Question: Net Present Value -Unequal Lives Healey Development Company has two competing projects: an office building and a condominium complex. Both projects have an initial investment

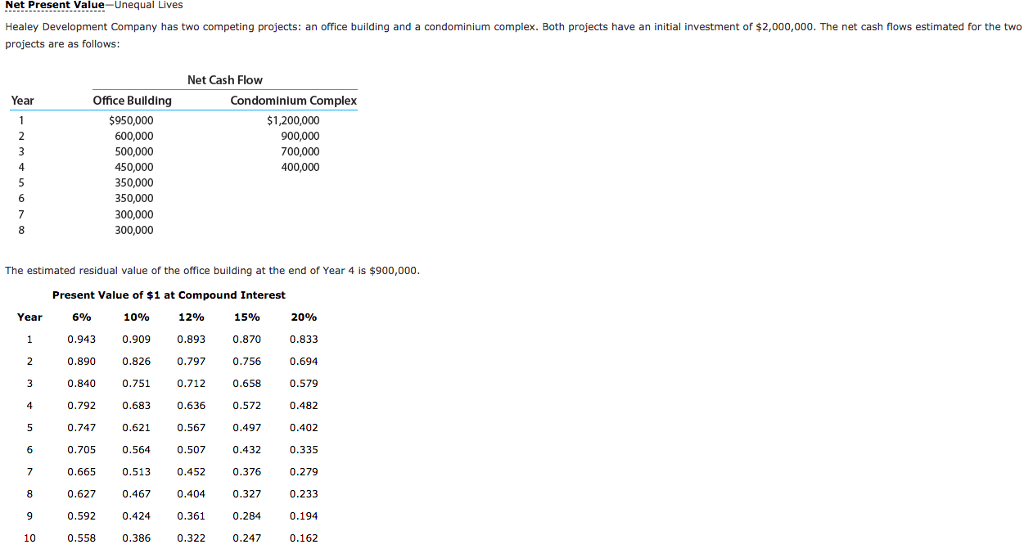

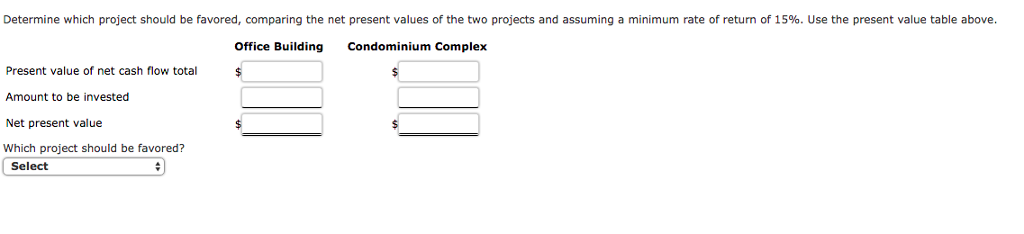

Net Present Value -Unequal Lives Healey Development Company has two competing projects: an office building and a condominium complex. Both projects have an initial investment of $2,000,000. The net cash flows estimated for the two projects are as follows Net Cash Flow Office Building $950,000 Year Condominium Complex $1,200,000 900,000 00,000 400,000 500,000 450,000 350,000 350,000 300,000 The estimated residual value of the office building at the end of Year 4 is $900,000 Present Value of $1 at Compound Interest Year 10% 12% 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 6% 15% 0.943 0.909 0.8930.870 0.890 0.826 0.797 0.756 0.840 0.751 0.712 0.658 0.792 0.683 0.636 0.572 0.747 0.621 0.567 0.497 0.705 0.564 0.507 0.432 0.376 0.327 0.284 0.247 0.665 0.513 0.452 0.627 0.467 0.404 0.592 0.424 0.361 0.558 0.386 0.322 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts