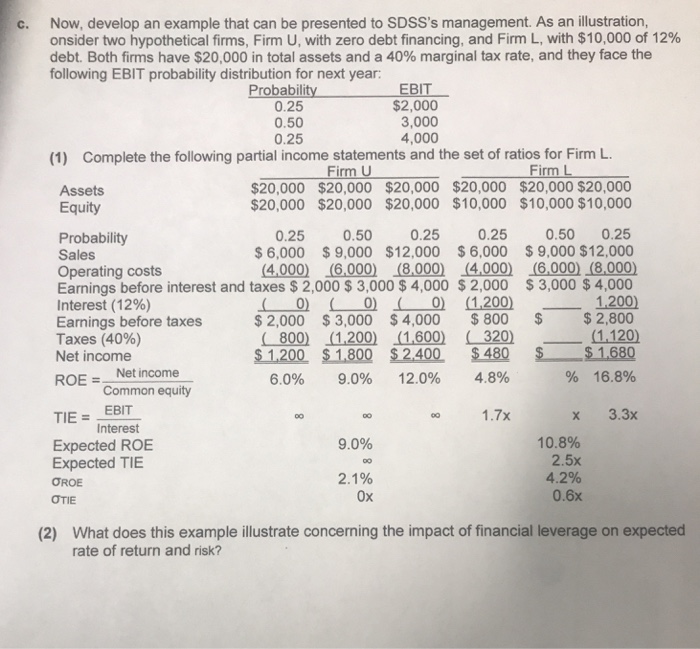

Question: Now, develop an example that can be presented to SDSS's management. As an illustration, onsider two hypothetical firms, Firm U, with zero debt financing, and

Now, develop an example that can be presented to SDSS's management. As an illustration, onsider two hypothetical firms, Firm U, with zero debt financing, and Firm L, with $10,000 of 12% debt. Both firms have $20,000 in total assets and a 40% marginal tax rate, and they face the following EBIT probability distribution for next year: c. ProbabilityEBIT 0.25 0.50 0.25 $2,000 3,000 4,000 (1) Complete the following partial income statements and the set of ratios for Firm L Firm U Firm L Assets Equity $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $10,000 $10,000 $10,000 0.25 0.500.25 0.25 0.50 0.25 $ 6,000 $9,000 $12,000 $ 6,000 $ 9,000 $12,000 4,000) (6,000) (8,000) (4,000) (6,000) (8,000) $3,000 $4,000 1200 $ 2,000 $ 3,000 $4,000 $800 $2,800 Probability Sales Operating costs Earnings before interest and taxes $ 2,000 $ 3,000 $ 4,000 $ 2,000 Interest (12%) Earnings before taxes Taxes (40%) Net income 0) O C 0 1200) L 8001 2001 (1,600) ( 320) 6.0% 9.0% 12.0% 4.8% 1.7x $ 1200 $ 1,800 $2.400 $480 $1680 % 16.8% ROE Net income Common equity x 3.3x Interest 10.8% 2.5x 4.2% 0.6x 9.0% Expected ROE Expected TIE 2.1% 0x What does this example illustrate concerning the impact of financial leverage on expected rate of return and risk? (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts