Question: no work needed. just answer question! thanks! 1 4 points Mike's Distributors has a levered equity cost of capital (RE) of 12 percent. The company

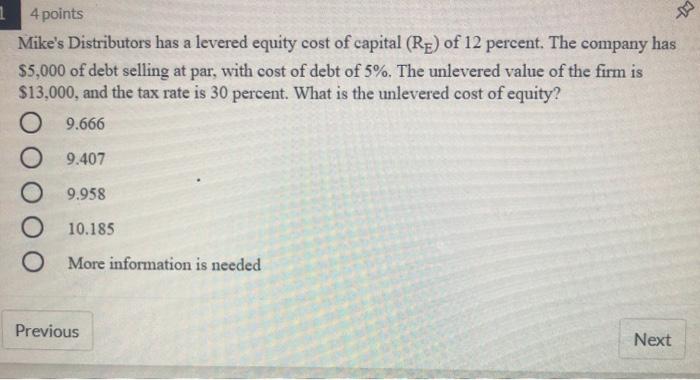

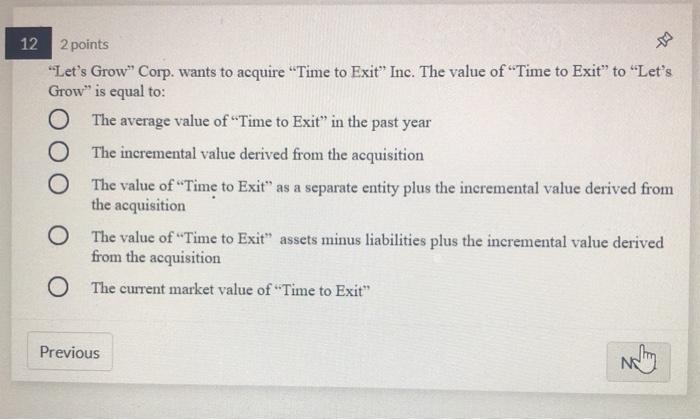

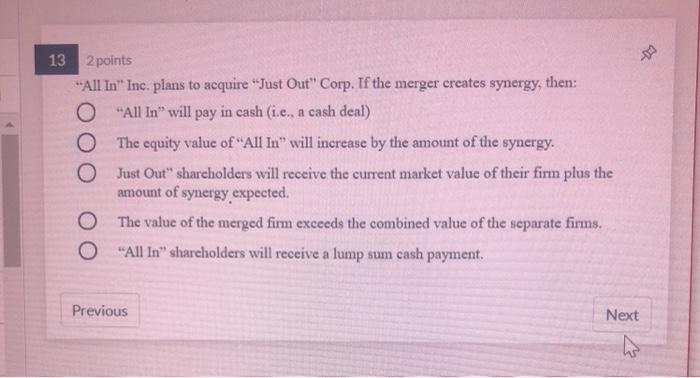

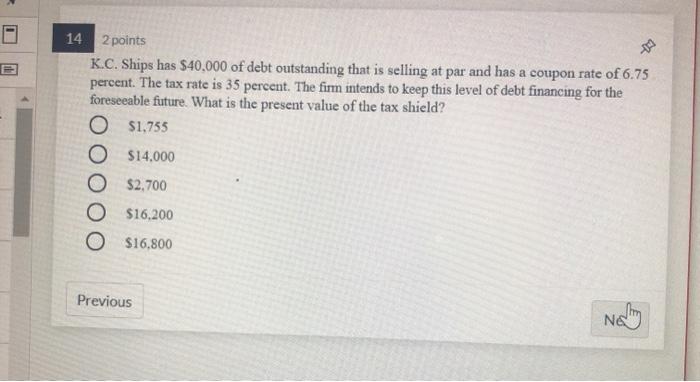

1 4 points Mike's Distributors has a levered equity cost of capital (RE) of 12 percent. The company has $5,000 of debt selling at par, with cost of debt of 5%. The unlevered value of the firm is $13,000, and the tax rate is 30 percent. What is the unlevered cost of equity? O 9.666 9.407 9.958 O 10.185 O More information is needed Previous Next 12 2 points "Let's Grow" Corp. wants to acquire "Time to Exit" Inc. The value of Time to Exit" to "Let's Grow" is equal to: O The average value of Time to Exit" in the past year O The incremental value derived from the acquisition O The value of "Time to Exit" as a separate entity plus the incremental value derived from the acquisition O The value of "Time to Exit" assets minus liabilities plus the incremental value derived from the acquisition O The current market value of "Time to Exit" Previous Anothing 13 2 points All In" Inc. plans to acquire "Just Out" Corp. If the merger creates synergy, then: "All In" will pay in cash (i.e., a cash deal) The equity value of "All In" will increase by the amount of the synergy. Just Out" shareholders will receive the current market value of their firm plus the amount of synergy expected. The value of the merged firm exceeds the combined value of the separate firms. "All In" shareholders will receive a lump sum cash payment. Previous Next 14 2 points K.C. Ships has $40,000 of debt outstanding that is selling at par and has a coupon rate of 6.75 percent. The tax rate is 35 percent. The firm intends to keep this level of debt financing for the foreseeable future. What is the present value of the tax shield? O $1,755 O $14.000 O $2,700 $16,200 0 $16,800 Previous NE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts