Question: Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. units, wnicn aiternative snouia pe seiectear Prepare rorecastea income statements

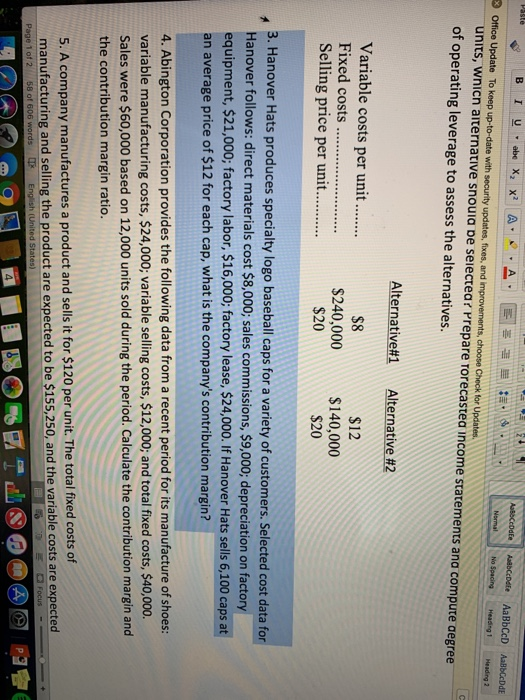

Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. units, wnicn aiternative snouia pe seiectear Prepare rorecastea income statements ana compute aegree of operating leverage to assess the alternatives Alternative #2 Variable costs per unit Fixed costs. Selling price per unit. $8 $240,000 $20 $12 $140,000 $20 3. Hanover Hats produces specialty logo baseball caps for a variety of customers. Selected cost data for Hanover follows: direct materials cost $8,000; sales commissions, $9,000; depreciation on factory equipment, $21,000; factory labor, $16,000; factory lease, $24,000. If Hanover Hats sells 6,100 caps at an average price of $12 for each cap, what is the company's contribution margin? 4. Abington Corporation provides the following data from a recent period for its manufacture of shoes: variable manufacturing costs, $24,000; variable selling costs, $12,000; and total fixed costs, $40,000 Sales were $60,000 based on 12,000 units sold during the period. Calculate the contribution margin and the contribution margin ratio 5. A company manufacture manufacturing and selling the product are expected to be $155,250, and the variable costs are expected s a product and sells it for $120 per unit. The total fixed costs of Tk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts