Question: Notes: All work with the methodology and the equations used must be shown in a detailed way. A timeline is required, wherever possible. Calculator steps

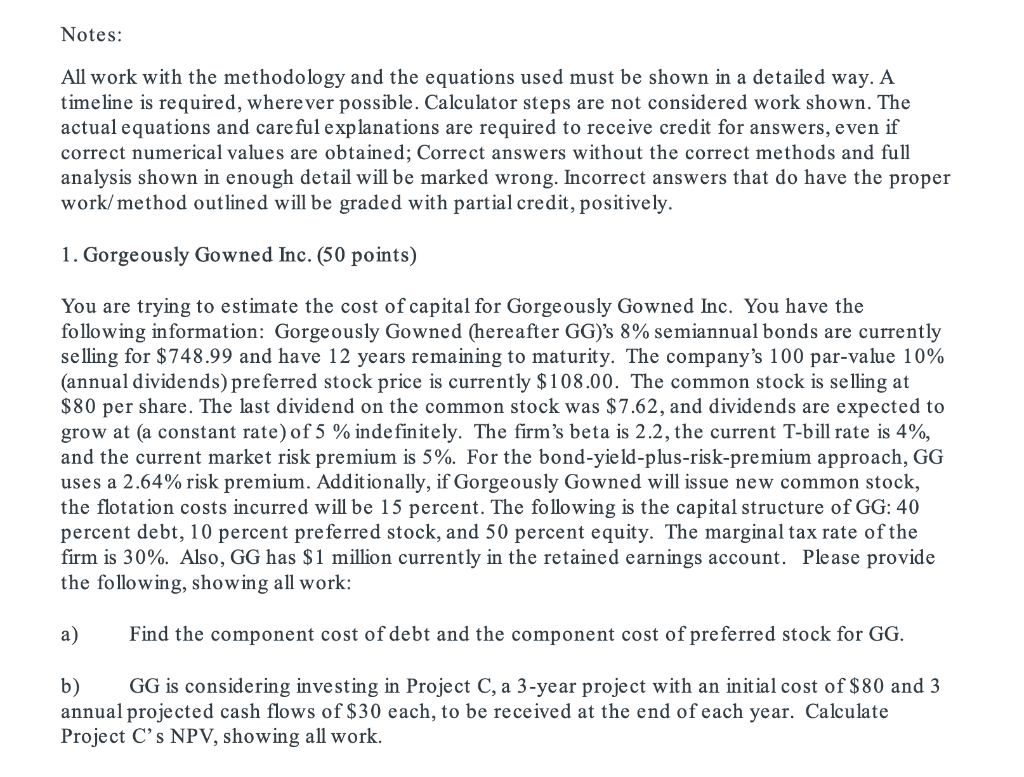

Notes: All work with the methodology and the equations used must be shown in a detailed way. A timeline is required, wherever possible. Calculator steps are not considered work shown. The actual equations and careful explanations are required to receive credit for answers, even if correct numerical values are obtained; Correct answers without the correct methods and full analysis shown in enough detail will be marked wrong. Incorrect answers that do have the proper work/method outlined will be graded with partial credit, positively. 1. Gorgeously Gowned Inc. (50 points) You are trying to estimate the cost of capital for Gorgeously Gowned Inc. You have the following information: Gorgeously Gowned (hereafter GG)'s 8% semiannual bonds are currently selling for $748.99 and have 12 years remaining to maturity. The company's 100 par-value 10% (annual dividends) preferred stock price is currently $108.00. The common stock is selling at $80 per share. The last dividend on the common stock was $7.62, and dividends are expected to grow at (a constant rate) of 5% indefinitely. The firm's beta is 2.2, the current T-bill rate is 4%, and the current market risk premium is 5%. For the bond-yield-plus-risk-premium approach, GG uses a 2.64% risk premium. Additionally, if Gorgeously Gowned will issue new common stock, the flotation costs incurred will be 15 percent. The following is the capital structure of GG: 40 percent debt, 10 percent preferred stock, and 50 percent equity. The marginal tax rate of the firm is 30%. Also, GG has $1 million currently in the retained earnings account. Please provide the following, showing all work: a) Find the component cost of debt and the component cost of preferred stock for GG. b) GG is considering investing in Project C, a 3 -year project with an initial cost of $80 and 3 annual projected cash flows of $30 each, to be received at the end of each year. Calculate Project C's NPV, showing all work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts