Question: O Project X only O. Both projects QUESTION 2 A firm with a 9 percent cost of capital is considering a project for this year's

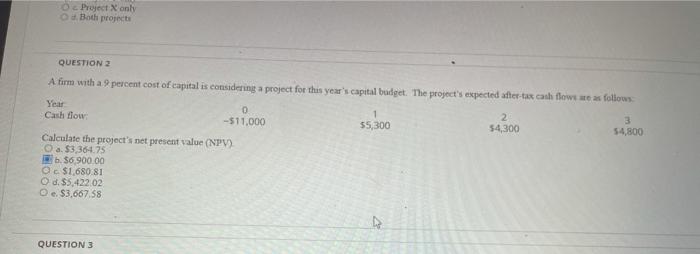

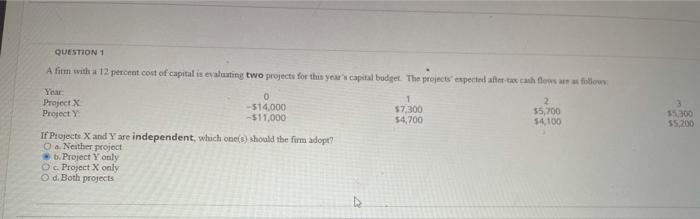

O Project X only O. Both projects QUESTION 2 A firm with a 9 percent cost of capital is considering a project for this year's capital budget. The project's expected after-tax cash flow me as follows: 0 1 2 3 Cash flow -511.000 55,300 54,300 54,800 Calculate the project's net present value (NPV) O a $3,364.75 $6 900.00 O $1,680.81 O d. $5.422.02 O e. $3,667.58 QUESTION 3 QUESTION 1 A firm with a 12 percent cost of capital is evaluating two projects for this year's capital budget. The projects' expected as cash flow follow Year 0 1 2 Project X -514.000 57,300 55,700 Project -$11,000 54,700 54,100 If Projects X and Y are independent, which one() should the firm adopt? O. Nesther project b. Project Yonly Project X only d. Both projects D. 15300 55.200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts