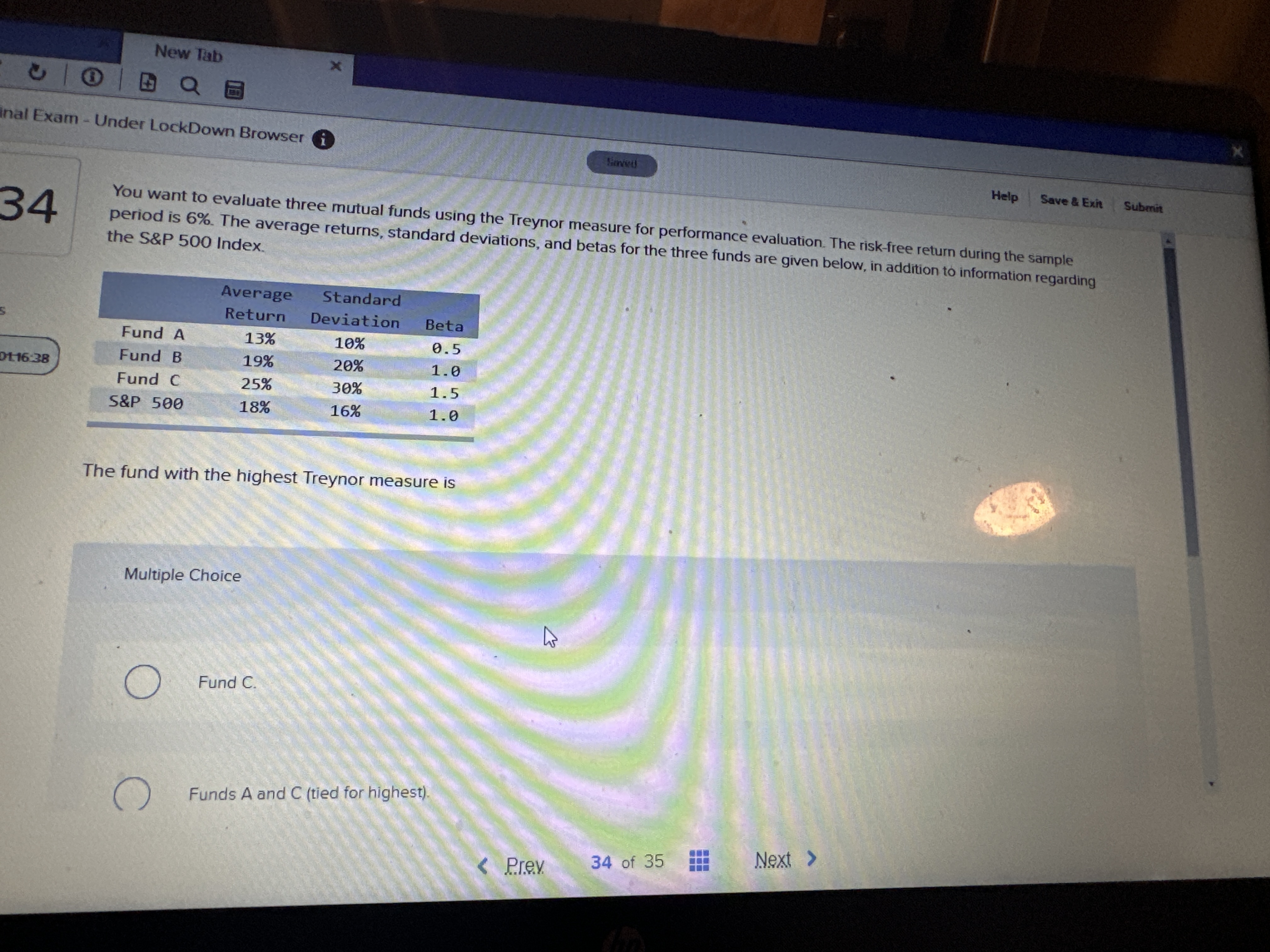

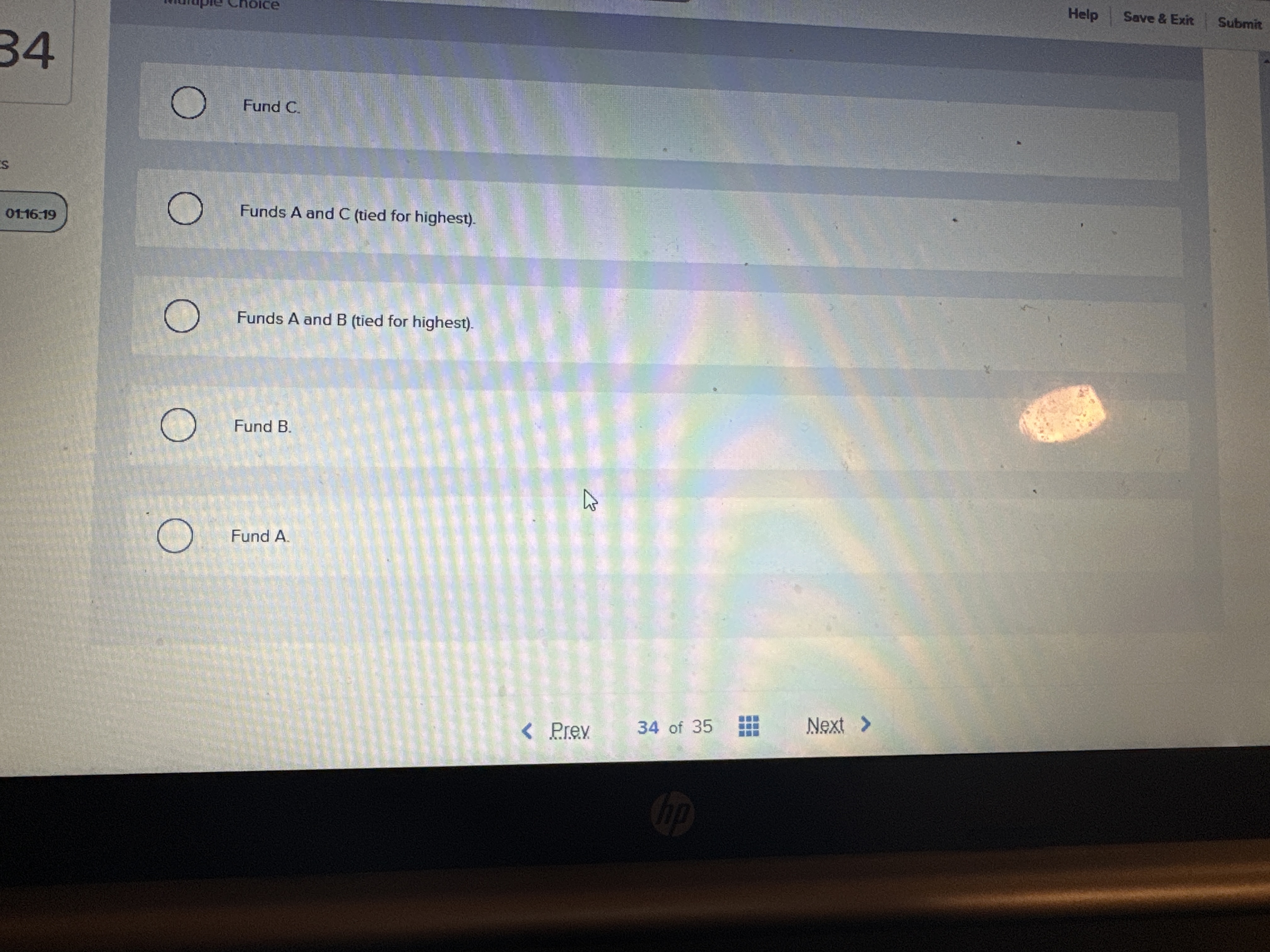

Question: New Tab X nal Exam - Under LockDown Browser i Help Save & Exit Submit 34 You want to evaluate three mutual funds using the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts