Question: Old MathJax webview Note: Part A of question has been answered Part A has been answered. i would like help with parts B through E.

Old MathJax webview

Note: Part A of question has been answered

Part A has been answered. i would like help with parts B through E. Thanks in advance

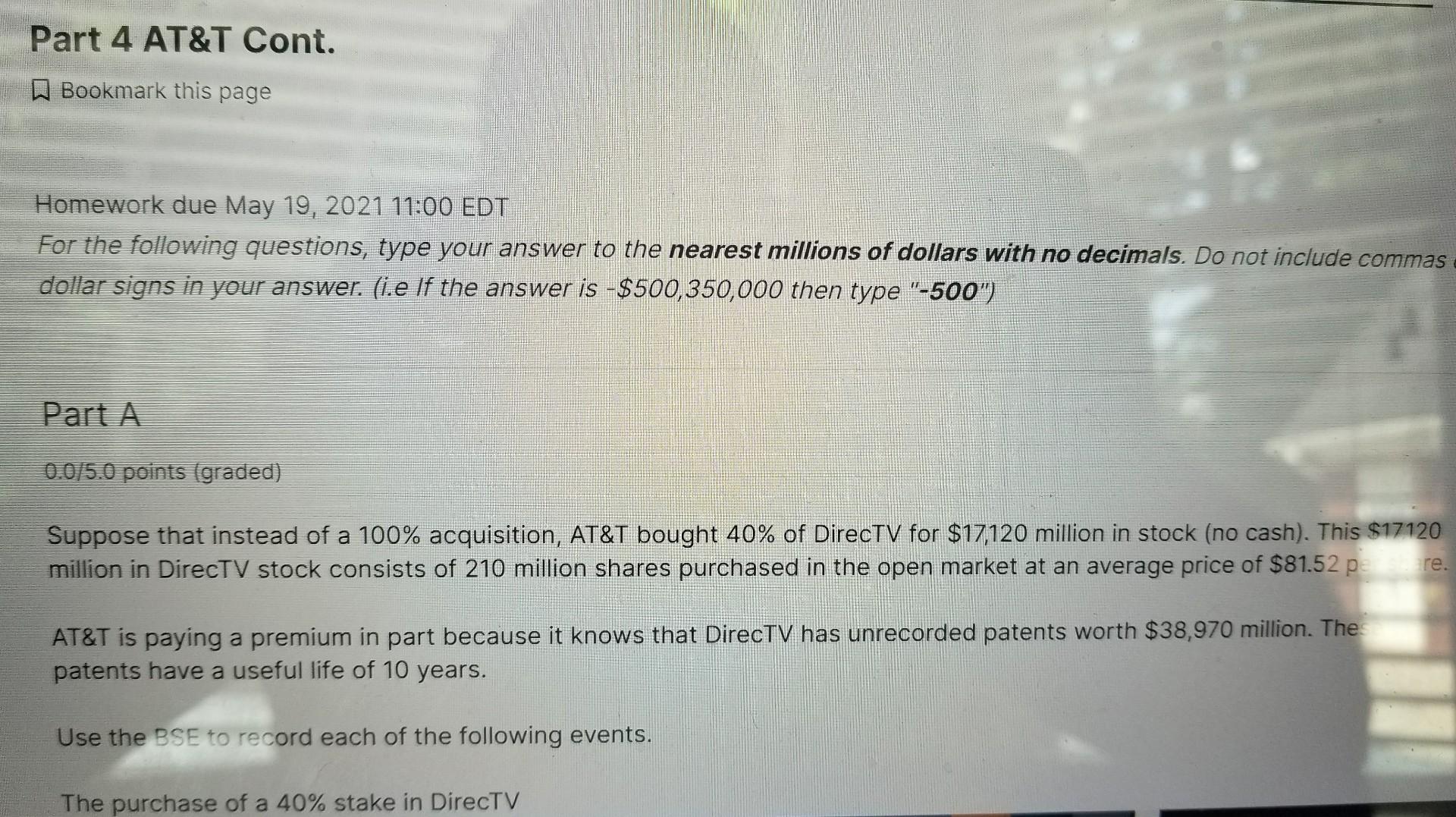

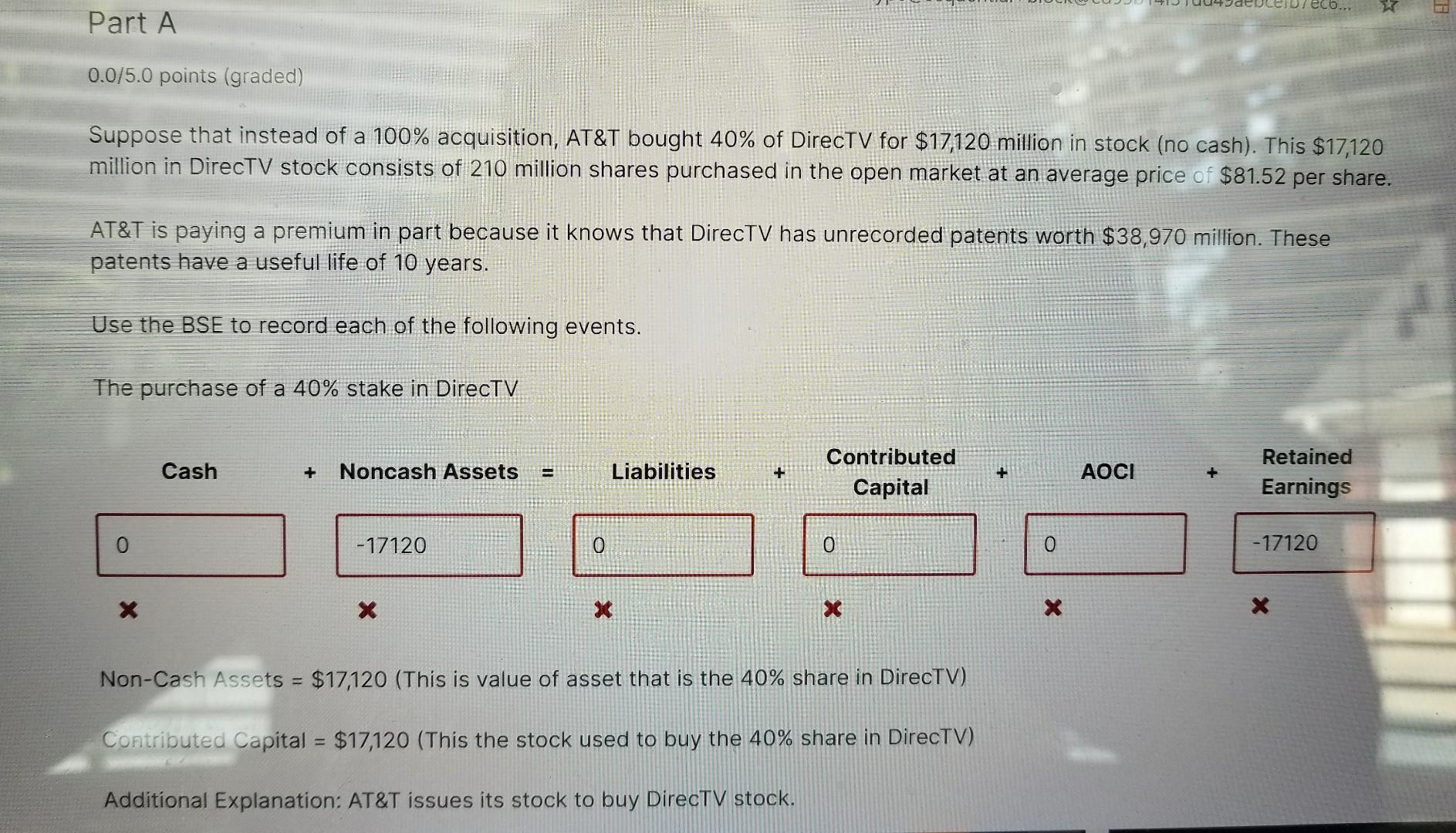

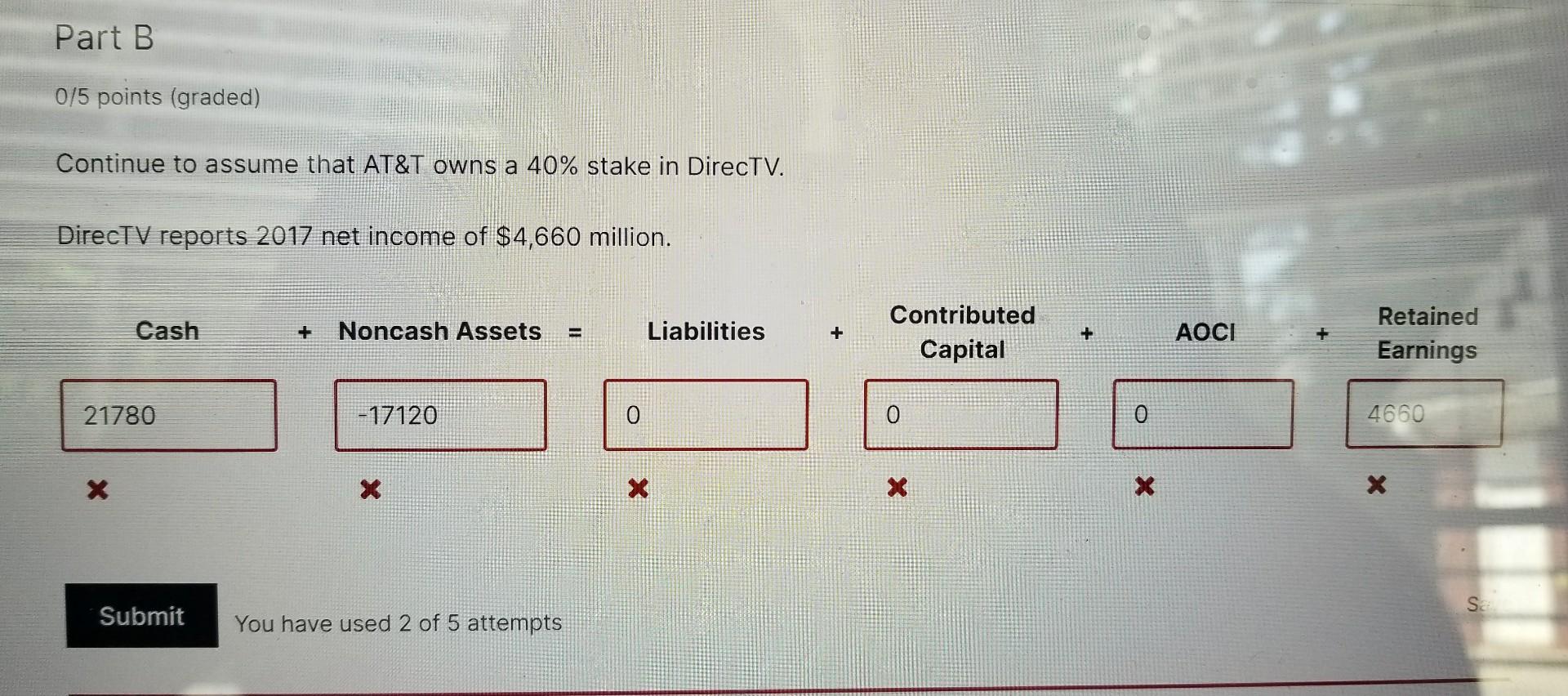

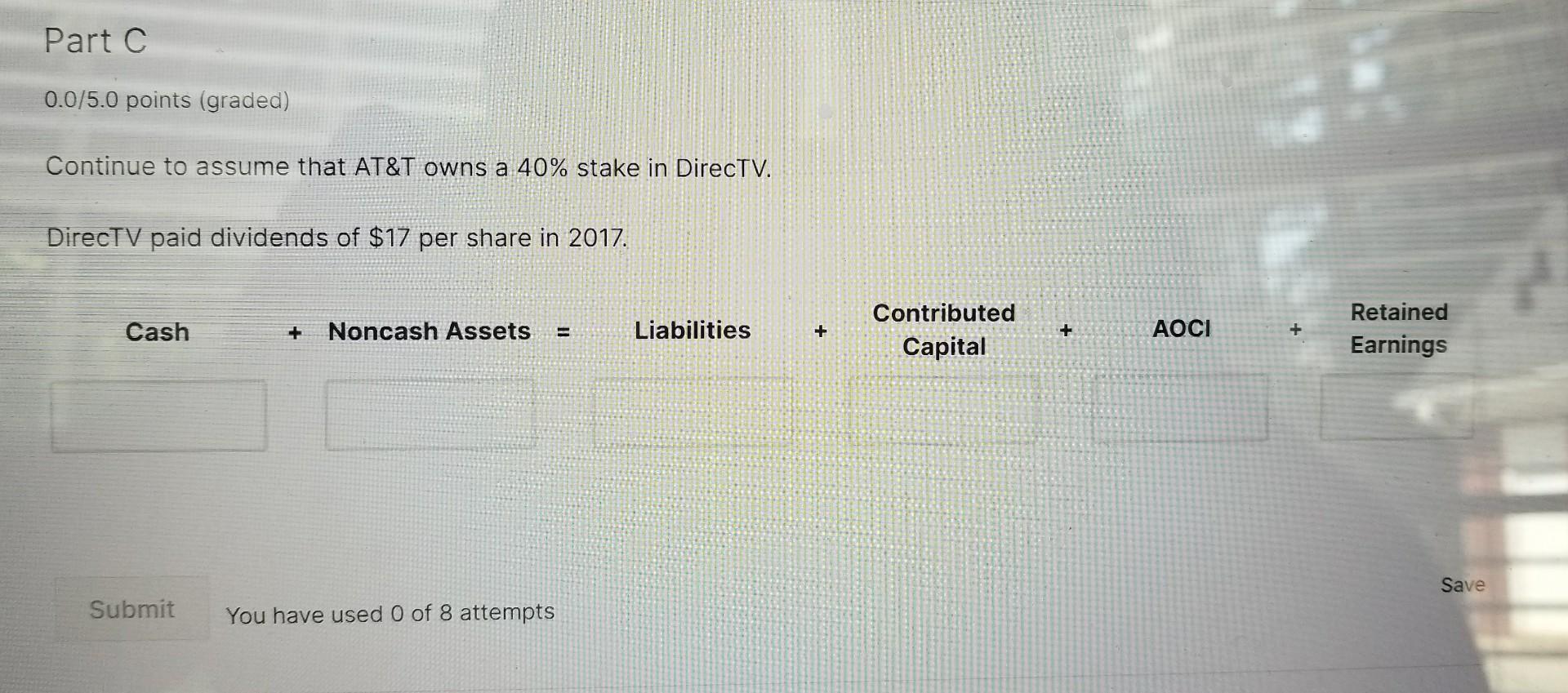

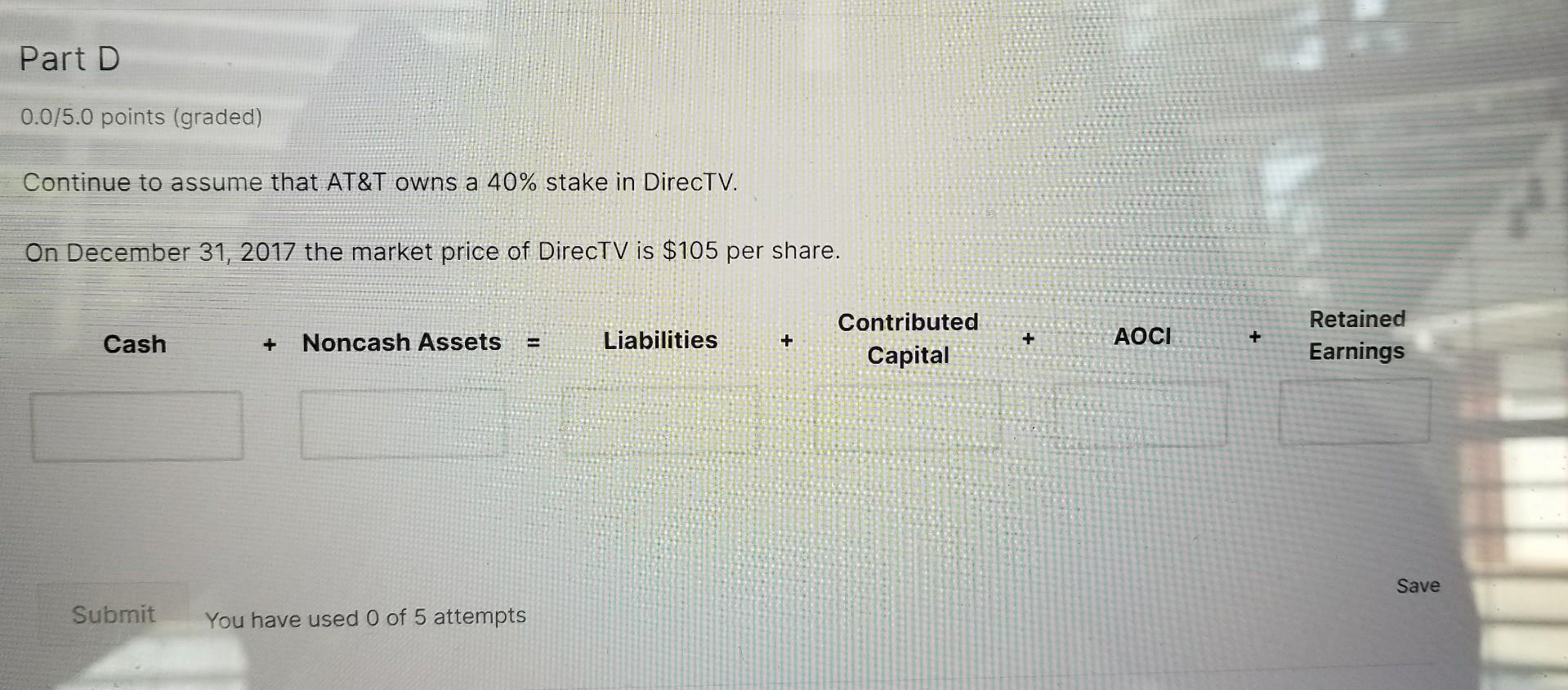

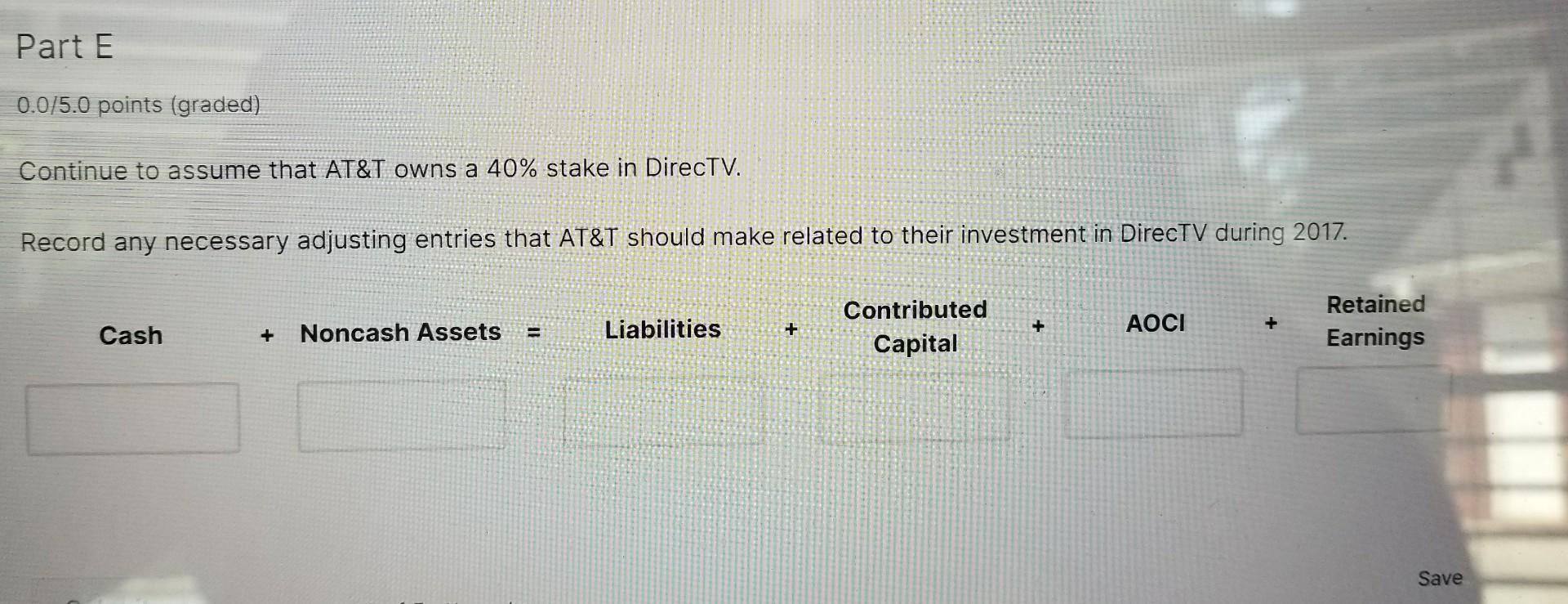

Part 4 AT&T Cont. a Bookmark this page Homework due May 19, 2021 11:00 EDT For the following questions, type your answer to the nearest millions of dollars with no decimals. Do not include commas dollar signs in your answer. (i.e If the answer is - $500,350,000 then type "-500") Part A 0.0/5.0 points (graded) Suppose that instead of a 100% acquisition, AT&T bought 40% of DirecTV for $17,120 million in stock (no cash). This $17120 million in DirecTV stock consists of 210 million shares purchased in the open market at an average price of $81.52 pere. AT&T is paying a premium in part because it knows that DirecTV has unrecorded patents worth $38,970 million. The patents have a useful life of 10 years. Use the BSE to record each of the following events. The purchase of a 40% stake in DirecTV Part A 0.0/5.0 points (graded) Suppose that instead of a 100% acquisition, AT&T bought 40% of DirecTV for $17,120 million in stock (no cash). This $17,120 million in DirecTV stock consists of 210 million shares purchased in the open market at an average price of $81.52 p per share. AT&T is paying a premium in part because it knows that DirecTV has unrecorded patents worth $38,970 million. These patents have a useful life of 10 years. Use the BSE to record each of the following events. The purchase of a 40% stake in DirecTV Cash + Noncash Assets Liabilities + Contributed Capital + AOCI Retained Earnings 0 -17120 0 0 0 -17120 X X X Non-Cash Assets = $17,120 (This is value of asset that is the 40% share in DirecTV) Contributed Capital = $17,120 (This the stock used to buy the 40% share in DirecTV) Additional Explanation: AT&T issues its stock to buy DirecTV stock. Part B 0/5 points (graded) Continue to assume that AT&T owns a 40% stake in DirecTV. DirecTV reports 2017 net income of $4,660 million. Cash + Noncash Assets Liabilities Contributed Capital + AOCI Retained Earnings 21780 -17120 0 0 0 4660 X X X X S Submit You have used 2 of 5 attempts Part C 0.0/5.0 points (graded) Continue to assume that AT&T owns a 40% stake in DirecTV. DirecTV paid dividends of $17 per share in 2017. Cash Noncash Assets Liabilities + Contributed Capital + AOCI + Retained Earnings Save Submit You have used 0 of 8 attempts Part D 0.0/5.0 points (graded) Continue to assume that AT&T owns a 40% stake in DirecTV. On December 31, 2017 the market price of DirecTV is $105 per share. Cash Noncash Assets = Liabilities + Contributed Capital + AOCI Retained Earnings Save Submit You have used 0 of 5 attempts Part E 0.0/5.0 points (graded) Continue to assume that AT&T owns a 40% stake in DirecTV. Record any necessary adjusting entries that AT&T should make related to their investment in DirecTV during 2017. Cash AOCI + Liabilities Noncash Assets + Contributed Capital Retained Earnings Save Part 4 AT&T Cont. a Bookmark this page Homework due May 19, 2021 11:00 EDT For the following questions, type your answer to the nearest millions of dollars with no decimals. Do not include commas dollar signs in your answer. (i.e If the answer is - $500,350,000 then type "-500") Part A 0.0/5.0 points (graded) Suppose that instead of a 100% acquisition, AT&T bought 40% of DirecTV for $17,120 million in stock (no cash). This $17120 million in DirecTV stock consists of 210 million shares purchased in the open market at an average price of $81.52 pere. AT&T is paying a premium in part because it knows that DirecTV has unrecorded patents worth $38,970 million. The patents have a useful life of 10 years. Use the BSE to record each of the following events. The purchase of a 40% stake in DirecTV Part A 0.0/5.0 points (graded) Suppose that instead of a 100% acquisition, AT&T bought 40% of DirecTV for $17,120 million in stock (no cash). This $17,120 million in DirecTV stock consists of 210 million shares purchased in the open market at an average price of $81.52 p per share. AT&T is paying a premium in part because it knows that DirecTV has unrecorded patents worth $38,970 million. These patents have a useful life of 10 years. Use the BSE to record each of the following events. The purchase of a 40% stake in DirecTV Cash + Noncash Assets Liabilities + Contributed Capital + AOCI Retained Earnings 0 -17120 0 0 0 -17120 X X X Non-Cash Assets = $17,120 (This is value of asset that is the 40% share in DirecTV) Contributed Capital = $17,120 (This the stock used to buy the 40% share in DirecTV) Additional Explanation: AT&T issues its stock to buy DirecTV stock. Part B 0/5 points (graded) Continue to assume that AT&T owns a 40% stake in DirecTV. DirecTV reports 2017 net income of $4,660 million. Cash + Noncash Assets Liabilities Contributed Capital + AOCI Retained Earnings 21780 -17120 0 0 0 4660 X X X X S Submit You have used 2 of 5 attempts Part C 0.0/5.0 points (graded) Continue to assume that AT&T owns a 40% stake in DirecTV. DirecTV paid dividends of $17 per share in 2017. Cash Noncash Assets Liabilities + Contributed Capital + AOCI + Retained Earnings Save Submit You have used 0 of 8 attempts Part D 0.0/5.0 points (graded) Continue to assume that AT&T owns a 40% stake in DirecTV. On December 31, 2017 the market price of DirecTV is $105 per share. Cash Noncash Assets = Liabilities + Contributed Capital + AOCI Retained Earnings Save Submit You have used 0 of 5 attempts Part E 0.0/5.0 points (graded) Continue to assume that AT&T owns a 40% stake in DirecTV. Record any necessary adjusting entries that AT&T should make related to their investment in DirecTV during 2017. Cash AOCI + Liabilities Noncash Assets + Contributed Capital Retained Earnings Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts