Question: Note: If the image appears too small you can right click and open in a new window to better see the image= Seamus rented an

Note: If the image appears too small you can right click and open in a new window to better see the image=

Note: If the image appears too small you can right click and open in a new window to better see the image=

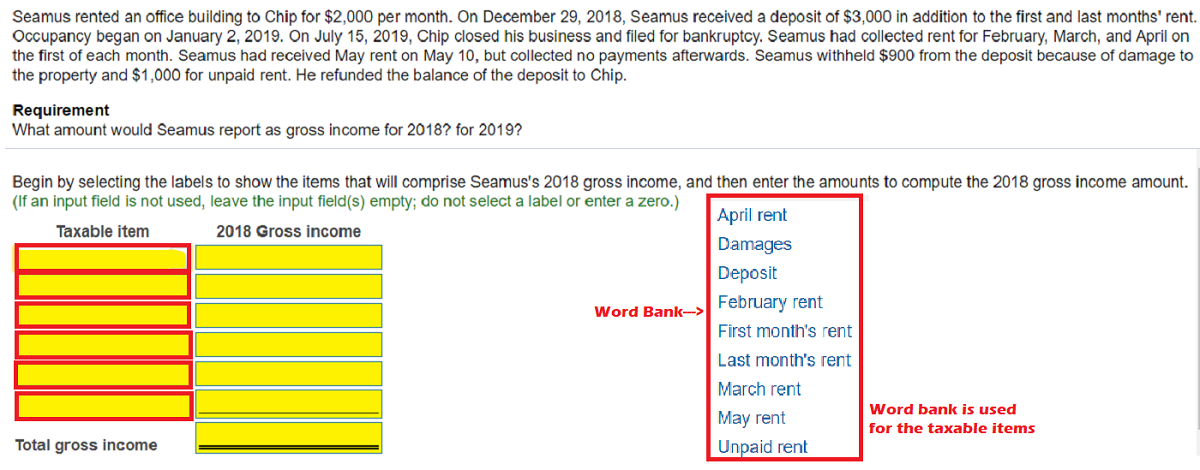

Seamus rented an office building to Chip for $2,000 per month. On December 29, 2018, Seamus received a deposit of $3,000 in addition to the first and last months' rent. Occupancy began on January 2, 2019. On July 15, 2019, Chip closed his business and filed for bankruptcy. Seamus had collected rent for February, March, and April on the first of each month. Seamus had received May rent on May 10, but collected no payments afterwards. Seamus withheld $900 from the deposit because of damage to the property and $1,000 for unpaid rent. He refunded the balance of the deposit to Chip. Requirement What amount would Seamus report as gross income for 2018? for 2019? Begin by selecting the labels to show the items that will comprise Seamus's 2018 gross income, and then enter the amounts to compute the 2018 gross income amount. (If an input field is not used, leave the input field(s) empty; do not select a label or enter a zero.) April rent Taxable item 2018 Gross income Damages Deposit Word Bank-> February rent First month's rent Last month's rent March rent Word bank is used May rent for the taxable items Total gross income Unpaid rent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts