Question: Now it's time to practice what you've learned. Consider a future value of $2,000, 8 years in the future. Assume that the nominal interest rate

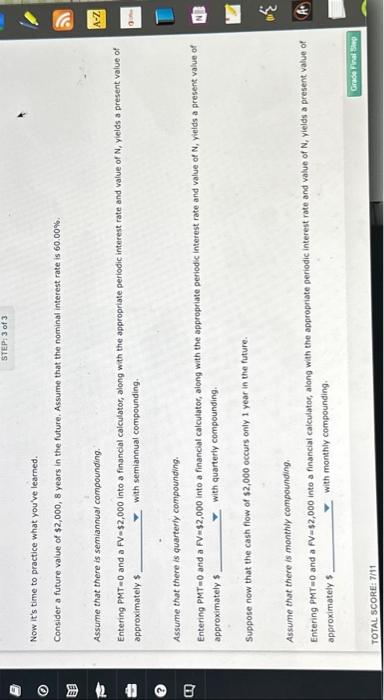

Now it's time to practice what you've learned. Consider a future value of $2,000,8 years in the future. Assume that the nominal interest rate is 60.00%. Assume that there is semiannual compounding. Entering PMT =0 and a FV =$2,000 into a financial calculator, along with the appropriate periodic interest rate and value of N, yields a present value of approximately $ with semiannual compounding. Assume that there is quarterily compounding. Entering PMT =0 and a FV =$2,000 into a financial calcutator, aiong with the appropriate periodic interest rate and value of N, yields a present value of approximatelys with quarterly compounding. Suppose now that the cash flow of \$2,000 occurs only 1 year in the future. Assume that there is monthy compounding. Entering PMT=0 and a FV=$2,000 into a financial calculator, along with the appropriate periodic interest rate and value of N, vieles a present value of epproximately s with monthly compounding. Now it's time to practice what you've learned. Consider a future value of $2,000,8 years in the future. Assume that the nominal interest rate is 60.00%. Assume that there is semiannual compounding. Entering PMT =0 and a FV =$2,000 into a financial calculator, along with the appropriate periodic interest rate and value of N, yields a present value of approximately $ with semiannual compounding. Assume that there is quarterily compounding. Entering PMT =0 and a FV =$2,000 into a financial calcutator, aiong with the appropriate periodic interest rate and value of N, yields a present value of approximatelys with quarterly compounding. Suppose now that the cash flow of \$2,000 occurs only 1 year in the future. Assume that there is monthy compounding. Entering PMT=0 and a FV=$2,000 into a financial calculator, along with the appropriate periodic interest rate and value of N, vieles a present value of epproximately s with monthly compounding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts