Question: please do it in one hour please urgently... I'll give you up thumb definitely and please do it in excel file and show all related

please do it in one hour please urgently... I'll give you up thumb definitely and please do it in excel file and show all related formulas

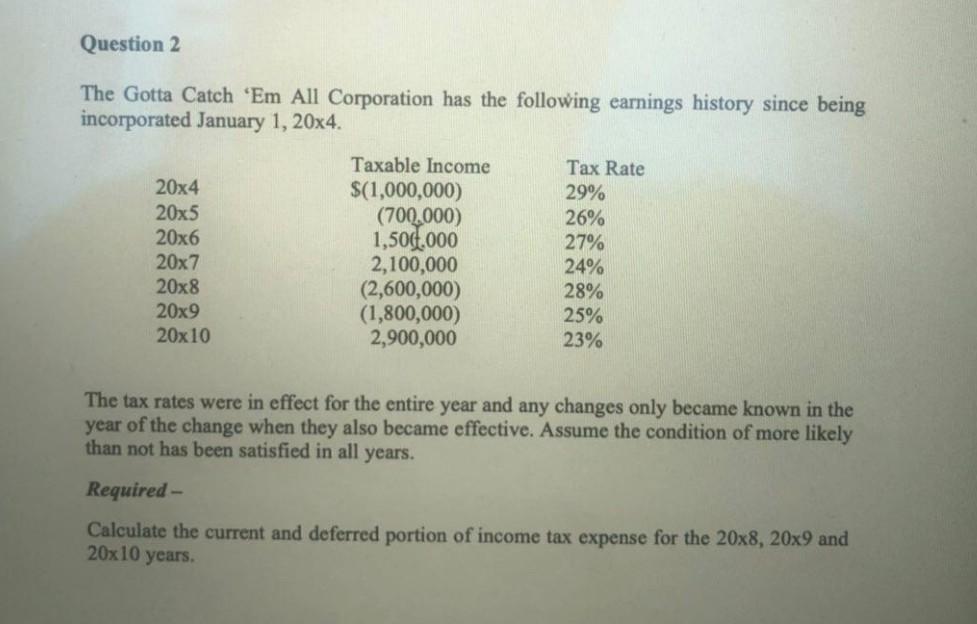

Question 2 The Gotta Catch 'Em All Corporation has the following earnings history since being incorporated January 1, 20x4. Taxable Income Tax Rate 20x4 $(1,000,000) 29% 20x5 (700.000) 26% 20x6 1,504.000 27% 20x7 2,100,000 24% 20x8 (2,600,000) 28% 20x9 (1,800,000) 25% 20x10 2,900,000 23% The tax rates were in effect for the entire year and any changes only became known in the year of the change when they also became effective. Assume the condition of more likely than not has been satisfied in all years. Required - Calculate the current and deferred portion of income tax expense for the 20x8,20x9 and 20x10 years Question 2 The Gotta Catch 'Em All Corporation has the following earnings history since being incorporated January 1, 20x4. Taxable Income Tax Rate 20x4 $(1,000,000) 29% 20x5 (700.000) 26% 20x6 1,504.000 27% 20x7 2,100,000 24% 20x8 (2,600,000) 28% 20x9 (1,800,000) 25% 20x10 2,900,000 23% The tax rates were in effect for the entire year and any changes only became known in the year of the change when they also became effective. Assume the condition of more likely than not has been satisfied in all years. Required - Calculate the current and deferred portion of income tax expense for the 20x8,20x9 and 20x10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts