Question: Old MathJax webview please do it in 10 minutes will upvote Question 4: Max, Lilly and Jiao Max, Lilly, and Jiao have been in partnership

Old MathJax webview

please do it in 10 minutes will upvote

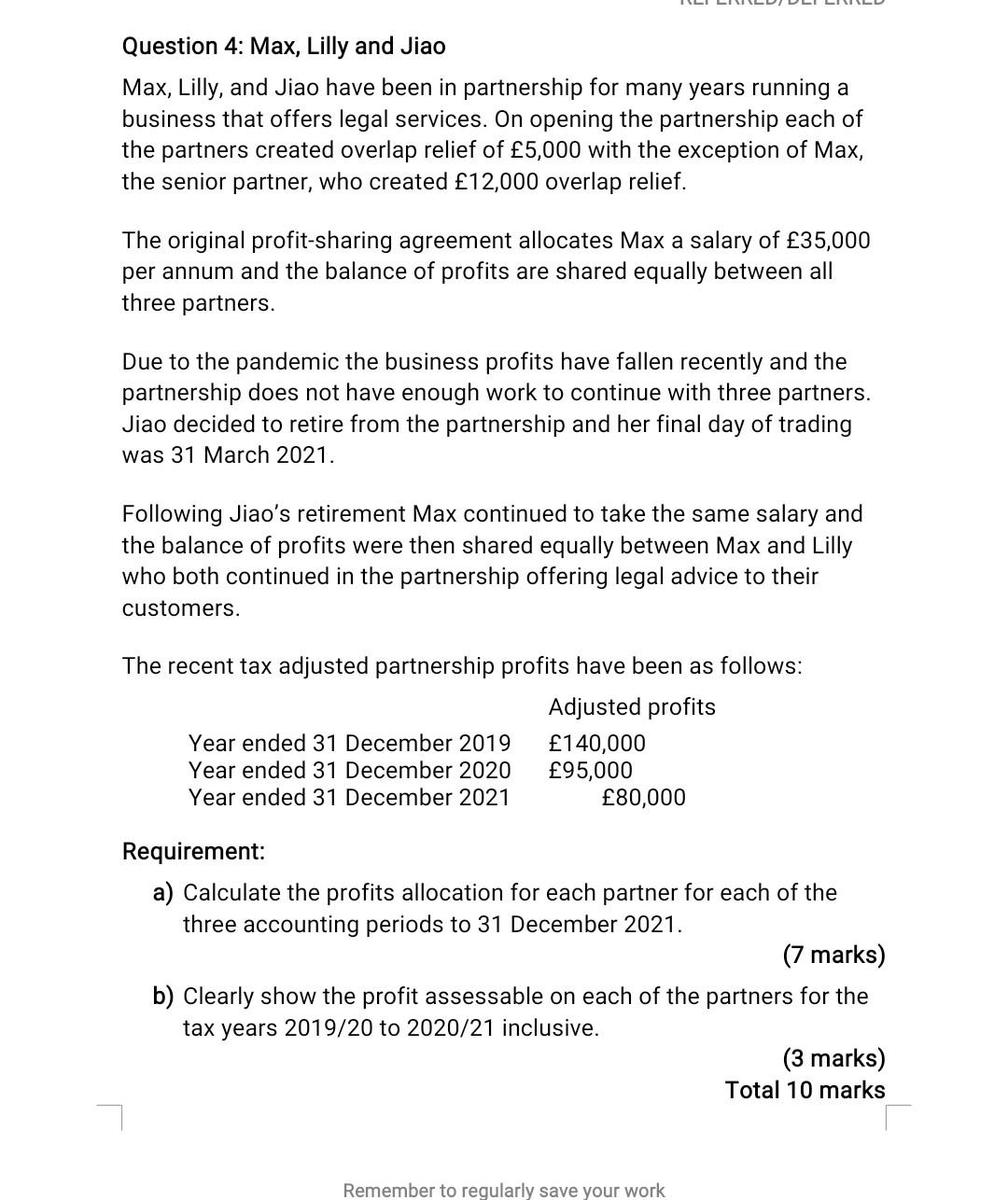

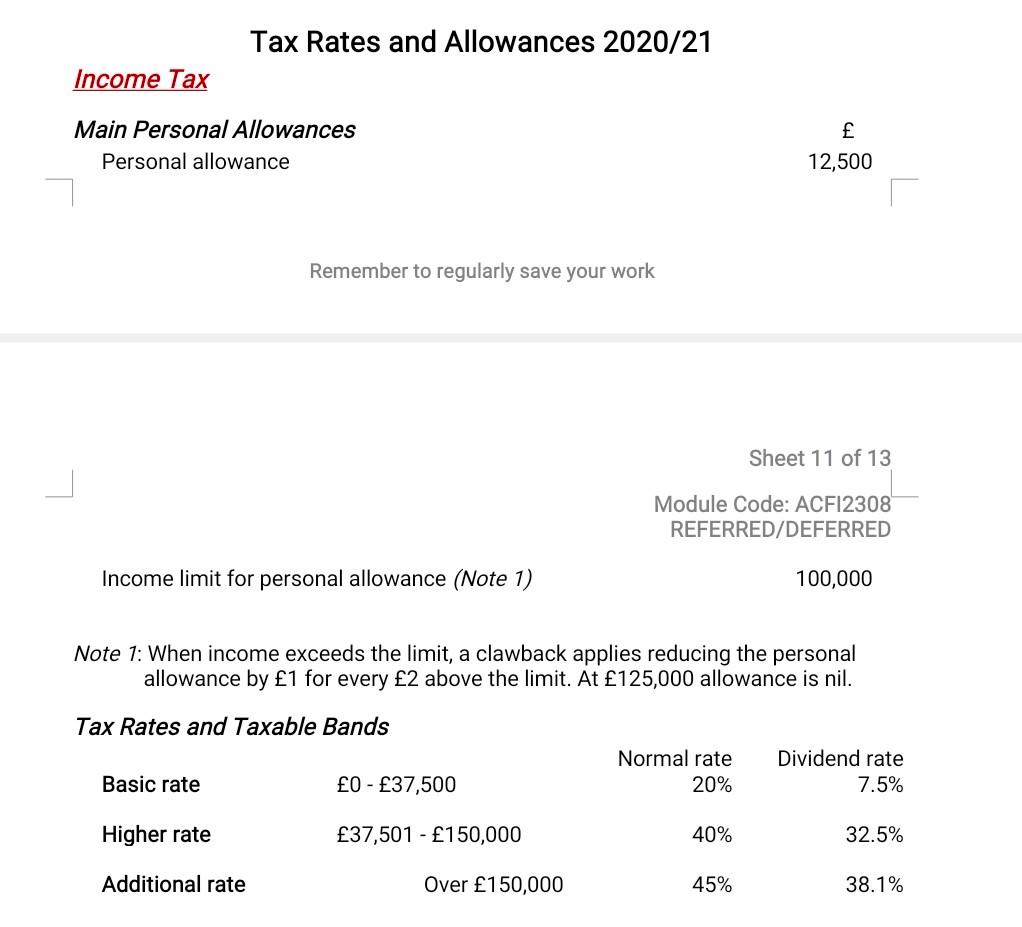

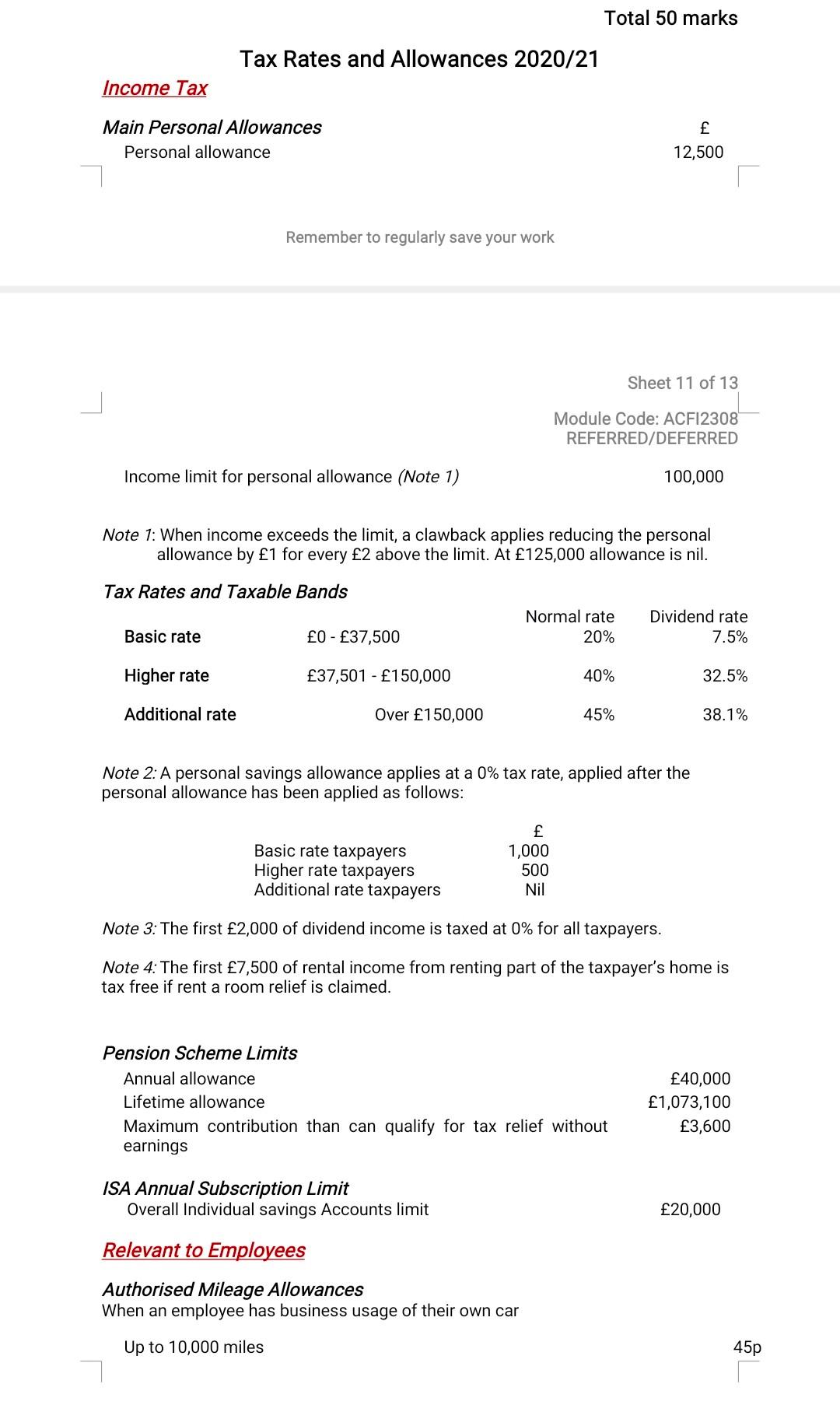

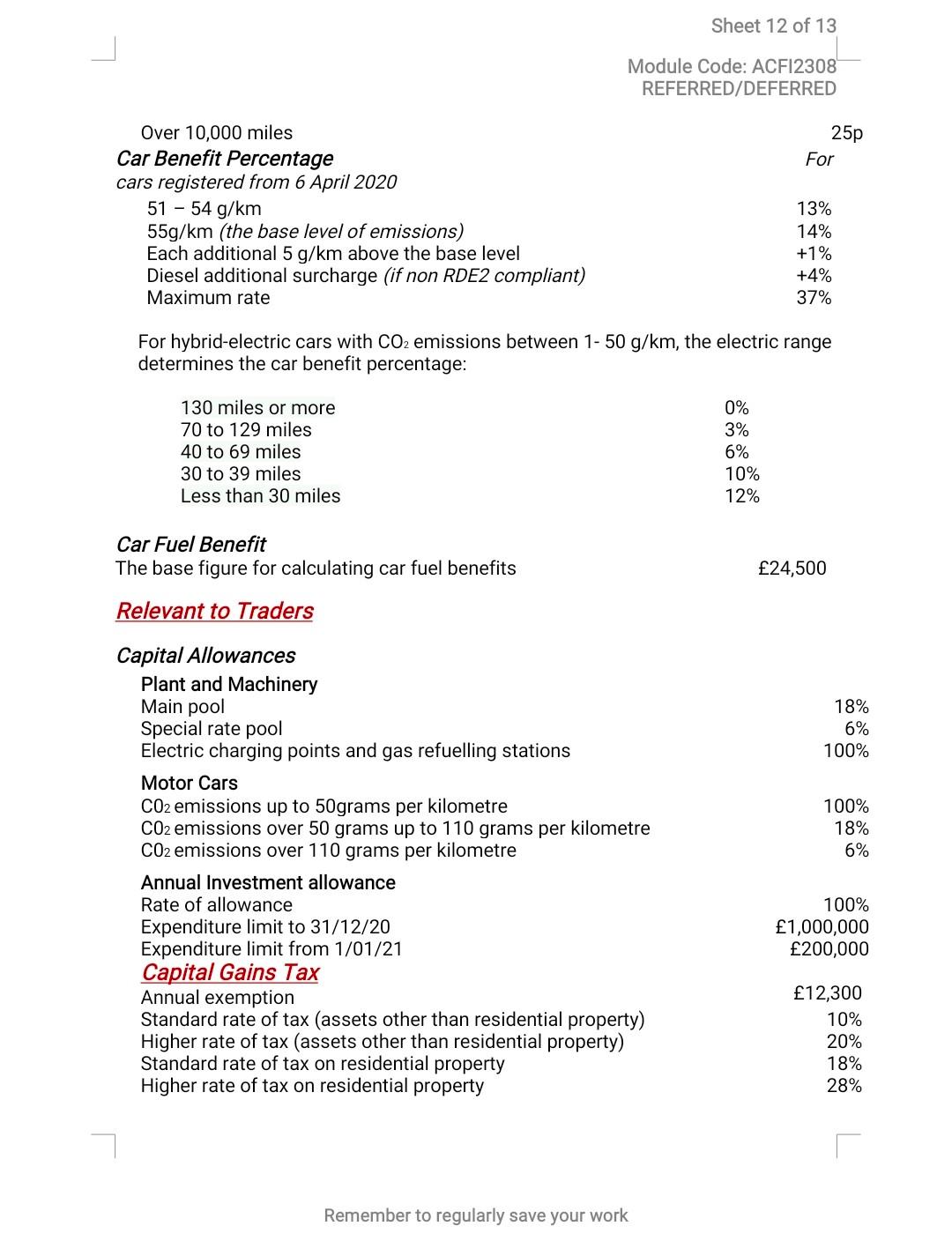

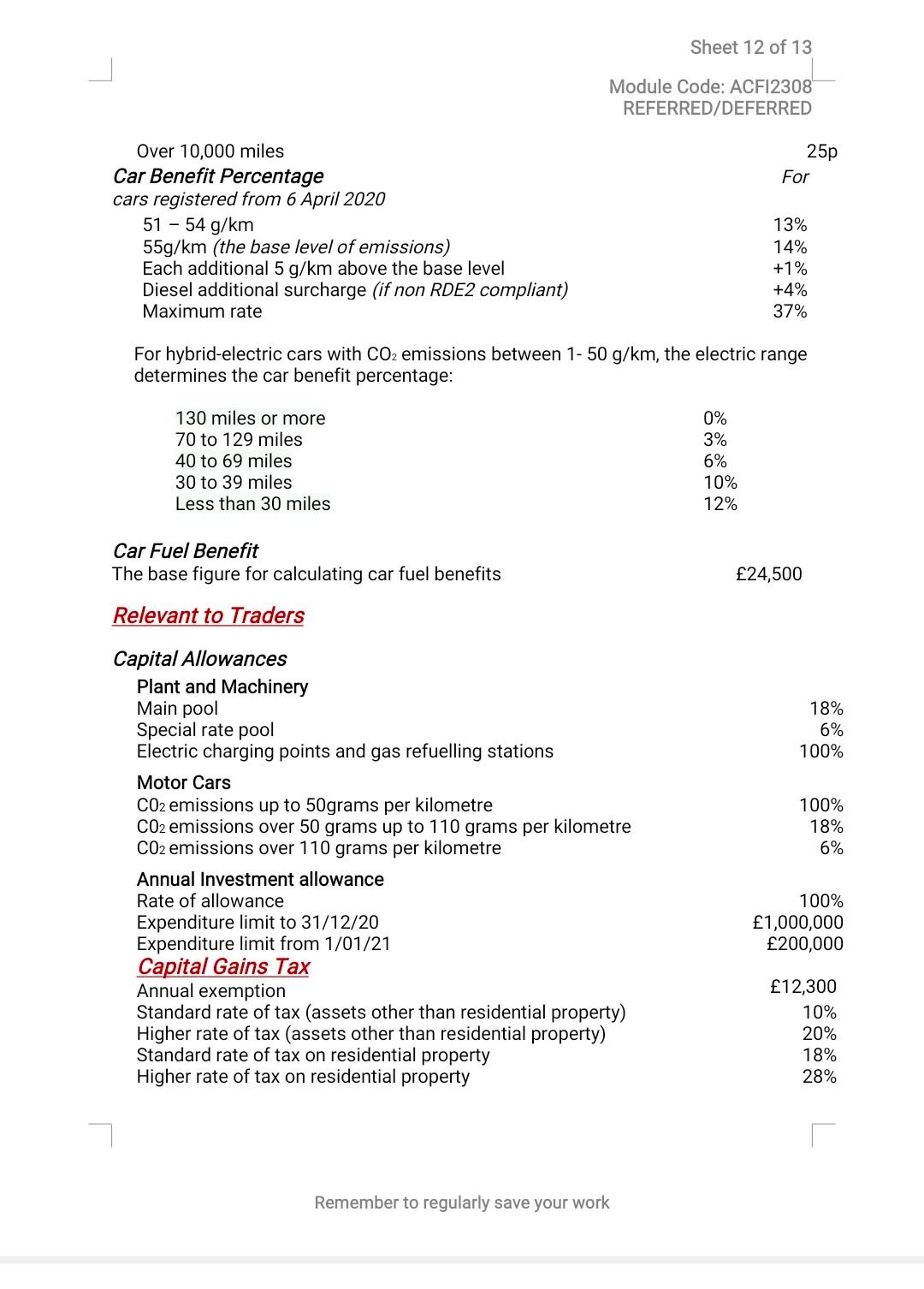

Question 4: Max, Lilly and Jiao Max, Lilly, and Jiao have been in partnership for many years running a business that offers legal services. On opening the partnership each of the partners created overlap relief of 5,000 with the exception of Max, the senior partner, who created 12,000 overlap relief. The original profit-sharing agreement allocates Max a salary of 35,000 per annum and the balance of profits are shared equally between all three partners. Due to the pandemic the business profits have fallen recently and the partnership does not have enough work to continue with three partners. Jiao decided to retire from the partnership and her final day of trading was 31 March 2021. Following Jiao's retirement Max continued to take the same salary and the balance of profits were then shared equally between Max and Lilly who both continued in the partnership offering legal advice to their customers. The recent tax adjusted partnership profits have been as follows: Requirement: a) Calculate the profits allocation for each partner for each of the three accounting periods to 31 December 2021. (7 marks) b) Clearly show the profit assessable on each of the partners for the tax years 2019/20 to 2020/21 inclusive. (3 marks) Total 10 marks Remember to regularly save your work Remember to regularly save your work Sheet 11 of 13 Module Code: ACFI2308 REFERRED/DEFERRED Income limit for personal allowance (Note 1) 100,000 Note 1: When income exceeds the limit, a clawback applies reducing the personal allowance by 1 for every 2 above the limit. At 125,000 allowance is nil. Note 2: A personal savings allowance applies at a 0% tax rate, applied after the personal allowance has been applied as follows: Note 3: The first 2,000 of dividend income is taxed at 0% for all taxpayers. Note 4: The first 7,500 of rental income from renting part of the taxpayer's home is tax free if rent a room relief is claimed. For hybrid-electric cars with CO2 emissions between 150g/km, the electric range determines the car benefit percentage: For hybrid-electric cars with CO2 emissions between 150g/km, the electric range determines the car benefit percentage: Car Fuel Benefit The base figure for calculating car fuel benefits 24,500 Remember to regularly save your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts