Question: Old MathJax webview please do it in one hour please urgently... I'll give you up thumb definitely please do it in excel and show all

Old MathJax webview

please do it in one hour please urgently... I'll give you up thumb definitely

please do it in excel and show all related formulas

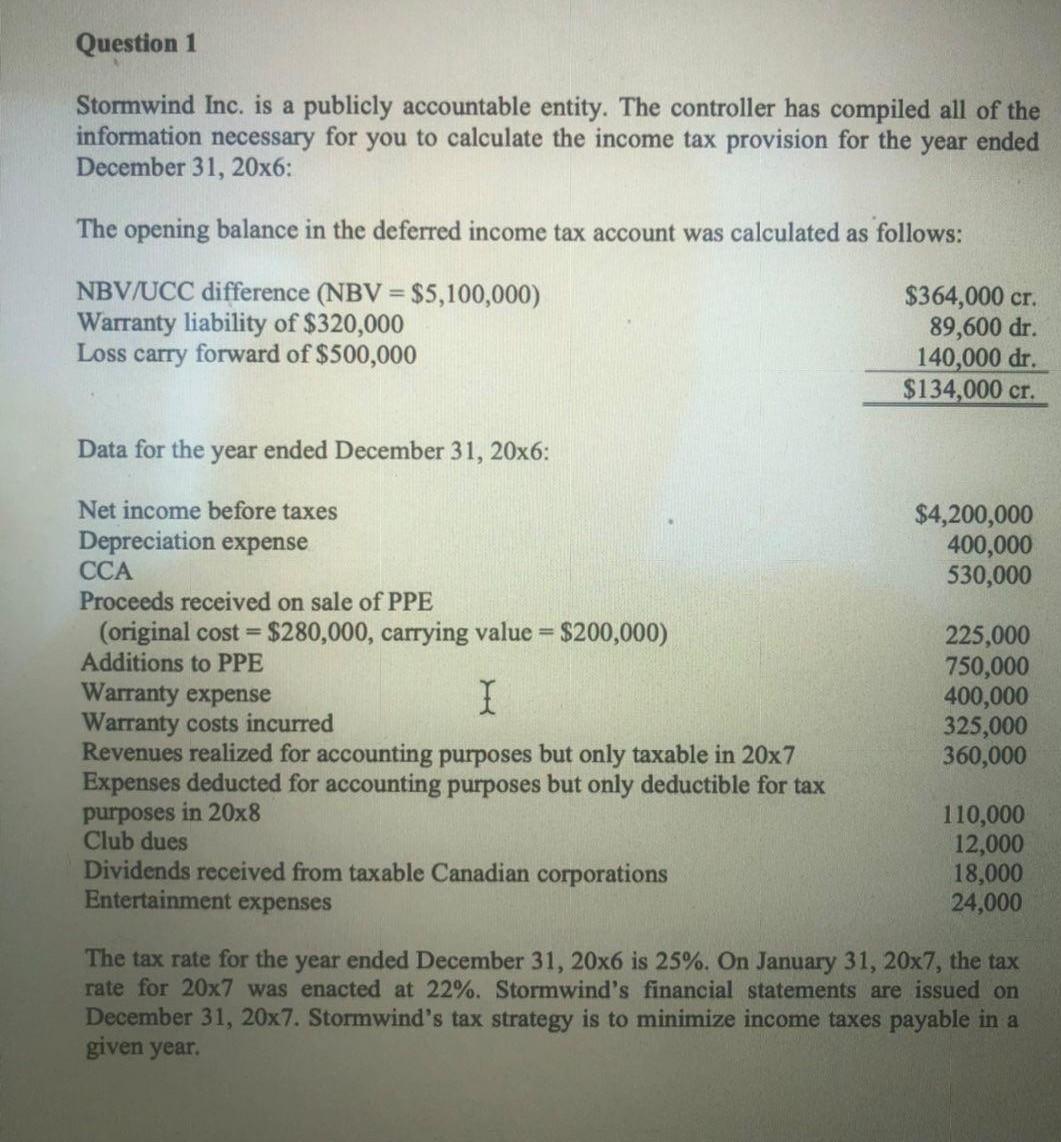

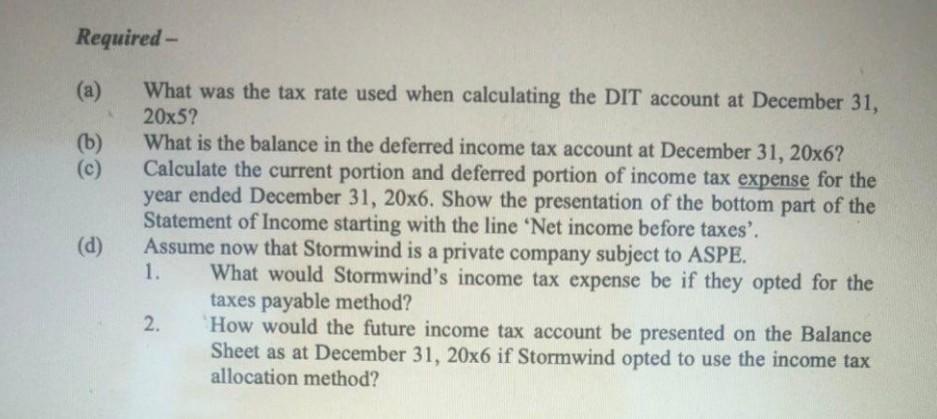

Question 1 Stormwind Inc. is a publicly accountable entity. The controller has compiled all of the information necessary for you to calculate the income tax provision for the December 31, 20x6: year ended The opening balance in the deferred income tax account was calculated as follows: NBV/UCC difference (NBV = $5,100,000) Warranty liability of $320,000 Loss carry forward of $500,000 $364,000 cr. 89,600 dr. 140,000 dr. $134,000 cr. Data for the year ended December 31, 20x6: $4,200,000 400,000 530,000 Net income before taxes Depreciation expense CCA Proceeds received on sale of PPE (original cost = $280,000, carrying value = $200,000) Additions to PPE Warranty expense I Warranty costs incurred Revenues realized for accounting purposes but only taxable in 20x7 Expenses deducted for accounting purposes but only deductible for tax purposes in 20x8 Club dues Dividends received from taxable Canadian corporations Entertainment expenses 225,000 750,000 400,000 325,000 360,000 110,000 12,000 18,000 24,000 The tax rate for the year ended December 31, 20x6 is 25%. On January 31, 20x7, the tax rate for 20x7 was enacted at 22%. Stormwind's financial statements are issued on December 31, 20x7. Stormwind's tax strategy is to minimize income taxes payable in a given year. Required - (b) (c) What was the tax rate used when calculating the DIT account at December 31, 20x5? What is the balance in the deferred income tax account at December 31, 20x6? Calculate the current portion and deferred portion of income tax expense for the year ended December 31, 20x6. Show the presentation of the bottom part of the Statement of Income starting with the line Net income before taxes'. Assume now that Stormwind is a private company subject to ASPE. 1. What would Stormwind's income tax expense be if they opted for the taxes payable method? 2. How would the future income tax account be presented on the Balance Sheet as at December 31, 20x6 if Stormwind opted to use the income tax allocation method? (d) Question 1 Stormwind Inc. is a publicly accountable entity. The controller has compiled all of the information necessary for you to calculate the income tax provision for the December 31, 20x6: year ended The opening balance in the deferred income tax account was calculated as follows: NBV/UCC difference (NBV = $5,100,000) Warranty liability of $320,000 Loss carry forward of $500,000 $364,000 cr. 89,600 dr. 140,000 dr. $134,000 cr. Data for the year ended December 31, 20x6: $4,200,000 400,000 530,000 Net income before taxes Depreciation expense CCA Proceeds received on sale of PPE (original cost = $280,000, carrying value = $200,000) Additions to PPE Warranty expense I Warranty costs incurred Revenues realized for accounting purposes but only taxable in 20x7 Expenses deducted for accounting purposes but only deductible for tax purposes in 20x8 Club dues Dividends received from taxable Canadian corporations Entertainment expenses 225,000 750,000 400,000 325,000 360,000 110,000 12,000 18,000 24,000 The tax rate for the year ended December 31, 20x6 is 25%. On January 31, 20x7, the tax rate for 20x7 was enacted at 22%. Stormwind's financial statements are issued on December 31, 20x7. Stormwind's tax strategy is to minimize income taxes payable in a given year. Required - (b) (c) What was the tax rate used when calculating the DIT account at December 31, 20x5? What is the balance in the deferred income tax account at December 31, 20x6? Calculate the current portion and deferred portion of income tax expense for the year ended December 31, 20x6. Show the presentation of the bottom part of the Statement of Income starting with the line Net income before taxes'. Assume now that Stormwind is a private company subject to ASPE. 1. What would Stormwind's income tax expense be if they opted for the taxes payable method? 2. How would the future income tax account be presented on the Balance Sheet as at December 31, 20x6 if Stormwind opted to use the income tax allocation method? (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts