Question: Note; If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On

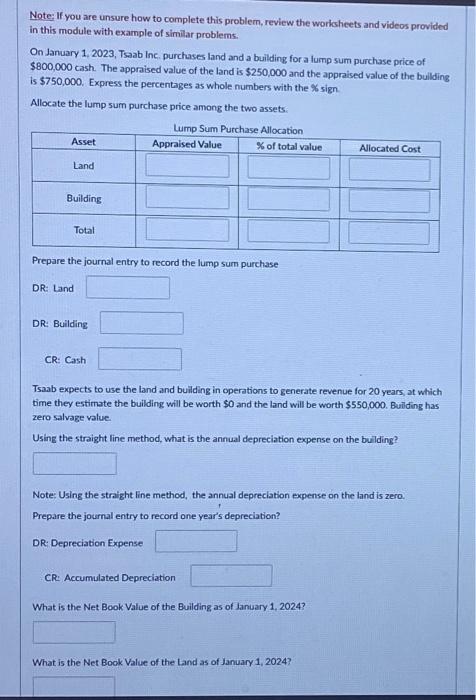

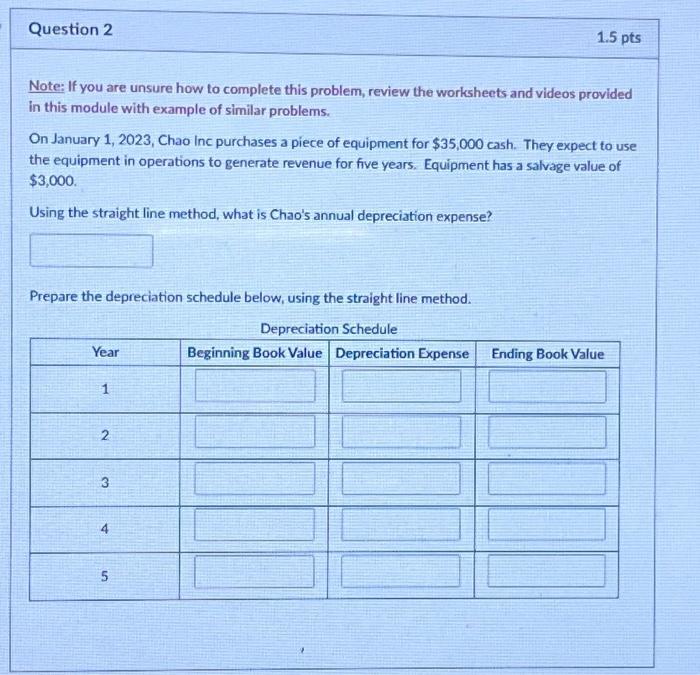

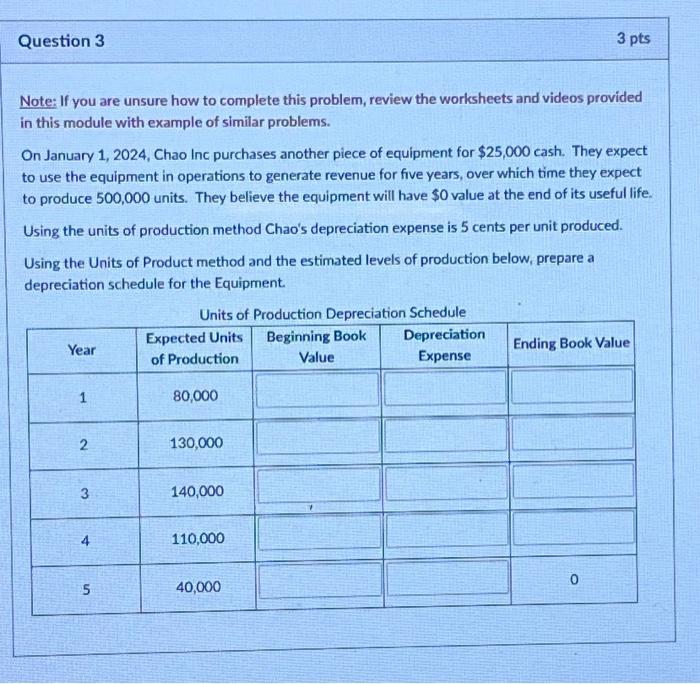

Note; If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On January 1, 2023, Tsaab Inc. purchases land and a building for a lump sum purchase price of $800,000 cash. The appraised value of the land is $250,000 and the appraised value of the bullding is $750,000. Express the percentages as whole numbers with the % sign. Allocate the lump sum purchase price among the two assets: Prepare the journal entry to record the lump sum purchase DR: tand DR: Building CR: Cash Tsaab expects to use the land and building in operations to generate revenue for 20 years, at which time they estimate the building will be worth $0 and the land will be worth $550,000. Building has zero salvage value. Using the straight line method, what is the annual depreciation expense on the bulding? Note: Using the straight line method, the annual depreclation expense on the land is zero. Prepare the journal entry to record one year's depreciation? DR: Depreciation Expense CR: Accumulated Depreciation What is the Net Book Value of the Building as of January 1, 2024? What is the Net Book Value of the Land as of January 1, 2024? Note: If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On January 1, 2024, Chao Inc purchases another piece of equipment for $25,000 cash. They expect to use the equipment in operations to generate revenue for five years, over which time they expect to produce 500,000 units. They believe the equipment will have $0 value at the end of its useful life. Using the units of production method Chao's depreciation expense is 5 cents per unit produced. Using the Units of Product method and the estimated levels of production below, prepare a depreciation schedule for the Equipment. Note: If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On January 1,2023, Chao Inc purchases a piece of equipment for $35,000 cash. They expect to use the equipment in operations to generate revenue for five years. Equipment has a salvage value of $3,000. Using the straight line method, what is Chao's annual depreciation expense? Prepare the depreciation schedule below, using the straight line method. Note; If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On January 1, 2023, Tsaab Inc. purchases land and a building for a lump sum purchase price of $800,000 cash. The appraised value of the land is $250,000 and the appraised value of the bullding is $750,000. Express the percentages as whole numbers with the % sign. Allocate the lump sum purchase price among the two assets: Prepare the journal entry to record the lump sum purchase DR: tand DR: Building CR: Cash Tsaab expects to use the land and building in operations to generate revenue for 20 years, at which time they estimate the building will be worth $0 and the land will be worth $550,000. Building has zero salvage value. Using the straight line method, what is the annual depreciation expense on the bulding? Note: Using the straight line method, the annual depreclation expense on the land is zero. Prepare the journal entry to record one year's depreciation? DR: Depreciation Expense CR: Accumulated Depreciation What is the Net Book Value of the Building as of January 1, 2024? What is the Net Book Value of the Land as of January 1, 2024? Note: If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On January 1, 2024, Chao Inc purchases another piece of equipment for $25,000 cash. They expect to use the equipment in operations to generate revenue for five years, over which time they expect to produce 500,000 units. They believe the equipment will have $0 value at the end of its useful life. Using the units of production method Chao's depreciation expense is 5 cents per unit produced. Using the Units of Product method and the estimated levels of production below, prepare a depreciation schedule for the Equipment. Note: If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On January 1,2023, Chao Inc purchases a piece of equipment for $35,000 cash. They expect to use the equipment in operations to generate revenue for five years. Equipment has a salvage value of $3,000. Using the straight line method, what is Chao's annual depreciation expense? Prepare the depreciation schedule below, using the straight line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts