Question: (not using the PRICE function or PV, FV, RATE, PMT, NPER functions ) each of the questions please show all work and please answer this

(not using the PRICE function or PV, FV, RATE, PMT, NPER functions ) each of the questions please show all work and please answer this

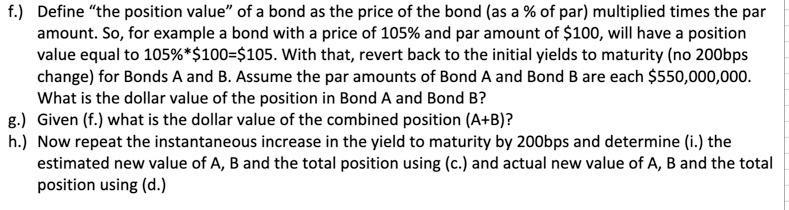

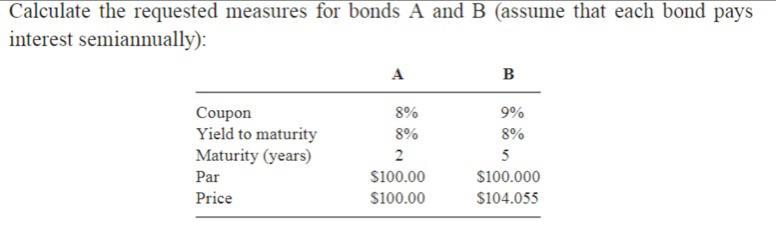

f.) Define "the position value of a bond as the price of the bond (as a % of par) multiplied times the par amount. So, for example a bond with a price of 105% and par amount of $100, will have a position value equal to 105%*$100=$105. With that, revert back to the initial yields to maturity (no 200bps change) for Bonds A and B. Assume the par amounts of Bond A and Bond B are each $550,000,000. What is the dollar value of the position in Bond A and Bond B? g.) Given (f.) what is the dollar value of the combined position (A+B)? h.) Now repeat the instantaneous increase in the yield to maturity by 200bps and determine (i.) the estimated new value of A, B and the total position using (c.) and actual new value of A, B and the total position using (d.) Calculate the requested measures for bonds A and B (assume that each bond pays interest semiannually): A B Coupon Yield to maturity Maturity (years) Par Price 8% 8% 2 $100.00 $100.00 9% 8% 5 $100.000 $104.055 f.) Define "the position value of a bond as the price of the bond (as a % of par) multiplied times the par amount. So, for example a bond with a price of 105% and par amount of $100, will have a position value equal to 105%*$100=$105. With that, revert back to the initial yields to maturity (no 200bps change) for Bonds A and B. Assume the par amounts of Bond A and Bond B are each $550,000,000. What is the dollar value of the position in Bond A and Bond B? g.) Given (f.) what is the dollar value of the combined position (A+B)? h.) Now repeat the instantaneous increase in the yield to maturity by 200bps and determine (i.) the estimated new value of A, B and the total position using (c.) and actual new value of A, B and the total position using (d.) Calculate the requested measures for bonds A and B (assume that each bond pays interest semiannually): A B Coupon Yield to maturity Maturity (years) Par Price 8% 8% 2 $100.00 $100.00 9% 8% 5 $100.000 $104.055

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts