Question: Old MathJax webview Old MathJax webview Please help! Trying to figure out how to do 5. [Capital Structure and Agency cost] The All-Mine Corporation is

Old MathJax webview

Please help! Trying to figure out how to do

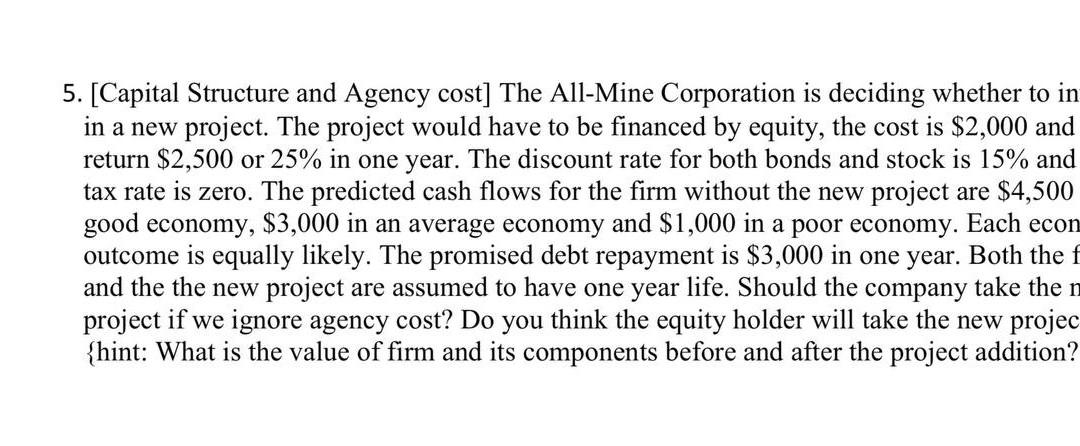

5. [Capital Structure and Agency cost] The All-Mine Corporation is deciding whether to in in a new project. The project would have to be financed by equity, the cost is $2,000 and return $2,500 or 25% in one year. The discount rate for both bonds and stock is 15% and tax rate is zero. The predicted cash flows for the firm without the new project are $4,500 good economy, $3,000 in an average economy and $1,000 in a poor economy. Each econ outcome is equally likely. The promised debt repayment is $3,000 in one year. Both the f and the the new project are assumed to have one year life. Should the company take the n project if we ignore agency cost? Do you think the equity holder will take the new projec {hint: What is the value of firm and its components before and after the project addition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts