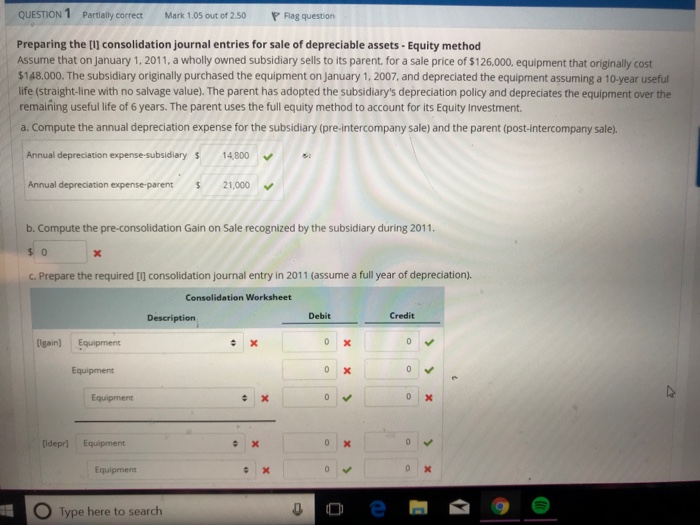

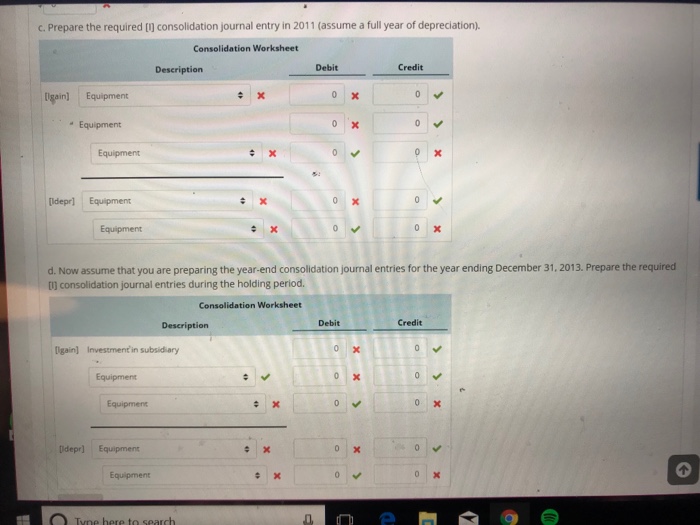

Question: Not sure how to complete the rest. Please help :) QUESTION 1 Partially correct Mark 1.05 out of 2.50 Flag question Preparing the [I] consolidation

QUESTION 1 Partially correct Mark 1.05 out of 2.50 Flag question Preparing the [I] consolidation journal entries for sale of depreciable assets-Equity method Assume that on January 1, 2011, a wholly owned subsidiary sells to its parent, for a sale price of $126,000, equipment that originally cost $148.000. The subsidiary originally purchased the equipment on January 1, 2007, and depreciated the equipment assuming a 10-year useful life (straight-line with no salvage value). The parent has adopted the subsidiary's depreciation policy and depreciates the equipment over the remaining useful life of 6 years. The parent uses the full equity method to account for its Equity Investment. a. Compute the annual depreciation expense for the subsidiary (pre-intercompany sale) and the parent (post-intercompany sale). diary 14,800 Annual depreciation expens Annual depreciation expense-parent 21,000 b. Compute the pre-consolidation Gain on Sale recognized by the subsidiary during 2011 e-subsidi c. Prepare the required [] consolidation journal entry in 2011 (assume a full year of depreciation). Consolidation Worksheet Description Debit Credit [lgain) Equipment e x 0X Equipment e x [idepr) Equipment ex e x Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts