Question: Questions on Bonds: Answer with a working worksheet making the cashflows in each period explicit (not using the PRICE function or PV, FV, RATE, PMT,

Questions on Bonds: Answer with a working worksheet making the cashflows in each period explicit (not using the PRICE function or PV, FV, RATE, PMT, NPER functions ) each of the questions below

Please show all steps

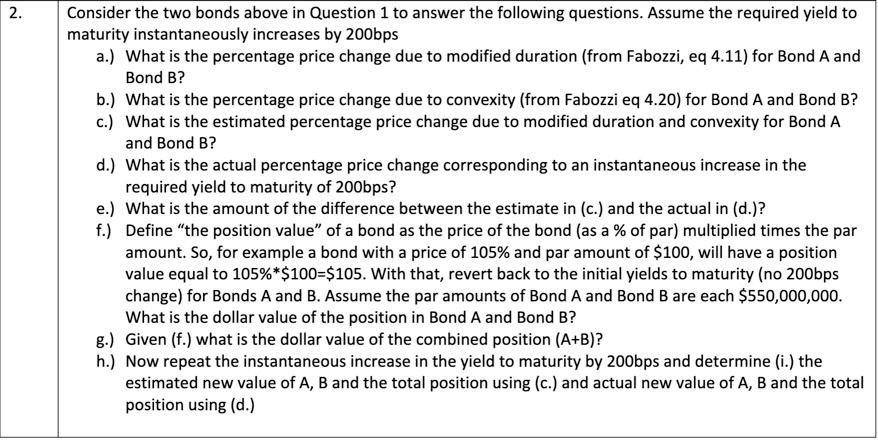

2. Consider the two bonds above in Question 1 to answer the following questions. Assume the required yield to maturity instantaneously increases by 200bps a.) What is the percentage price change due to modified duration (from Fabozzi, eq 4.11) for Bond A and Bond B? b.) What is the percentage price change due to convexity (from Fabozzi eq 4.20) for Bond A and Bond B? c.) What is the estimated percentage price change due to modified duration and convexity for Bond A and Bond B? d.) What is the actual percentage price change corresponding to an instantaneous increase in the required yield to maturity of 200bps? e.) What is the amount of the difference between the estimate in (c.) and the actual in (d.)? f.) Define "the position value of a bond as the price of the bond (as a % of par) multiplied times the par amount. So, for example a bond with a price of 105% and par amount of $100, will have a position value equal to 105%*$100=$105. With that, revert back to the initial yields to maturity (no 200bps change) for Bonds A and B. Assume the par amounts of Bond A and Bond B are each $550,000,000. What is the dollar value of the position in Bond A and Bond B? g.) Given (f.) what is the dollar value of the combined position (A+B)? h.) Now repeat the instantaneous increase in the yield to maturity by 200bps and determine (i.) the estimated new value of A, B and the total position using (c.) and actual new value of A, B and the total position using (d.) 2. Consider the two bonds above in Question 1 to answer the following questions. Assume the required yield to maturity instantaneously increases by 200bps a.) What is the percentage price change due to modified duration (from Fabozzi, eq 4.11) for Bond A and Bond B? b.) What is the percentage price change due to convexity (from Fabozzi eq 4.20) for Bond A and Bond B? c.) What is the estimated percentage price change due to modified duration and convexity for Bond A and Bond B? d.) What is the actual percentage price change corresponding to an instantaneous increase in the required yield to maturity of 200bps? e.) What is the amount of the difference between the estimate in (c.) and the actual in (d.)? f.) Define "the position value of a bond as the price of the bond (as a % of par) multiplied times the par amount. So, for example a bond with a price of 105% and par amount of $100, will have a position value equal to 105%*$100=$105. With that, revert back to the initial yields to maturity (no 200bps change) for Bonds A and B. Assume the par amounts of Bond A and Bond B are each $550,000,000. What is the dollar value of the position in Bond A and Bond B? g.) Given (f.) what is the dollar value of the combined position (A+B)? h.) Now repeat the instantaneous increase in the yield to maturity by 200bps and determine (i.) the estimated new value of A, B and the total position using (c.) and actual new value of A, B and the total position using (d.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts