Question: Note to student: Do not round off values in the calculations. Maintain precision by rounding all intermediate and final answers to two decimal places to

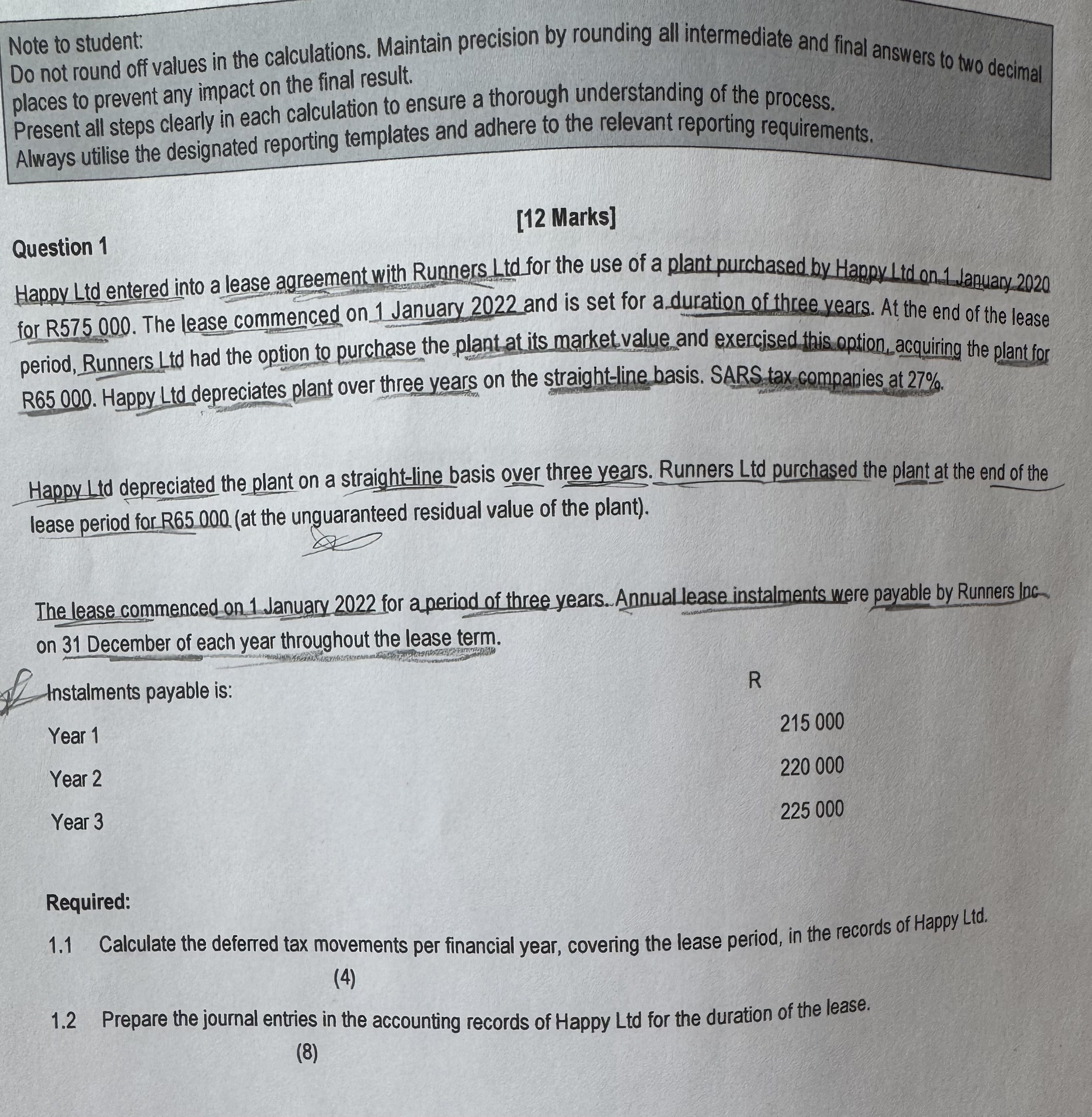

Note to student: Do not round off values in the calculations. Maintain precision by rounding all intermediate and final answers to two decimal places to prevent any impact on the final result. Present all steps clearly in each calculation to ensure a thorough understanding of the process. Always utilise the designated reporting templates and adhere to the relevant reporting requirements. Marks Question Happy Ltd entered into a lease agreement with Runners Ltd for the use of a plant purchased by Hanpy Ltd on Januany for R The lease commenced on January and is set for a duration of three years. At the end of the lease period, Runners Ltd had the option to purchase the plant at its market value and exercised this option, acquiring the plant for R Happy Ltd depreciates plant over three years on the straightline basis. SARS tax companies at Happy Ltd depreciated the plant on a straightline basis over three years. Runners Ltd purchased the plant at the end of the lease period for Rat the unguaranteed residual value of the plant The lease commenced on January for a period of three years. Annual lease instalments were payable by Runners lnc on December of each year throughout the lease term. Instalments payable is: Required: Calculate the deferred tax movements per financial year, covering the lease period, in the records of Happy Ltd Prepare the journal entries in the accounting records of Happy Ltd for the duration of the lease.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock