Question: Old MathJax webview Old MathJax webview AAA AAA Best Buy Co., Inc. By 2017, the value of Best Buy's stock climbed over 200 percent' since

Old MathJax webview

Old MathJax webview

AAA

AAA

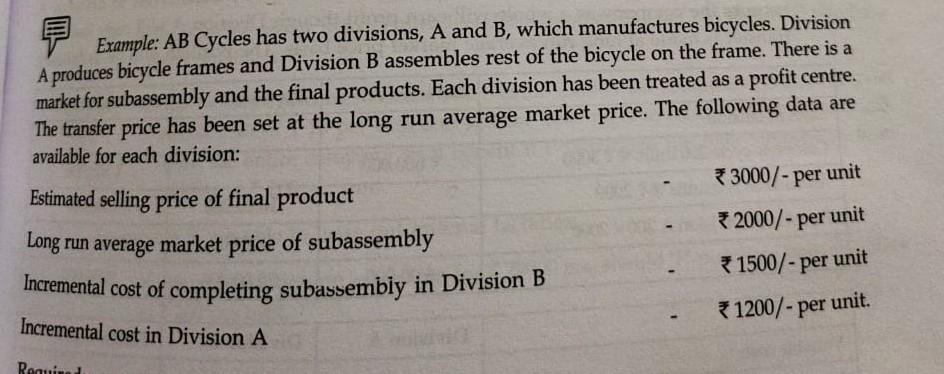

Best Buy Co., Inc. By 2017, the value of Best Buy's stock climbed over 200 percent' since Hubert Joly was appointed CEO in 2012. Although lagging the returns of Amazon (300 percent), it exceeds the 75 percent return on the S&P 500 over the same time period? (Exhibit 1 depicts a stock price comparison from August 20. 2012 the day that Hubert Joly was appointed as Best Buy CEO to September 6, 2017 Best Buy's performance reflects a stark difference for many retailers that have declared or are facing bankruptcy. such as RadioShack and Sears. Best Buy has used its physical presence to engage customers in "high touch products that allow customers to interact with products combined with competitive prices. and then offering after-sales support such as in-home installation Joly implemented a mix of "Expert Service. Unbeatable Prices to provide a clear value proposition. The strategy's success is reflected in Best Buy's performance, and Hubert Joly being touted as the "retailer of the year" by Forbes for 2016. Still Hubert Joly increasingly confronts questions about how to maintain the firm's improved performance. Currently Best Buy is focusing on in-home advisors with a brand-agnostic approach to unlock latent demand and drive sales. However, it is unclear whether it will work. It is either possible that Best Buy may provide a glimpse of what the future may look like, or these moves may simply prelude the firm's demise. Amazon remains a formidable competitor for Best Buy. For example. Amazon has begun offering in- home consultation with Alexa' and Best Buy does not have an offering in the growing area of digital assistants that may substitute for its trained sales staff. Amazon is also creating increased physical presence through the expansion of warehouses and through its purchase of Whole Foods. While the purchase of Whole Foods by Amazon has mainly driven grocery chain companies stock lower." it also gives Amazon a physical presence where customers will be able to pick up purchases. Additionally through a partnership with Sears. Amazon is rolling out the sale of Kenmore appliances nationwide. Appliances played a large part in Best Buy's recent growth and recovery." and Best Buy cannot simply rest on its laurels as competition continues to evolve. Competition in the consumer-electronics industry remains cut-throat. While Best Buy is no longer considered doomed to follow other national consumer electronics retail superstores into extinction, it will be harder for Best Buy to meet increased expectations for continued performance. For example, analysts are skeptical that Best Buy's recent performance is sustainable and rate Best Buy's stock as a hold. This likely reflects concerns Best Buy may simply have received a temporary boost from struggles at other traditional retailers. If insider stock sales are any indication. Best Buy's manag- ers may agree, as over the last two years of its high-performance, Best Buy managers have been net sellers of the company's stock. Further, reflecting potential concerns with growing revenue, Best Buy has announced plans to cut costs by $600 million by 2021, after reaching a previous goal of reducing costs by $400 million. Meanwhile. Best Buy is looking for growth outside the U.S. by expanding in Canada and Mexica. A Brief History of Best Buy Together with his business partner, James Wheeler, Richard Schulze founded Sound of Music, an audio specialty store, in Minnesota in 1966. The fledgling company ended its first fiscal year with gross sales of $173.000, and continued to grow rapidly over the next few years. By the time of its initial public offering in 1969 the home-town enterprise had acquired two of its local competitors and it opened two new outlets near the University of Minnesota in downtown Minneapolis. Schulze bought out. Wheeler in 1971.'s shortly after Sound of Music hit the $1 million mark in annual revenues." Subsequent years saw continued expansion through additional locations, new prod- net lines and revel promotional techniones. For example in 1979 Sound of Music became the first Example: AB Cycles has two divisions, A and B, which manufactures bicycles. Division A produces bicycle frames and Division B assembles rest of the bicycle on the frame. There is a market for subassembly and the final products. Each division has been treated as a profit centre. The transfer price has been set at the long run average market price. The following data are available for each division: Estimated selling price of final product *3000/- per unit Long run average market price of subassembly * 2000/- per unit Incremental cost of completing subassembly in Division B *1500/- per unit 1200/- per unit. Incremental cost in Division A Romu Best Buy Co., Inc. By 2017, the value of Best Buy's stock climbed over 200 percent' since Hubert Joly was appointed CEO in 2012. Although lagging the returns of Amazon (300 percent), it exceeds the 75 percent return on the S&P 500 over the same time period? (Exhibit 1 depicts a stock price comparison from August 20. 2012 the day that Hubert Joly was appointed as Best Buy CEO to September 6, 2017 Best Buy's performance reflects a stark difference for many retailers that have declared or are facing bankruptcy. such as RadioShack and Sears. Best Buy has used its physical presence to engage customers in "high touch products that allow customers to interact with products combined with competitive prices. and then offering after-sales support such as in-home installation Joly implemented a mix of "Expert Service. Unbeatable Prices to provide a clear value proposition. The strategy's success is reflected in Best Buy's performance, and Hubert Joly being touted as the "retailer of the year" by Forbes for 2016. Still Hubert Joly increasingly confronts questions about how to maintain the firm's improved performance. Currently Best Buy is focusing on in-home advisors with a brand-agnostic approach to unlock latent demand and drive sales. However, it is unclear whether it will work. It is either possible that Best Buy may provide a glimpse of what the future may look like, or these moves may simply prelude the firm's demise. Amazon remains a formidable competitor for Best Buy. For example. Amazon has begun offering in- home consultation with Alexa' and Best Buy does not have an offering in the growing area of digital assistants that may substitute for its trained sales staff. Amazon is also creating increased physical presence through the expansion of warehouses and through its purchase of Whole Foods. While the purchase of Whole Foods by Amazon has mainly driven grocery chain companies stock lower." it also gives Amazon a physical presence where customers will be able to pick up purchases. Additionally through a partnership with Sears. Amazon is rolling out the sale of Kenmore appliances nationwide. Appliances played a large part in Best Buy's recent growth and recovery." and Best Buy cannot simply rest on its laurels as competition continues to evolve. Competition in the consumer-electronics industry remains cut-throat. While Best Buy is no longer considered doomed to follow other national consumer electronics retail superstores into extinction, it will be harder for Best Buy to meet increased expectations for continued performance. For example, analysts are skeptical that Best Buy's recent performance is sustainable and rate Best Buy's stock as a hold. This likely reflects concerns Best Buy may simply have received a temporary boost from struggles at other traditional retailers. If insider stock sales are any indication. Best Buy's manag- ers may agree, as over the last two years of its high-performance, Best Buy managers have been net sellers of the company's stock. Further, reflecting potential concerns with growing revenue, Best Buy has announced plans to cut costs by $600 million by 2021, after reaching a previous goal of reducing costs by $400 million. Meanwhile. Best Buy is looking for growth outside the U.S. by expanding in Canada and Mexica. A Brief History of Best Buy Together with his business partner, James Wheeler, Richard Schulze founded Sound of Music, an audio specialty store, in Minnesota in 1966. The fledgling company ended its first fiscal year with gross sales of $173.000, and continued to grow rapidly over the next few years. By the time of its initial public offering in 1969 the home-town enterprise had acquired two of its local competitors and it opened two new outlets near the University of Minnesota in downtown Minneapolis. Schulze bought out. Wheeler in 1971.'s shortly after Sound of Music hit the $1 million mark in annual revenues." Subsequent years saw continued expansion through additional locations, new prod- net lines and revel promotional techniones. For example in 1979 Sound of Music became the first Example: AB Cycles has two divisions, A and B, which manufactures bicycles. Division A produces bicycle frames and Division B assembles rest of the bicycle on the frame. There is a market for subassembly and the final products. Each division has been treated as a profit centre. The transfer price has been set at the long run average market price. The following data are available for each division: Estimated selling price of final product *3000/- per unit Long run average market price of subassembly * 2000/- per unit Incremental cost of completing subassembly in Division B *1500/- per unit 1200/- per unit. Incremental cost in Division A RomuStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock