Question: Nick has just finished plotting the relationship between the NPV of two independent projects (MiniHospital and SuperHospital) for different discount rates. He finds that the

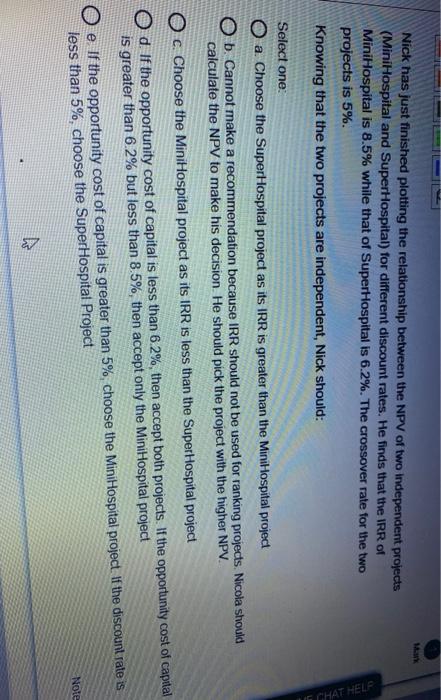

Nick has just finished plotting the relationship between the NPV of two independent projects (MiniHospital and SuperHospital) for different discount rates. He finds that the IRR of MiniHospital is 8.5% while that of SuperHospital is 6.2%. The crossover rate for the two projects is 5%. Knowing that the two projects are independent, Nick should: UGCHAT HELP Select one O a. Choose the SuperHospital project as its IRR is greater than the MiniHospital project O b. Cannot make a recommendation because IRR should not be used for ranking projects. Nicola should calculate the NPV to make his decision. He should pick the project with the higher NPV. O c. Choose the MiniHospital project as its IRR is less than the Super Hospital project O d. If the opportunity cost of capital is less than 6.2%, then accept both projects. If the opportunity cost of capital is greater than 6.2% but less than 8,5%, then accept only the Mini Hospital project e If the opportunity cost of capital is greater than 5% choose the MiniHospital project. If the discount rate is less than 5%, choose the SuperHospital Project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts