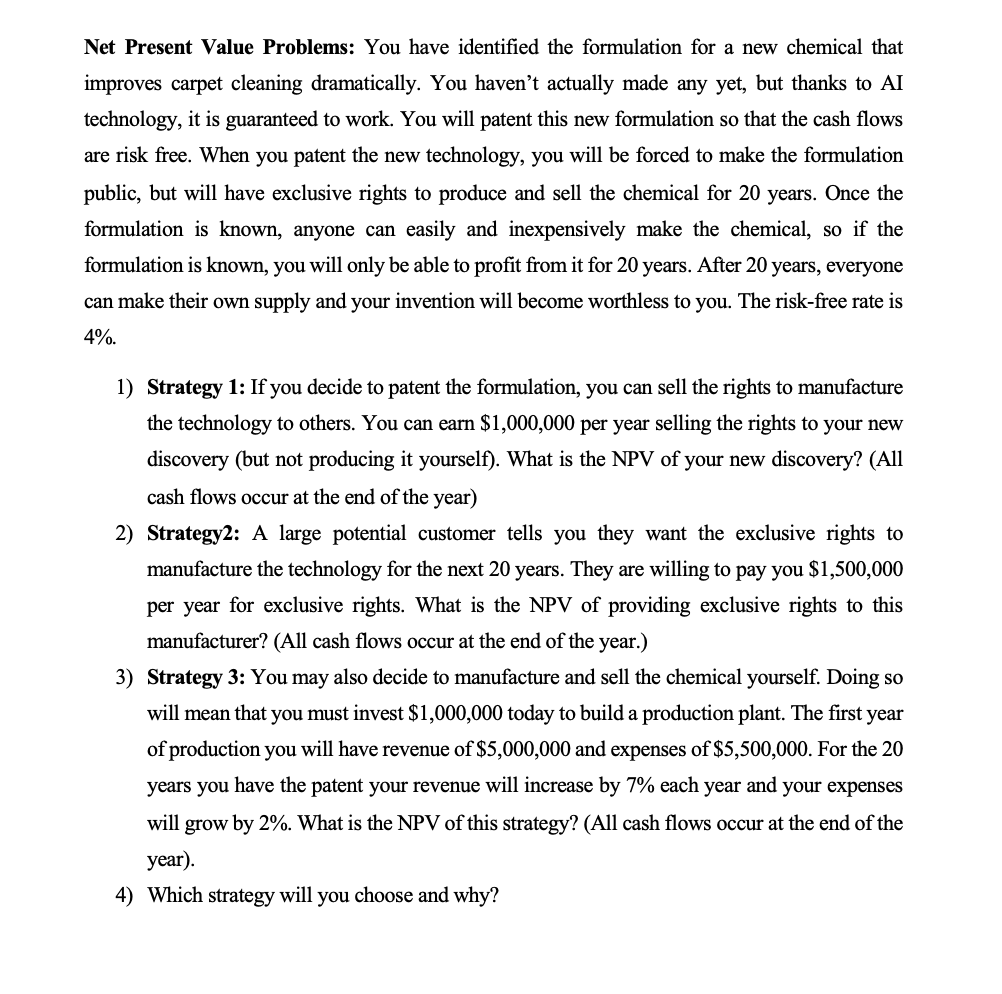

Net Present Value Problems: You have identified the formulation for a new chemical that improves carpet cleaning dramatically. You haven't actually made any yet, but thanks to AI technology, it is guaranteed to work. You will patent this new formulation so that the cash flows are risk free. When you patent the new technology, you will be forced to make the formulation public, but will have exclusive rights to produce and sell the chemical for 20 years. Once the formulation is known, anyone can easily and inexpensively make the chemical, so if the formulation is known, you will only be able to profit from it for 20 years. After 20 years, everyone can make their own supply and your invention will become worthless to you. The risk-free rate is 4%. 1) Strategy 1: If you decide to patent the formulation, you can sell the rights to manufacture the technology to others. You can earn $1,000,000 per year selling the rights to your new discovery (but not producing it yourself). What is the NPV of your new discovery? (All cash flows occur at the end of the year) 2) Strategy2: A large potential customer tells you they want the exclusive rights to manufacture the technology for the next 20 years. They are willing to pay you $1,500,000 per year for exclusive rights. What is the NPV of providing exclusive rights to this manufacturer? (All cash flows occur at the end of the year.) 3) Strategy 3: You may also decide to manufacture and sell the chemical yourself. Doing so will mean that you must invest $1,000,000 today to build a production plant. The first year of production you will have revenue of $5,000,000 and expenses of $5,500,000. For the 20 years you have the patent your revenue will increase by 7% each year and your expenses will grow by 2%. What is the NPV of this strategy? (All cash flows occur at the end of the year). 4) Which strategy will you choose and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts