Question: NOTE FROM STUDENT: Please explain how you got the answers for the bottom! I struggle LIFO and FIFO and I would like for someone to

NOTE FROM STUDENT: Please explain how you got the answers for the bottom! I struggle LIFO and FIFO and I would like for someone to explain in the best way they can, how they got the answers so I won't need help every time I see it.

to

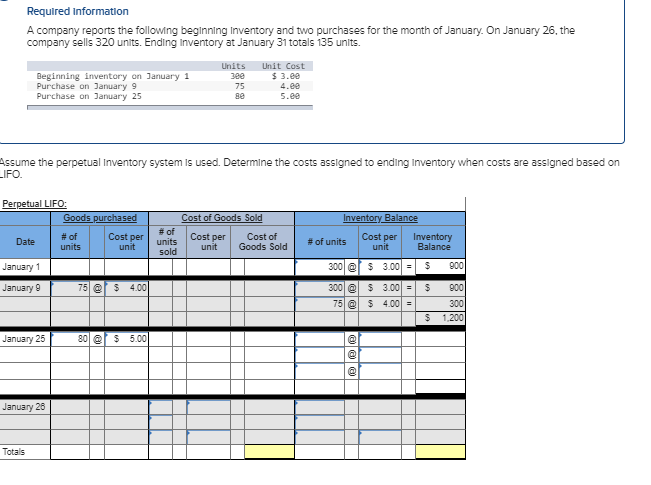

Required information A company reports the following beginning Inventory and two purchases for the month of January. On January 26, the company sells 320 units. Ending Inventory at January 31 totals 135 units. Units Unit Cost $ 3.60 Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 75 se 5.00 Assume the perpetual Inventory system is used. Determine the costs assigned to ending Inventory when costs are assigned based on LIFO. Perpetual LIFO: Goods purchased Cost of Goods Sold Inventory Balance Date Cost per Cost per # of units # of units sold Cost of Goods Sold Cost per #of units unit unit Inventory unit Balance $ 3.00 = $ 900 January 1 3001 January 9 75 @ $ 4.00 $ 300 @ $ 3.00 = 75 @ $ 4.00 = 900 3001 1.200 $ January 25 80 @ $ 5.00 @ January 26 Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts