Question: Old MathJax webview Old MathJax webview Please answer only part f, g and h Check now please answer only part last 3 parts not all

Old MathJax webview

Please answer only part f, g and h

Check now please answer only part last 3 parts not all

Please check full question I need only part e f, g and h

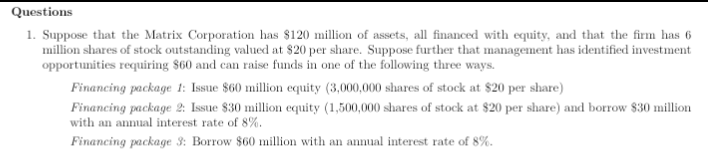

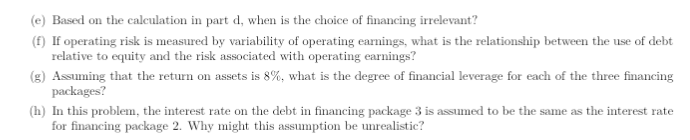

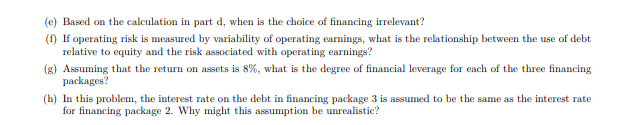

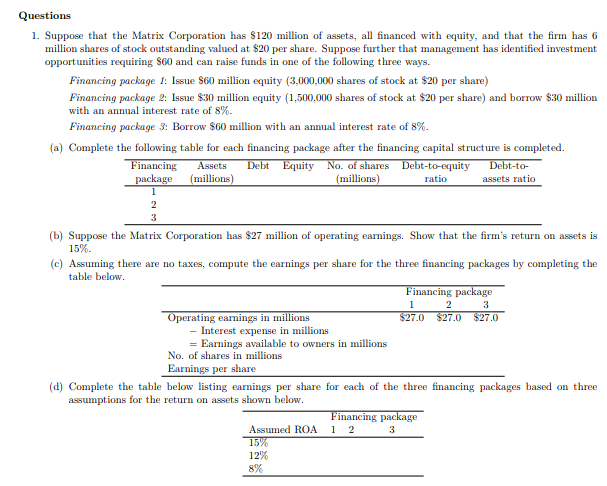

Questions 1. Suppose that the Matrix Corporation has $120 million of assets, all financed with equity, and that the firm has 6 million shares of stock outstanding valued at $20 per share. Suppose further that management has identified investment opportunities requiring $60 and can raise funds in one of the following three ways. Financing package 1: Issue 860 million equity (3,000,000 shares of stock at $20 per share) Financing package 2: Issue $30 million equity (1,500,000 shares of stock at $20 per share) and borrow $30 million with an annual interest rate of 8%. Financing package 3: Borrow $60 million with an annual interest rate of 8%. (e) Based on the calculation in part d, when is the choice of financing irrelevant? (f) If operating risk is measured by variability of operating earnings, what is the relationship between the use of debt relative to equity and the risk associated with operating earnings? (g) Assuming that the return on assets is 8%, what is the degree of financial leverage for each of the three financing packages? (h) In this problem, the interest rate on the debt in financing package 3 is assumed to be the same as the interest rate for financing package 2. Why might this assumption be unrealistic? (e) Based on the calculation in part d, when is the choice of financing irrelevant? (f) If operating risk is measured by variability of operating earnings, what is the relationship between the use of debt relative to equity and the risk associated with operating earnings? (8) Assuming that the return on assets is 8%, what is the degree of financial leverage for each of the three financing packages? (h) In this problem, the interest rate on the debt in financing package 3 is assumed to be the same as the interest rate for financing package 2. Why might this assumption be unrealistic? 1 Questions 1. Suppose that the Matrix Corporation has $120 million of assets, all financed with equity, and that the firm has 6 million shares of stock outstanding valued at $20 per share. Suppose further that management has identified investment opportunities requiring $60 and can raise funds in one of the following three ways. Financing package 1: Issue 860 million equity (3,000,000 shares of stock at $20 per share) Financing package 2: Issue $30 million equity (1,500,000 shares of stock at $20 per share) and borrow $30 million with an annual interest rate of 8%. Financing package 3: Borrow $60 million with an annual interest rate of 8%. (a) Complete the following table for each financing package after the financing capital structure is completed. Financing Assets Debt Equity No. of shares Debt-to-equity Debt-to- package (millions) (millions) ratio assets ratio 2 3 (b) Suppose the Matrix Corporation has $27 million of operating earnings. Show that the firm's return on assets is 15% (c) Assuming there are no taxes, compute the earnings per share for the three financing packages by completing the table below. Financing package 1 2 3 Operating earnings in millions $27.0 $27.0 $27.0 Interest expense in millions = Earnings available to owners in millions No. of shares in millions Earnings per share (a) Complete the table below listing earnings per share for each of the three financing packages based on three assumptions for the return on assets shown below. Financing package Assumed ROA 1 2 3 15% 12% 8% Questions 1. Suppose that the Matrix Corporation has $120 million of assets, all financed with equity, and that the firm has 6 million shares of stock outstanding valued at $20 per share. Suppose further that management has identified investment opportunities requiring $60 and can raise funds in one of the following three ways. Financing package 1: Issue 860 million equity (3,000,000 shares of stock at $20 per share) Financing package 2: Issue $30 million equity (1,500,000 shares of stock at $20 per share) and borrow $30 million with an annual interest rate of 8%. Financing package 3: Borrow $60 million with an annual interest rate of 8%. (e) Based on the calculation in part d, when is the choice of financing irrelevant? (f) If operating risk is measured by variability of operating earnings, what is the relationship between the use of debt relative to equity and the risk associated with operating earnings? (g) Assuming that the return on assets is 8%, what is the degree of financial leverage for each of the three financing packages? (h) In this problem, the interest rate on the debt in financing package 3 is assumed to be the same as the interest rate for financing package 2. Why might this assumption be unrealistic? (e) Based on the calculation in part d, when is the choice of financing irrelevant? (f) If operating risk is measured by variability of operating earnings, what is the relationship between the use of debt relative to equity and the risk associated with operating earnings? (8) Assuming that the return on assets is 8%, what is the degree of financial leverage for each of the three financing packages? (h) In this problem, the interest rate on the debt in financing package 3 is assumed to be the same as the interest rate for financing package 2. Why might this assumption be unrealistic? 1 Questions 1. Suppose that the Matrix Corporation has $120 million of assets, all financed with equity, and that the firm has 6 million shares of stock outstanding valued at $20 per share. Suppose further that management has identified investment opportunities requiring $60 and can raise funds in one of the following three ways. Financing package 1: Issue 860 million equity (3,000,000 shares of stock at $20 per share) Financing package 2: Issue $30 million equity (1,500,000 shares of stock at $20 per share) and borrow $30 million with an annual interest rate of 8%. Financing package 3: Borrow $60 million with an annual interest rate of 8%. (a) Complete the following table for each financing package after the financing capital structure is completed. Financing Assets Debt Equity No. of shares Debt-to-equity Debt-to- package (millions) (millions) ratio assets ratio 2 3 (b) Suppose the Matrix Corporation has $27 million of operating earnings. Show that the firm's return on assets is 15% (c) Assuming there are no taxes, compute the earnings per share for the three financing packages by completing the table below. Financing package 1 2 3 Operating earnings in millions $27.0 $27.0 $27.0 Interest expense in millions = Earnings available to owners in millions No. of shares in millions Earnings per share (a) Complete the table below listing earnings per share for each of the three financing packages based on three assumptions for the return on assets shown below. Financing package Assumed ROA 1 2 3 15% 12% 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts