Question: Nico Corp issued a callable bond which bears a coupon rate of 8%, has 10 years remaining to maturity, and is currently priced at

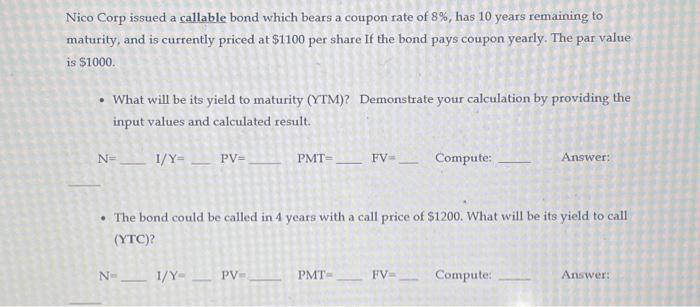

Nico Corp issued a callable bond which bears a coupon rate of 8%, has 10 years remaining to maturity, and is currently priced at $1100 per share If the bond pays coupon yearly. The par value is $1000. What will be its yield to maturity (YTM)? Demonstrate your calculation by providing the input values and calculated result. N=1/Y= PV= PMT= N=1/Y-PV- FV Compute: The bond could be called in 4 years with a call price of $1200. What will be its yield to call (YTC)? PMT- FV= Answer: Compute: Answer:

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

To calculate the yield to maturity YTM of the bond we need to solve for the discount rate that equat... View full answer

Get step-by-step solutions from verified subject matter experts