Question: Now suppose that the correlation between stock A and B was 0.01 instead of the number given in the table. Without doing any calculations explain

Now suppose that the correlation between stock A and B was 0.01 instead of the number given in the table. Without doing any calculations explain what effect this would have on the return and standard deviation of your portfolio.

Now suppose that the correlation between stock A and B was 0.01 instead of the number given in the table. Without doing any calculations explain what effect this would have on the return and standard deviation of your portfolio.

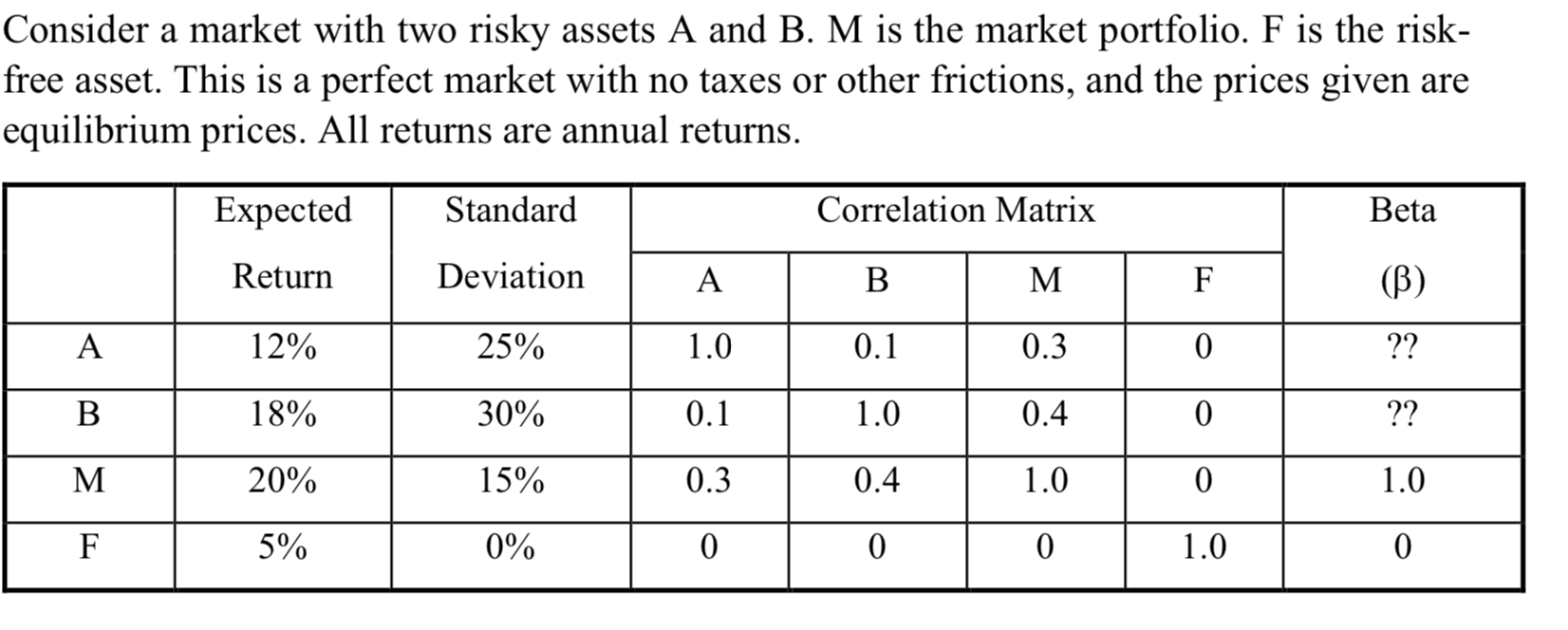

Consider a market with two risky assets A and B. M is the market portfolio. F is the risk- free asset. This is a perfect market with no taxes or other frictions, and the prices given are equilibrium prices. All returns are annual returns. Expected Standard Correlation Matrix Beta Return Deviation A B M F (B) A 12% 25% 1.0 0.1 0.3 0 ?? B 18% 30% 0.1 1.0 0.4 0 ?? M 20% 15% 0.3 0.4 1.0 0 1.0 F 5% 0% 0 0 0 1.0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts