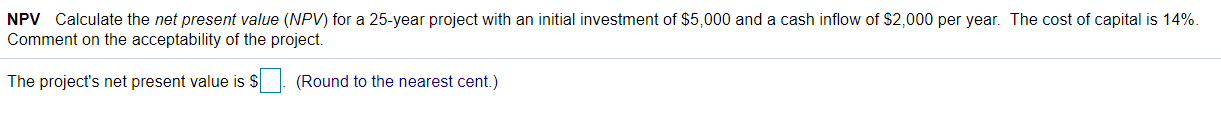

Question: NPV Calculate the net present value (NPV) for a 25-year project with an initial investment of $5,000 and a cash inflow of $2,000 per year.

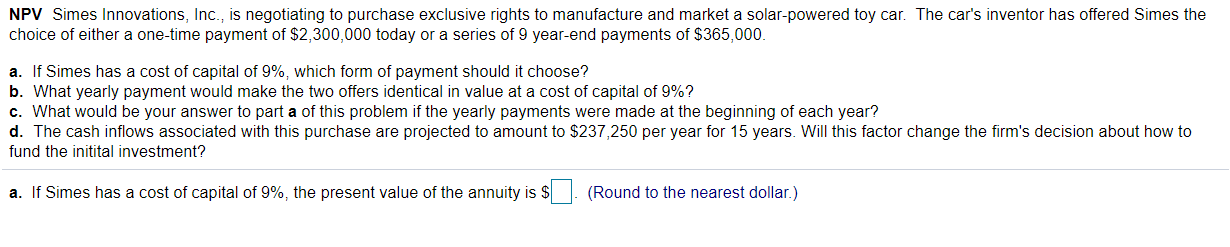

NPV Calculate the net present value (NPV) for a 25-year project with an initial investment of $5,000 and a cash inflow of $2,000 per year. The cost of capital is 14%. Comment on the acceptability of the project. The project's net present value is S (Round to the nearest cent.) NPV Simes Innovations, Inc., is negotiating to purchase exclusive rights to manufacture and market a solar-powered toy car. The car's inventor has offered Simes the choice of either a one-time payment of $2,300,000 today or a series of 9 year-end payments of $365,000. a. If Simes has a cost of capital of 9%, which form of payment should it choose? b. What yearly payment would make the two offers identical in value at a cost of capital of 9%? c. What would be your answer to part a of this problem if the yearly payments were made at the beginning of each year? d. The cash inflows associated with this purchase are projected to amount to $237,250 per year for 15 years. Will this factor change the firm's decision about how to fund the initital investment? a. If Simes has a cost of capital of 9%, the present value of the annuity is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts