Question: Old MathJax webview Old MathJax webview please do only part C in 50 minutes please urgently... I'll give you up thumb definitely please do part

Old MathJax webview

please do only part C in 50 minutes please urgently... I'll give you up thumb definitely

please do part C only in 50 minutes please urgently... I'll give you up thumb definitely

please do only part C in 50 minutes please urgently... I'll give you up thumb definitely

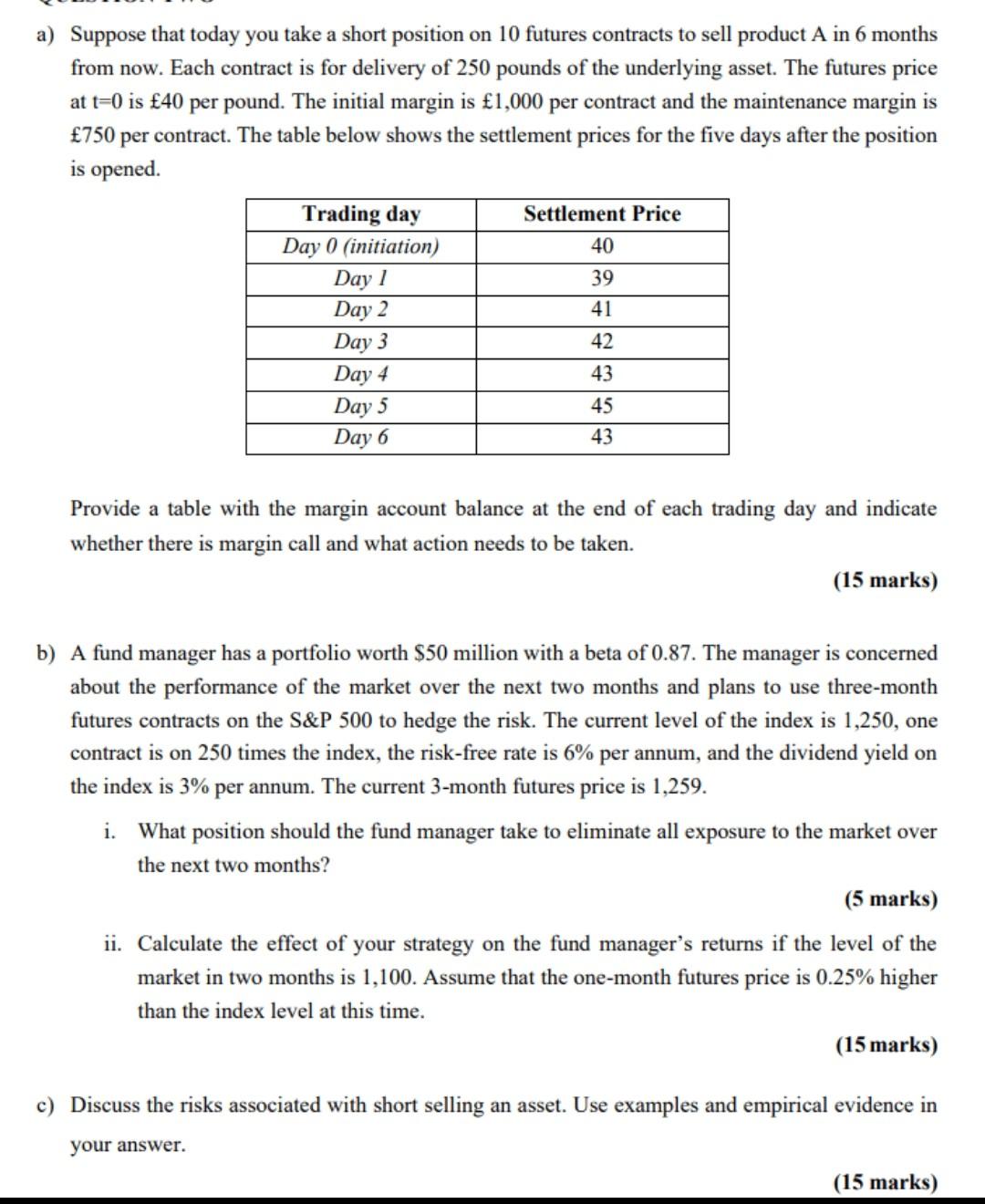

a) Suppose that today you take a short position on 10 futures contracts to sell product A in 6 months from now. Each contract is for delivery of 250 pounds of the underlying asset. The futures price at t=0 is 40 per pound. The initial margin is 1,000 per contract and the maintenance margin is 750 per contract. The table below shows the settlement prices for the five days after the position is opened. Trading day Settlement Price Day 0 (initiation) Day 1 39 Day 2 41 Day 3 42 Day 4 43 Day 5 Day 6 40 45 43 Provide a table with the margin account balance at the end of each trading day and indicate whether there is margin call and what action needs to be taken. (15 marks) b) A fund manager has a portfolio worth $50 million with a beta of 0.87. The manager is concerned about the performance of the market over the next two months and plans to use three-month futures contracts on the S&P 500 to hedge the risk. The current level of the index is 1,250, one contract is on 250 times the index, the risk-free rate is 6% per annum, and the dividend yield on the index is 3% per annum. The current 3-month futures price is 1,259. i. What position should the fund manager take to eliminate all exposure to the market over the next two months? (5 marks) ii. Calculate the effect of your strategy on the fund manager's returns if the level of the market in two months is 1,100. Assume that the one-month futures price is 0.25% higher than the index level at this time. (15 marks) c) Discuss the risks associated with short selling an asset. Use examples and empirical evidence in your answer. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts