Question: On August 1 , Saola issued a $ 7 4 0 , ooo, semi - annual, 7 year, 6 . 5 % bond. The market

On August Saola issued a $ooo, semiannual, year, bond. The market rate for similar

bonds on that day was Saola uses the effective interest method to record the amortization or

premiums and discounts. Saola's management has decided to report net bonds on the balance sheet,

instead of reporting the bond and its premium or discount separately. No entries have yet been made

for the bond.

Saola's management would like to know the effect of your adjustment on the following ratios:

Debt to Equity Ratio Total Liabilities Total Equity

Current Ratio

ROA

Calculations

Make the appropriate journal entries, if any, to account for the new bond and any accruedinterest including any necessary changes to income tax expenseMake any necessary changes to the financial statements.Critical ThinkingCalculate each of the required ratios using the original values before any changes and theupdated values after your changesIssuing this bond has left Saola with a lot of cash on hand. Do you think holding so muchcash is a good decision? What do you think investor's reaction will be to such a high cashbalance? Consider the effect it has had on the three ratios you calculated. Would the changesimprove or reduce investors' perception of Saola? Defend your answer.Saola's CFO has been concerned about the issuance of this bond. The company really doesn'tneed the additional cash at the moment, despite some vague plans to expand in the nearfuture. The rest of the management team, on the other hand, felt that the additional cashwould allow them to repurchase shares and pay a larger dividend for the period, both ofwhich would help to calm investors' fears after all of the changes that needed to be made tothe financial statements this period. Provide two arguments that the CFO could haveused to try to talk his colleagues out of issuing the bond.

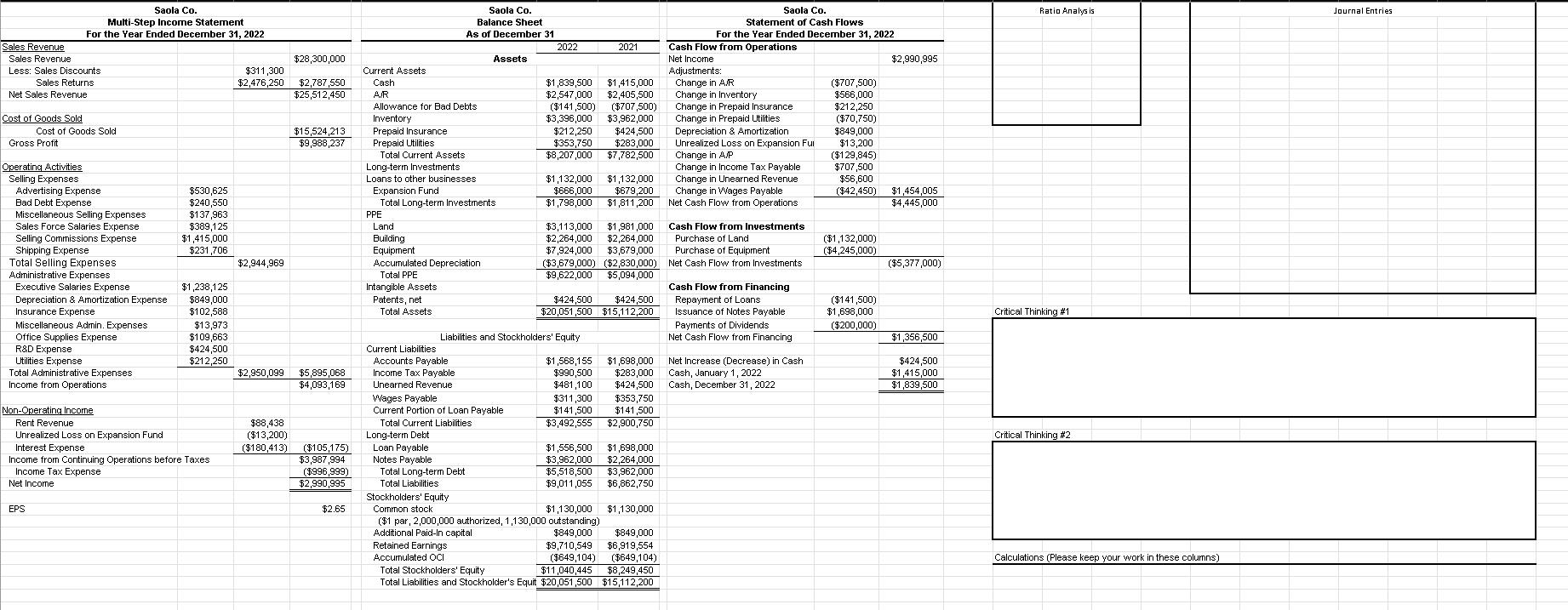

Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Net Sales Revenue Cost of Goods Sold Saola Co. Multi-Step Income Statement For the Year Ended December 31, 2022 Gross Profit Cost of Goods Sold Operating Activities Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Executive Salaries Expense Depreciation & Amortization Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense R&D Expense Utilities Expense Total Administrative Expenses Income from Operations Non-Operating Income Rent Revenue EPS $530,625 $240,550 $137,963 $389,125 $1,415,000 $231,706 $1,238,125 $849,000 $102,588 $13,973 $109,663 $424,500 $212,250 Unrealized Loss on Expansion Fund Interest Expense Income from Continuing Operations before Taxes Income Tax Expense Net Income $28,300,000 $311,300 $2,476,250 $2,787,550 $25,512,450 $2,944,969 $2,950,099 $88,438 ($13,200) ($180,413) $15,524,213 $9,988,237 $5,895,068 $4,093,169 ($105,175) $3,987,994 ($996,999) $2,990,995 $2.65 Current Assets Cash A/R Allowance for Bad Debts Inventory Prepaid Insurance Prepaid Utilities Total Current Assets Long-term Investments Loans to other businesses Expansion Fund PPE Saola Co. Balance Sheet As of December 31 Total Long-term Investments Land Building Equipment Accumulated Depreciation Total PPE Intangible Assets Patents, net Total Assets Assets Current Liabilities Accounts Payable Income Tax Payable Unearned Revenue 2022 Wages Payable Current Portion of Loan Payable Total Current Liabilities Long-term Debt Loan Payable Notes Payable Total Long-term Debt Total Liabilities Stockholders' Equity Common stock $1,839,500 $1,415,000 $2,547,000 $2,405,500 ($141,500) ($707,500) $3,396,000 $3,962,000 $212,250 $424,500 $353,750 $283,000 $8,207,000 $7,782,500 $1,132,000 $1,132,000 $666,000 $679,200 $1,798,000 $1,811,200 Liabilities and Stockholders' Equity $1,568,155 $990,500 $481,100 $3,113,000 $1,981,000 $2,264,000 $2,264,000 $7,924,000 $3,679,000 ($3,679,000) ($2,830,000) $9,622,000 $5,094,000 2021 $424,500 $424,500 $20,051,500 $15,112,200 $311,300 $141,500 $3,492,555 $1,130,000 ($1 par, 2,000,000 authorized, 1,130,000 outstanding) Additional Paid-In capital. Retained Earnings Accumulated OCI $1,556,500 $1,698,000 $3,962,000 $2,264,000 $5,518,500 $3,962,000 $9,011,055 $6,862,750 Total Stockholders' Equity Total Liabilities and Stockholder's Equit $20,051,500 $1,130,000 $849,000 $849,000 $9,710,549 $6,919,554 ($649,104) ($649,104) $11,040,445 $8,249,450 $15,112,200 Saola Co. Statement of Cash Flows For the Year Ended December 31, 2022 $1,698,000 Net Increase (Decrease) in Cash $283,000 Cash, January 1, 2022 $424,500 Cash, December 31, 2022 $353,750 $141,500 $2,900,750 Cash Flow from Operations Net Income Adjustments: Change in A/R Change in Inventory Change in Prepaid Insurance Change in Prepaid Utilities Depreciation & Amortization Unrealized Loss on Expansion Ful Change in A/P Change in Income Tax Payable Change in Unearned Revenue. Change in Wages Payable Net Cash Flow from Operations Cash Flow from Investments Purchase of Land Purchase of Equipment Net Cash Flow from Investments Cash Flow from Financing Repayment of Loans Issuance of Notes Payable Payments of Dividends Net Cash Flow from Financing ($707,500) $566,000 $212,250 ($70,750) $849,000 $13,200 ($129,845) $707,500 $56,600 ($42,450) $1,454,005 $4,445,000 ($1,132,000) ($4,245,000) $2,990,995 ($141,500) $1,698,000 ($200,000) ($5,377,000) $1,356,500 $424,500 $1,415,000 $1,839,500 Ratio Analysis Critical Thinking #1 Critical Thinking #2 Calculations (Please keep your work in these columns) Journal Entries

Step by Step Solution

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Ill provide accurate answers while showing all calculations for the Excel assignment scenario provided 1 Journal Entries for the New Bond Debit Cash f... View full answer

Get step-by-step solutions from verified subject matter experts