Question: Please show all steps Questions on Bonds: Answer with a working worksheet making the cashflows in each period explicit (not using the PRICE function or

Please show all steps

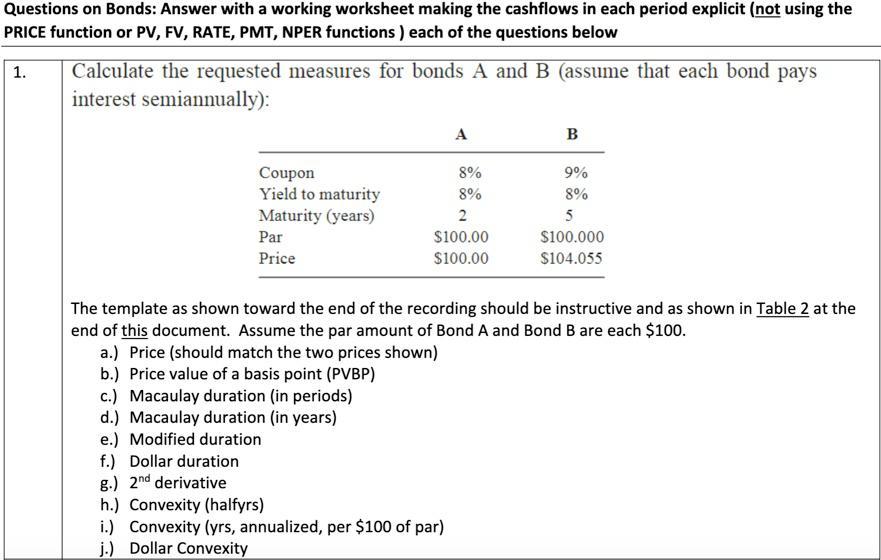

Questions on Bonds: Answer with a working worksheet making the cashflows in each period explicit (not using the PRICE function or PV, FV, RATE, PMT, NPER functions ) each of the questions below 1. Calculate the requested measures for bonds A and B (assume that each bond pays interest semiannually): B Coupon Yield to maturity Maturity (years) Par Price 8% 8% 2 $100.00 $100.00 9% 8% 5 $100.000 $104.055 The template as shown toward the end of the recording should be instructive and as shown in Table 2 at the end of this document. Assume the par amount of Bond A and Bond B are each $100. a.) Price (should match the two prices shown) b.) Price value of a basis point (PVBP) c.) Macaulay duration (in periods) d.) Macaulay duration (in years) e.) Modified duration f.) Dollar duration g.) 2nd derivative h.) Convexity (halfyrs) i.) Convexity (yrs, annualized, per $100 of par) j.) Dollar Convexity Questions on Bonds: Answer with a working worksheet making the cashflows in each period explicit (not using the PRICE function or PV, FV, RATE, PMT, NPER functions ) each of the questions below 1. Calculate the requested measures for bonds A and B (assume that each bond pays interest semiannually): B Coupon Yield to maturity Maturity (years) Par Price 8% 8% 2 $100.00 $100.00 9% 8% 5 $100.000 $104.055 The template as shown toward the end of the recording should be instructive and as shown in Table 2 at the end of this document. Assume the par amount of Bond A and Bond B are each $100. a.) Price (should match the two prices shown) b.) Price value of a basis point (PVBP) c.) Macaulay duration (in periods) d.) Macaulay duration (in years) e.) Modified duration f.) Dollar duration g.) 2nd derivative h.) Convexity (halfyrs) i.) Convexity (yrs, annualized, per $100 of par) j.) Dollar Convexity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts