Question: ( Note: use the following information for Externality, Part A thru C ) Suppose the demand and supply curve for crude oil at any given

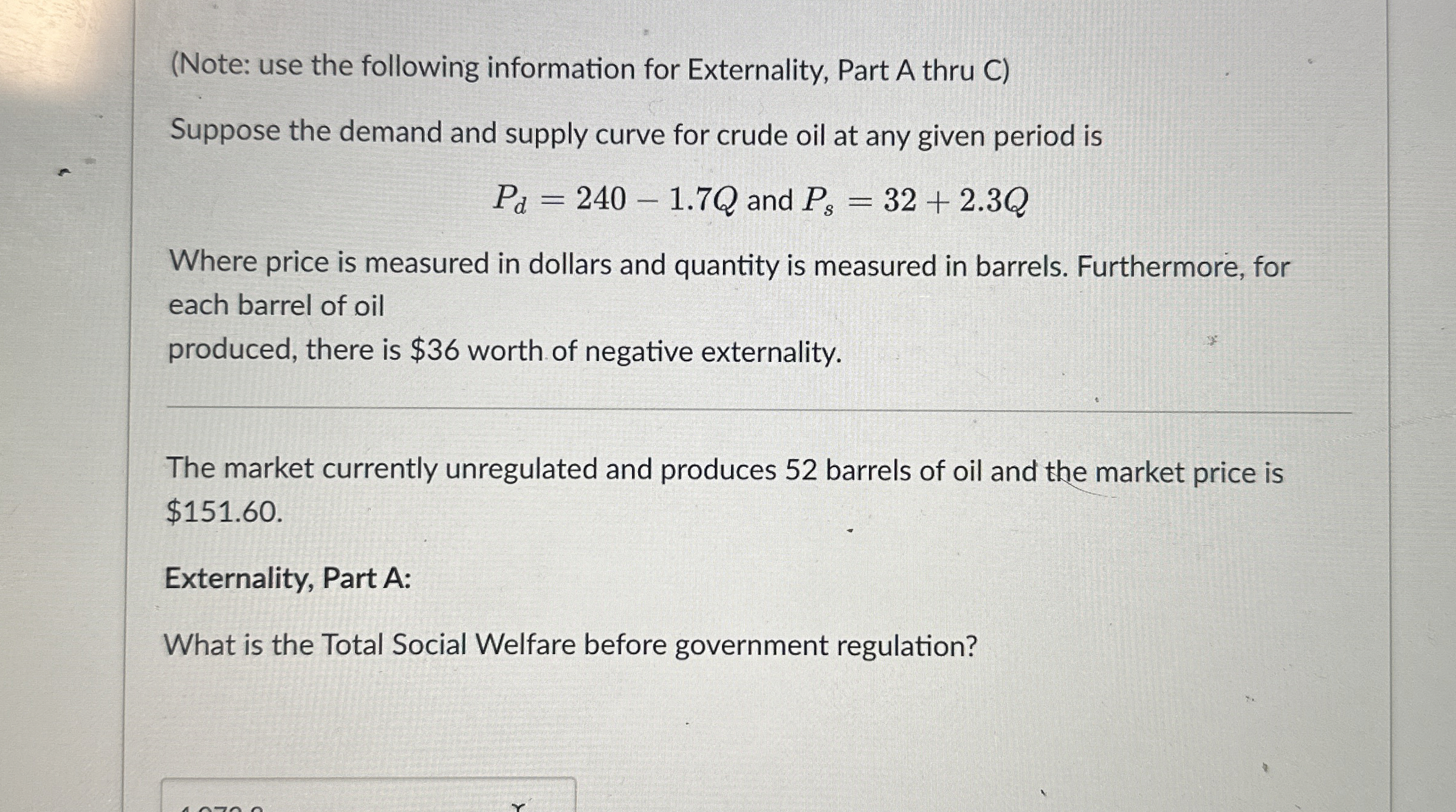

Note: use the following information for Externality, Part A thru C

Suppose the demand and supply curve for crude oil at any given period is

and

Where price is measured in dollars and quantity is measured in barrels. Furthermore, for each barrel of oil

produced, there is $ worth of negative externality.

The market currently unregulated and produces barrels of oil and the market price is $

Externality, Part A:

What is the Total Social Welfare before government regulation?Note: use the following information for Externality, Part A thru C

Suppose the demand and supply curve for crude oil at any given period is

and

Where price is measured in dollars and quantity is measured in barrels. Furthermore, for each barrel of oil

produced, there is $ worth of negative externality.

The market currently unregulated and produces barrels of oil and the market price is $

Externality, Part A:

What is the Total Social Welfare before government regulation?

Externality, Part B:

Suppose the government like to impose a Pigovian tax to internalize the negative externality.

AFTER the correct Pigovian tax is instituted, what will be the new market price? round answer to nearest dollar.

Question

pts

Externality, Part C:

Who, consumers or producers, bares the larger share of the tax burden? Explain how you know in a few sentences. Hint: you do not need to calculate the exact tax revenue

Edit View Insert Format Tools Table

pt Paragraph

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock