Question: Old MathJax webview Please help. THE VAT IS CALCULATED AT 15% Mr Chester, a registered VAT vendor and attorney, practices as a sole trader. The

Old MathJax webview

Please help.

THE VAT IS CALCULATED AT 15%

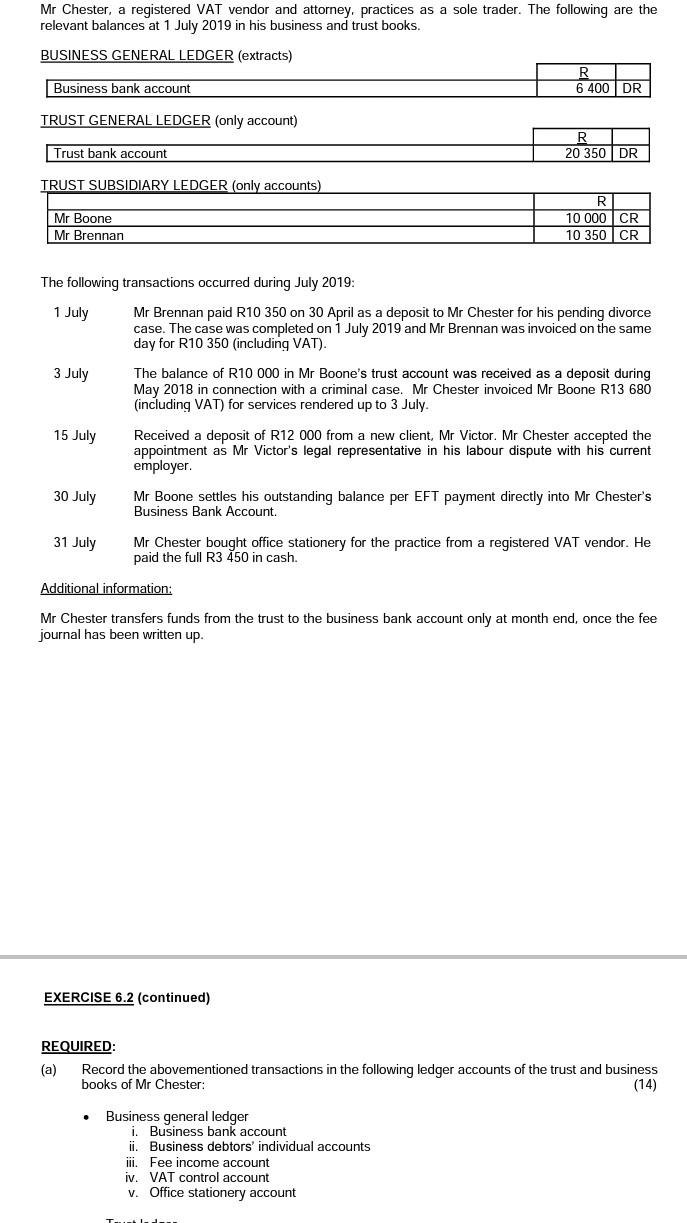

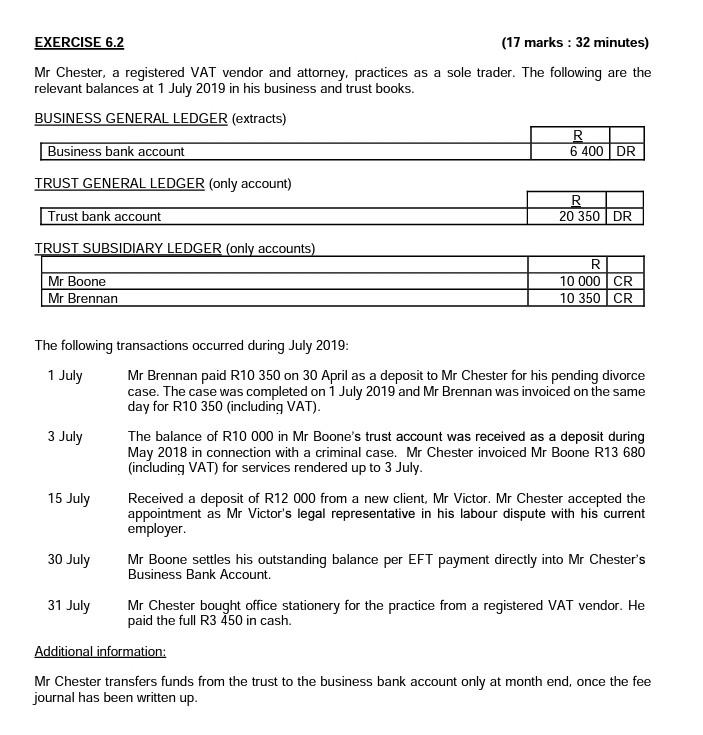

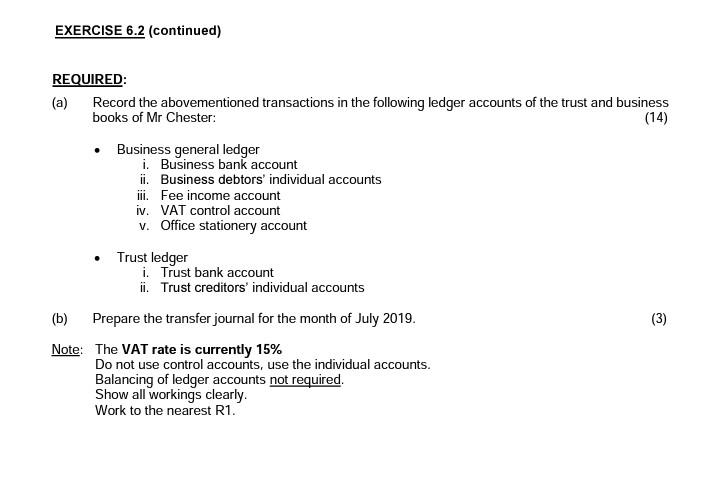

Mr Chester, a registered VAT vendor and attorney, practices as a sole trader. The following are the relevant balances at 1 July 2019 in his business and trust books. BUSINESS GENERAL LEDGER (extracts) Business bank account R 6 400 | DR TRUST GENERAL LEDGER (only account) Trust bank account R 20 350 DR TRUST SUBSIDIARY LEDGER (only accounts) Mr Boone Mr Brennan R 10 000 CR 10 350 CR 1 July The following transactions occurred during July 2019: Mr Brennan paid R10 350 on 30 April as a deposit to Mr Chester for his pending divorce case. The case was completed on 1 July 2019 and Mr Brennan was invoiced on the same day for R10 350 (including VAT). 3 July The balance of R10 000 in Mr Boone's trust account was received as a deposit during May 2018 in connection with a criminal case. Mr Chester invoiced Mr Boone R13 680 (including VAT) for services rendered up to 3 July. 15 July Received a deposit of R12 000 from a new client, Mr Victor. Mr Chester accepted the appointment as Mr Victor's legal representative in his labour dispute with his current employer 30 July Mr Boone settles his outstanding balance per EFT payment directly into Mr Chester's Business Bank Account. 31 July Mr Chester bought office stationery for the practice from a registered VAT vendor. He paid the full R3 450 in cash. Additional information: Mr Chester transfers funds from the trust to the business bank account only at month end, once the fee journal has been written up. EXERCISE 6.2 (continued) REQUIRED: (a) Record the abovementioned transactions in the following ledger accounts of the trust and business books of Mr Chester: (14) . Business general ledger i. Business bank account ii. Business debtors' individual accounts iii. Fee income account iv. VAT control account V Office stationery account EXERCISE 6.2 (17 marks : 32 minutes) Mr Chester, a registered VAT vendor and attorney, practices as a sole trader. The following are the relevant balances at 1 July 2019 in his business and trust books. BUSINESS GENERAL LEDGER (extracts) R Business bank account 6 400 DR TRUST GENERAL LEDGER (only account) R Trust bank account 20 350 DR TRUST SUBSIDIARY LEDGER (only accounts) Mr Boone Mr Brennan R 10 000 CR 10 350 CR 3 July The following transactions occurred during July 2019: 1 July Mr Brennan paid R10 350 on 30 April as a deposit to Mr Chester for his pending divorce case. The case was completed on 1 July 2019 and Mr Brennan was invoiced on the same day for R10 350 (including VAT). The balance of R10 000 in Mr Boone's trust account was received as a deposit during May 2018 in connection with a criminal case. Mr Chester invoiced Mr Boone R13 680 (including VAT) for services rendered up to 3 July. 15 July Received a deposit of R12 000 from a new client, Mr Victor. Mr Chester accepted the appointment as Mr Victor's legal representative in his labour dispute with his current employer. 30 July Mr Boone settles his outstanding balance per EFT payment directly into Mr Chester's Business Bank Account. 31 July Mr Chester bought office stationery for the practice from a registered VAT vendor. He paid the full R3 450 in cash. Additional information: Mr Chester transfers funds from the trust to the business bank account only at month end, once the fee journal has been written up. EXERCISE 6.2 (continued) REQUIRED: (a) Record the abovementioned transactions in the following ledger accounts of the trust and business books of Mr Chester: (14) Business general ledger i. Business bank account ii. Business debtors' individual accounts iii. Fee income account iv. VAT control account v. Office stationery account Trust ledger i. Trust bank account ii. Trust creditors' individual accounts (b) Prepare the transfer journal for the month of July 2019. (3) Note: The VAT rate is currently 15% Do not use control accounts, use the individual accounts. Balancing of ledger accounts not required. Show all workings clearly. Work to the nearest R1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts