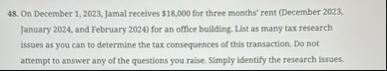

Question: On December 1 , 2 0 2 3 , Jamal receives $ 1 8 , 0 0 0 for three months' rent ( December 2

On December Jamal receives $ for three months' rent December January and February for an office building. List as many tax research issues as you can to determine the tax consequences of this transaction. Do not attempt to answer any of the questions you raise. Simply identify the research issues.On December Jamal receives $ for three months' rent December January and February for an office building. List as many tax research issues as you can to determine the tax consequences of this transaction. Do not attempt to answer any of the questions you raise. Simply identify the research issues.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock