Question: Note: If the image appears too small you can right click and open the image in a new tab to better see the information! Umeko

Note: If the image appears too small you can right click and open the image in a new tab to better see the information!

Note: If the image appears too small you can right click and open the image in a new tab to better see the information!

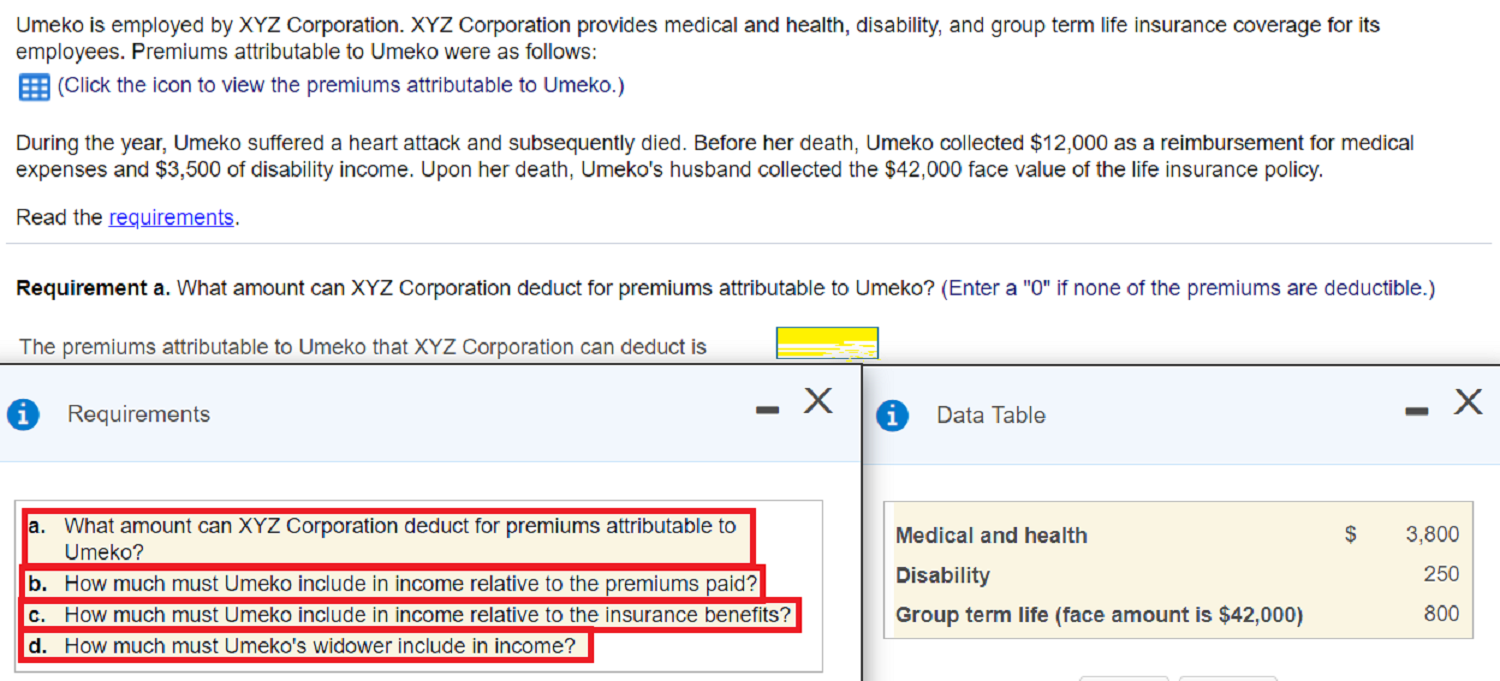

Umeko is employed by XYZ Corporation. XYZ Corporation provides medical and health, disability, and group term life insurance coverage for its employees. Premiums attributable to Umeko were as follows: E (Click the icon to view the premiums attributable to Umeko.) During the year, Umeko suffered a heart attack and subsequently died. Before her death, Umeko collected $12,000 as a reimbursement for medical expenses and $3,500 of disability income. Upon her death, Umeko's husband collected the $42,000 face value of the life insurance policy. Read the requirements. Requirement a. What amount can XYZ Corporation deduct for premiums attributable to Umeko? (Enter a "0" if none of the premiums are deductible.) The premiums attributable to Umeko that XYZ Corporation can deduct is X - Requirements Data Table Medical and health $ 3,800 250 a. What amount can XYZ Corporation deduct for premiums attributable to Umeko? b. How much must Umeko include in income relative to the premiums paid? C. How much must Umeko include in income relative to the insurance benefits? d. How much must Umeko's widower include in income? Disability Group term life (face amount is $42,000) 800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts