Question: Old MathJax webview Please answer completely The Learning Journal is a space where you should reflect on what was learned during the week and how

Old MathJax webview

Please answer completely

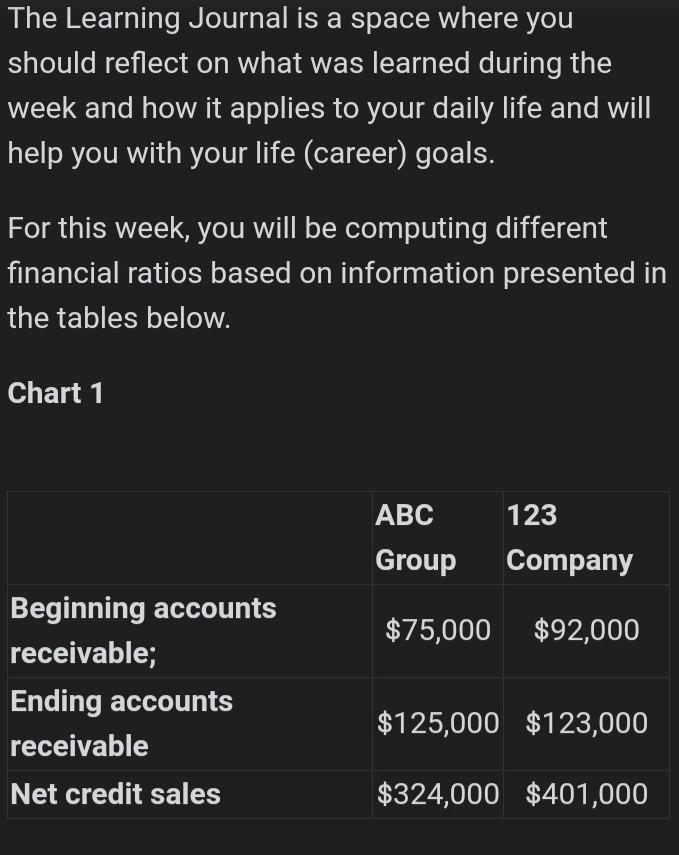

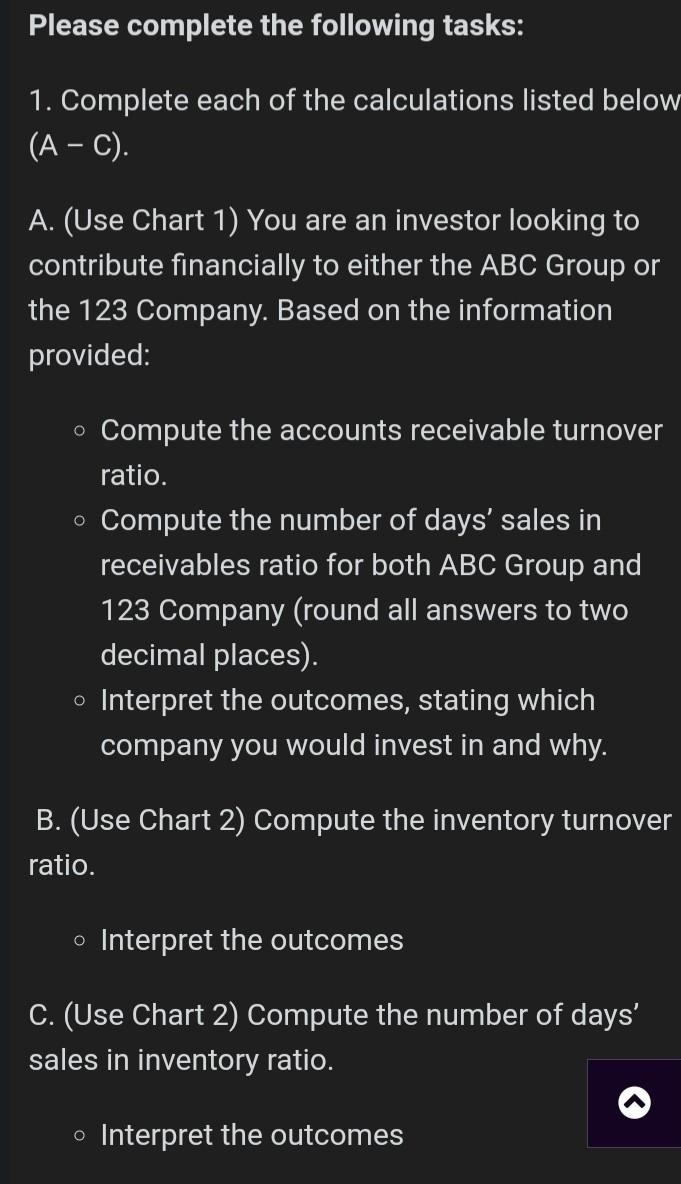

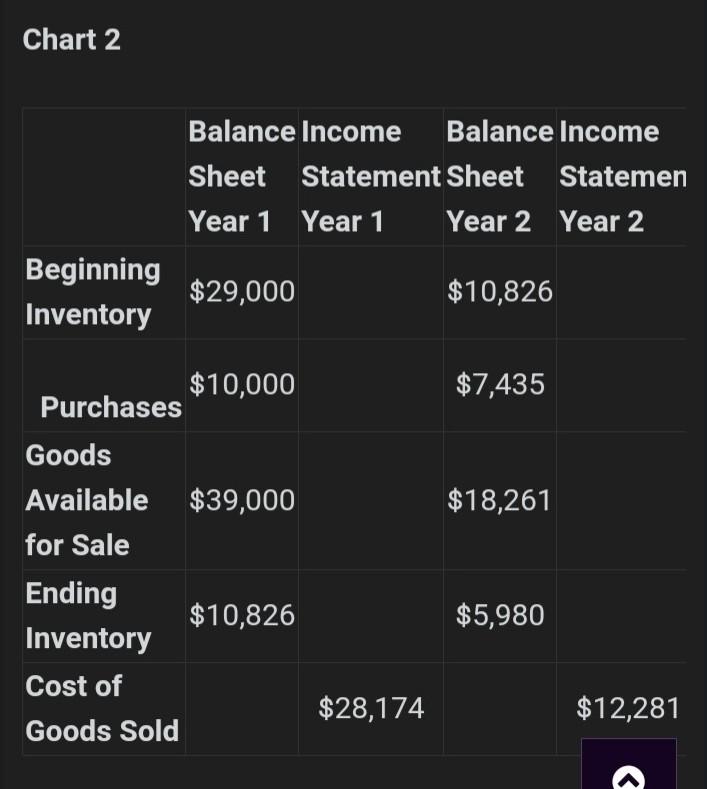

The Learning Journal is a space where you should reflect on what was learned during the week and how it applies to your daily life and will help you with your life (career) goals. For this week, you will be computing different financial ratios based on information presented in the tables below. Chart 1 ABC 123 Group Company $75,000 $92,000 Beginning accounts receivable; Ending accounts receivable Net credit sales $125,000 $123,000 $324,000 $401,000 Please complete the following tasks: 1. Complete each of the calculations listed below (A - C). A. (Use Chart 1) You are an investor looking to contribute financially to either the ABC Group or the 123 Company. Based on the information provided: o Compute the accounts receivable turnover ratio. o Compute the number of days' sales in receivables ratio for both ABC Group and 123 Company (round all answers to two decimal places). o Interpret the outcomes, stating which company you would invest in and why. B. (Use Chart 2) Compute the inventory turnover ratio. o Interpret the outcomes C. (Use Chart 2) Compute the number of days' sales in inventory ratio. o Interpret the outcomes Chart 2 Balance Income Balance Income Sheet Statement Sheet Statemen Year 1 Year 1 Year 2 Year 2 Beginning Inventory $29,000 $10,826 $7,435 $18,261 $10,000 Purchases Goods Available $39,000 for Sale Ending $10,826 Inventory Cost of Goods Sold $5,980 $28,174 $12,281

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts