Question: NPV Calculate the net present value (NPV) for a 25-year project with an initial investment of $35,000 and a cash inflow of $5,000 per year.

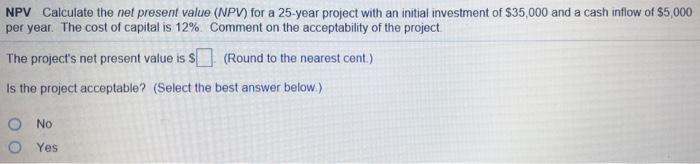

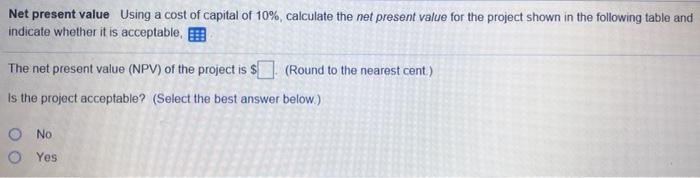

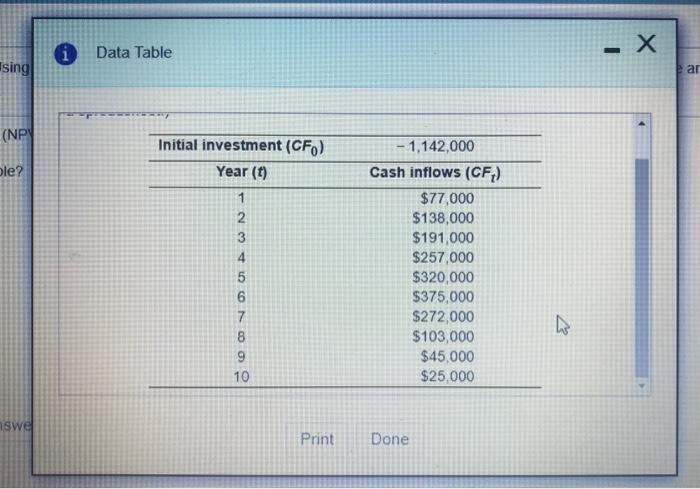

NPV Calculate the net present value (NPV) for a 25-year project with an initial investment of $35,000 and a cash inflow of $5,000 per year. The cost of capital is 12% Comment on the acceptability of the project. The project's net present value is $ (Round to the nearest cent.) Is the project acceptable? (Select the best answer below.) Yes Net present value Using a cost of capital of 10%, calculate the net present value for the project shown in the following table and indicate whether it is acceptable, The net present value (NPV) of the project is $(Round to the nearest cent.) Is the project acceptable? (Select the best answer below) Yes Data Table - X sing Ear (NP) ole? Initial investment (CF) Year (1) 1 2 3 4 5 6 7 8 9 10 - 1,142,000 Cash inflows (CF) $77,000 $138,000 $191,000 $257,000 $320,000 $375,000 $272,000 $103,000 $45,000 $25,000 aswel Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts