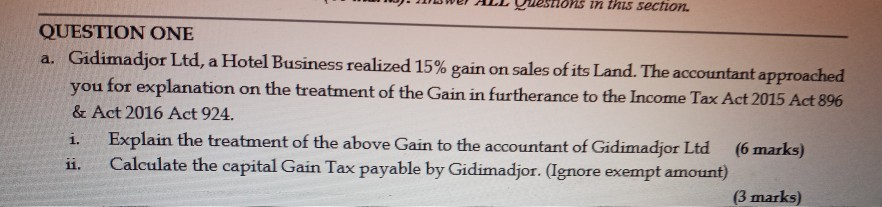

Question: nons in this section. QUESTION ONE a. Gidimadjor Ltd, a Hotel Business realized 15% gain on sales of its Land. The accountant approached you for

nons in this section. QUESTION ONE a. Gidimadjor Ltd, a Hotel Business realized 15% gain on sales of its Land. The accountant approached you for explanation on the treatment of the Gain in furtherance to the Income Tax Act 2015 Act 896 & Act 2016 Act 924. i. Explain the treatment of the above Gain to the accountant of Gidimadjor Ltd (6 marks) 11. Calculate the capital Gain Tax payable by Gidimadjor. (Ignore exempt amount) (3 marks) nons in this section. QUESTION ONE a. Gidimadjor Ltd, a Hotel Business realized 15% gain on sales of its Land. The accountant approached you for explanation on the treatment of the Gain in furtherance to the Income Tax Act 2015 Act 896 & Act 2016 Act 924. i. Explain the treatment of the above Gain to the accountant of Gidimadjor Ltd (6 marks) 11. Calculate the capital Gain Tax payable by Gidimadjor. (Ignore exempt amount)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts