Question: Not with excel or financial calc, and please explain irr in easy steps, Thank you 1. You are considering two independent projects with the following

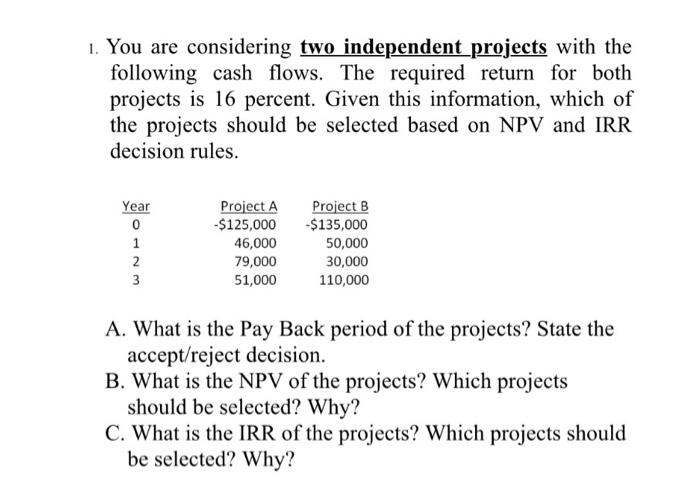

1. You are considering two independent projects with the following cash flows. The required return for both projects is 16 percent. Given this information, which of the projects should be selected based on NPV and IRR decision rules. Year 0 1 2 3 Project A -$125,000 46,000 79,000 51,000 Project B $135,000 50,000 30,000 110,000 A. What is the Pay Back period of the projects? State the accept/reject decision. B. What is the NPV of the projects? Which projects should be selected? Why? C. What is the IRR of the projects? Which projects should be selected? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts