Question: NOTE: The same cash-flow model will be used in some parts of upcoming homeworks. The spreadsheet must be built in a way that calculations refer

NOTE: The same cash-flow model will be used in some parts of upcoming homeworks. The spreadsheet must be built in a way that calculations refer to all input parameters (constants). Save your spreadsheet and correct your mistakes accordingly after the solutions are uploaded. Future homeworks will require manipulation of input parameters for the same cash-flow model.

NOTE: The same cash-flow model will be used in some parts of upcoming homeworks. The spreadsheet must be built in a way that calculations refer to all input parameters (constants). Save your spreadsheet and correct your mistakes accordingly after the solutions are uploaded. Future homeworks will require manipulation of input parameters for the same cash-flow model.

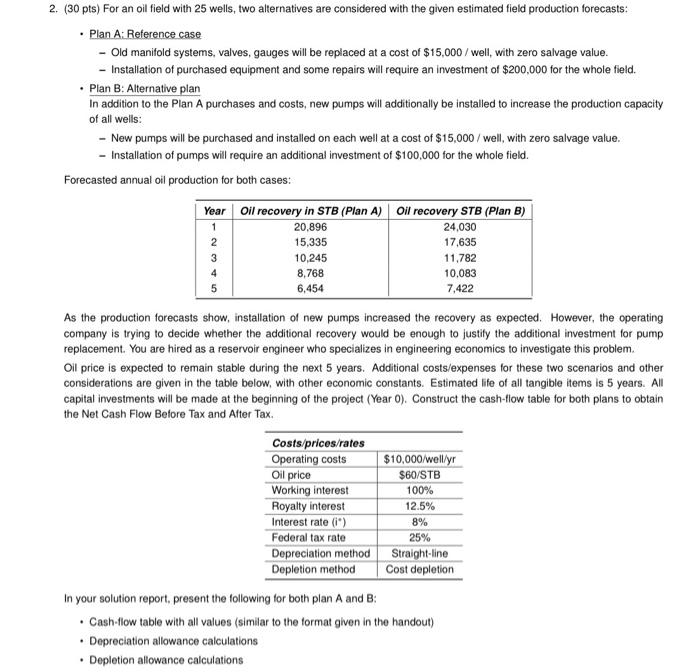

2. (30 pts) For an oil field with 25 wells, two alternatives are considered with the given estimated field production forecasts: Plan A: Reference case - Old manifold systems, valves, gauges will be replaced at a cost of $15,000 / well, with zero salvage value. - Installation of purchased equipment and some repairs will require an investment of $200,000 for the whole field. Plan B: Alternative plan In addition to the Plan A purchases and costs, new pumps will additionally be installed to increase the production capacity of all wells: - New pumps will be purchased and installed on each well at a cost of $15,000/well, with zero salvage value. - Installation of pumps will require an additional investment of $100,000 for the whole field. Forecasted annual oil production for both cases: Year oil recovery in STB (Plan A) oil recovery STB (Plan B) 1 20,896 24,030 2 15,335 17,635 3 10,245 11,782 4 8,768 10.083 5 6.454 7.422 As the production forecasts show, installation of new pumps increased the recovery as expected. However, the operating company is trying to decide whether the additional recovery would be enough to justify the additional investment for pump replacement. You are hired as a reservoir engineer who specializes in engineering economics to investigate this problem. Oil price is expected to remain stable during the next 5 years. Additional costs/expenses for these two scenarios and other considerations are given in the table below, with other economic constants. Estimated life of all tangible items is 5 years. All capital investments will be made at the beginning of the project (Year O). Construct the cash-flow table for both plans to obtain the Net Cash Flow Before Tax and After Tax Costs/prices/rates Operating costs $10,000/well/yr Oil price $60/STB Working interest 100% Royalty interest 12.5% Interest rate (*) 8% Federal tax rate 25% Depreciation method Straight-line Depletion method Cost depletion In your solution report, present the following for both plan A and B: Cash-flow table with all values (similar to the format given in the handout) Depreciation allowance calculations Depletion allowance calculations 2. (30 pts) For an oil field with 25 wells, two alternatives are considered with the given estimated field production forecasts: Plan A: Reference case - Old manifold systems, valves, gauges will be replaced at a cost of $15,000 / well, with zero salvage value. - Installation of purchased equipment and some repairs will require an investment of $200,000 for the whole field. Plan B: Alternative plan In addition to the Plan A purchases and costs, new pumps will additionally be installed to increase the production capacity of all wells: - New pumps will be purchased and installed on each well at a cost of $15,000/well, with zero salvage value. - Installation of pumps will require an additional investment of $100,000 for the whole field. Forecasted annual oil production for both cases: Year oil recovery in STB (Plan A) oil recovery STB (Plan B) 1 20,896 24,030 2 15,335 17,635 3 10,245 11,782 4 8,768 10.083 5 6.454 7.422 As the production forecasts show, installation of new pumps increased the recovery as expected. However, the operating company is trying to decide whether the additional recovery would be enough to justify the additional investment for pump replacement. You are hired as a reservoir engineer who specializes in engineering economics to investigate this problem. Oil price is expected to remain stable during the next 5 years. Additional costs/expenses for these two scenarios and other considerations are given in the table below, with other economic constants. Estimated life of all tangible items is 5 years. All capital investments will be made at the beginning of the project (Year O). Construct the cash-flow table for both plans to obtain the Net Cash Flow Before Tax and After Tax Costs/prices/rates Operating costs $10,000/well/yr Oil price $60/STB Working interest 100% Royalty interest 12.5% Interest rate (*) 8% Federal tax rate 25% Depreciation method Straight-line Depletion method Cost depletion In your solution report, present the following for both plan A and B: Cash-flow table with all values (similar to the format given in the handout) Depreciation allowance calculations Depletion allowance calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts