Question: Note: If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On

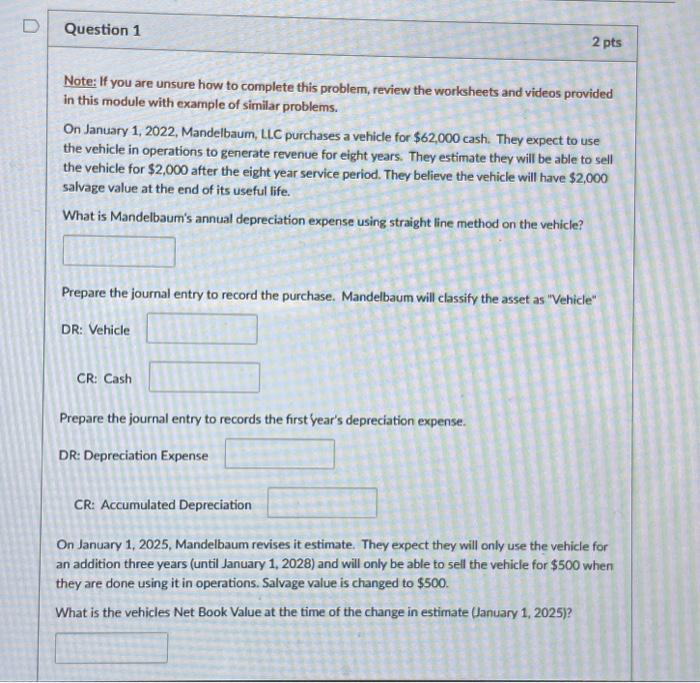

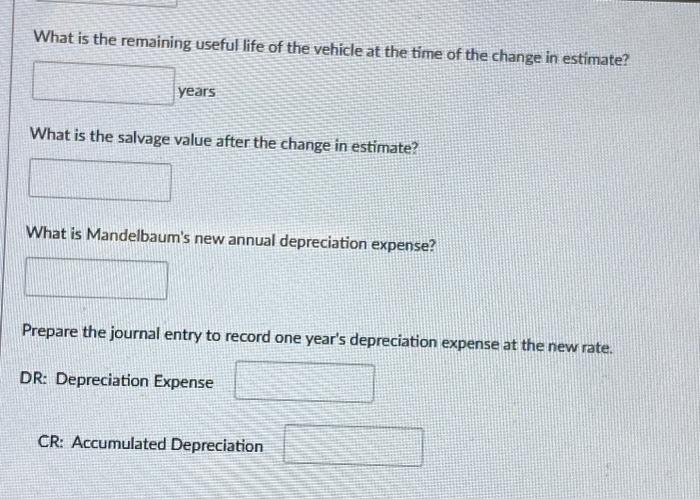

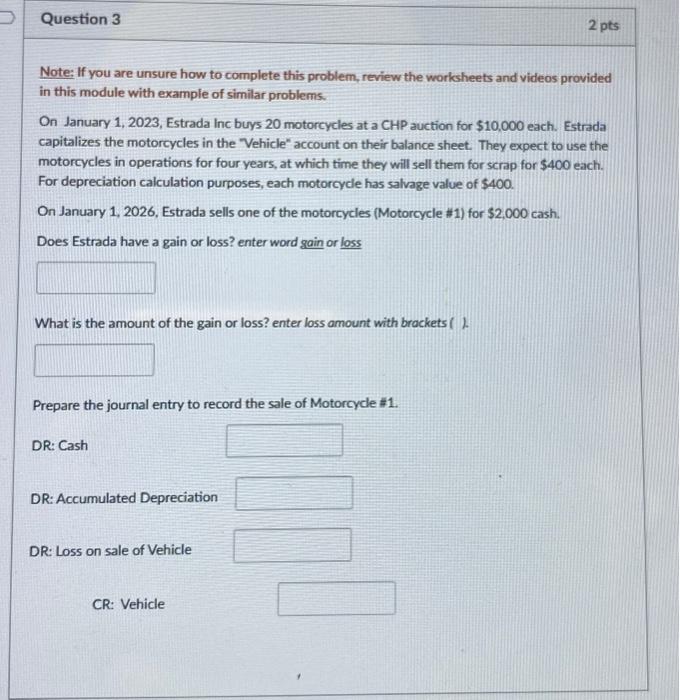

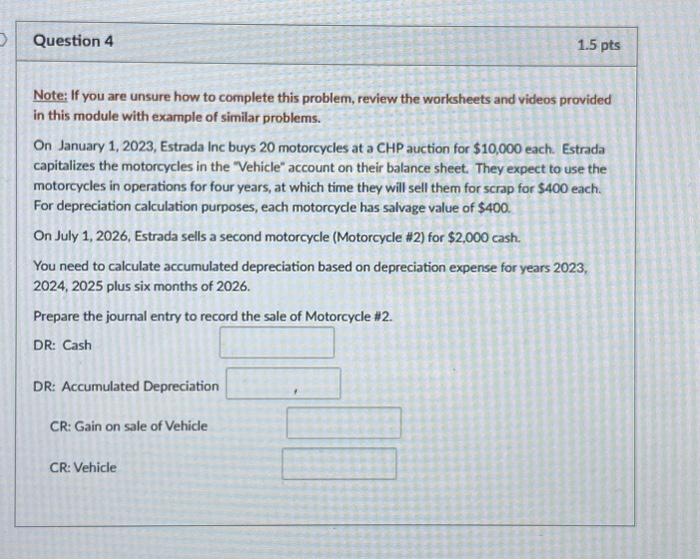

Note: If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On January 1, 2022, Mandelbaum, LLC purchases a vehicle for $62,000 cash. They expect to use the vehicle in operations to generate revenue for eight years. They estimate they will be able to sell the vehicle for $2,000 after the eight year service period. Ther believe the vehicle will have $2,000 salvage value at the end of its useful life. What is Mandelbaum's annual depreciation expense using straight line method on the vehicle? Prepare the journal entry to record the purchase. Mandelbaum will classify the asset as "Vehicle" DR: Vehicle CR: Cash Prepare the journal entry to records the first Year's depreciation expense. DR: Depreciation Expense CR: Accumulated Depreciation On January 1, 2025, Mandelbaum revises it estimate. They expect they will only use the vehicle for an addition three years (until January 1, 2028) and will only be able to sell the vehicle for $500 when they are done using it in operations. Salvage value is changed to $500. What is the vehicles Net Book Value at the time of the change in estimate (January 1, 2025)? What is the remaining useful life of the vehicle at the time of the change in estimate? years What is the salvage value after the change in estimate? What is Mandelbaum's new annual depreciation expense? Prepare the journal entry to record one year's depreciation expense at the new rate. DR: Depreciation Expense CR: Accumulated Depreciation Note: If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On January 1, 2023, Estrada Inc buys 20 motorcycles at a CHP auction for $10,000 each. Estrada capitalizes the motorcycles in the "Vehicle" account on their balance sheet. They expect to use the motorcycles in operations for four years, at which time they will sell them for scrap for $400 each. For depreciation calculation purposes, each motorcycle has salvage value of $400. On January 1, 2026, Estrada sells one of the motorcycles (Motorcycle \#1) for $2,000 cash. Does Estrada have a gain or loss? enter word gain or loss What is the amount of the gain or loss? enter loss amount with brackets ( ). Prepare the journal entry to record the sale of Motorcycle $1. DR: Cash DR: Accumulated Depreciation DR: Loss on sale of Vehicle CR: Vehicle Note: If you are unsure how to complete this problem, review the worksheets and videos provided in this module with example of similar problems. On January 1, 2023, Estrada Inc buys 20 motorcycles at a CHP auction for $10,000 each. Estrada capitalizes the motorcycles in the "Vehicle" account on their balance sheet. They expect to use the motorcycles in operations for four years, at which time they will sell them for scrap for $400 each. For depreciation calculation purposes, each motorcycle has salvage value of $400. On July 1, 2026, Estrada sells a second motorcycle (Motorcycle \#2) for \$2,000 cash. You need to calculate accumulated depreciation based on depreciation expense for years 2023 , 2024,2025 plus six months of 2026. Prepare the journal entry to record the sale of Motorcycle #2. DR: Cash DR: Accumulated Depreciation CR: Gain on sale of Vehicle CR: Vehicle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts