Question: Price a 3-year, 6% annual coupon bond, using the following interest rate tree for one-year rates. Assume annual compounding. Par is 100. Both states

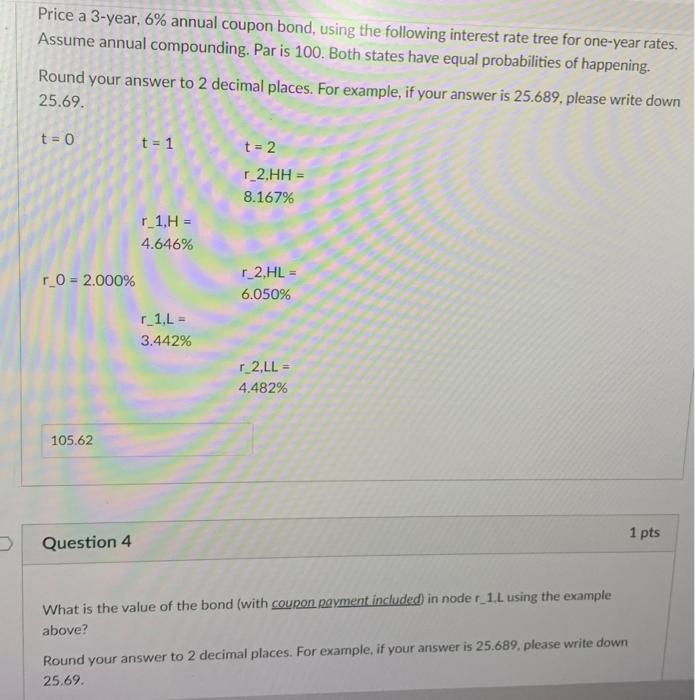

Price a 3-year, 6% annual coupon bond, using the following interest rate tree for one-year rates. Assume annual compounding. Par is 100. Both states have equal probabilities of happening. Round your answer to 2 decimal places. For example, if your answer is 25.689, please write down 25.69. t = 0 r_0 = 2.000% 105.62 Question 4 t = 1 r_1,H= 4.646% r_1,L= 3.442% t=2 r_2.HH = 8.167% r_2,HL= 6.050% r_2,LL = 4.482% What is the value of the bond (with coupon payment included) in node r_1.L using the example above? Round your answer to 2 decimal places. For example, if your answer is 25.689, please write down 25.69. 1 pts

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts