Question: On January 1 , 2 0 2 4 , the general ledger of ACME Fireworks includes the following account balances: During January 2 0 2

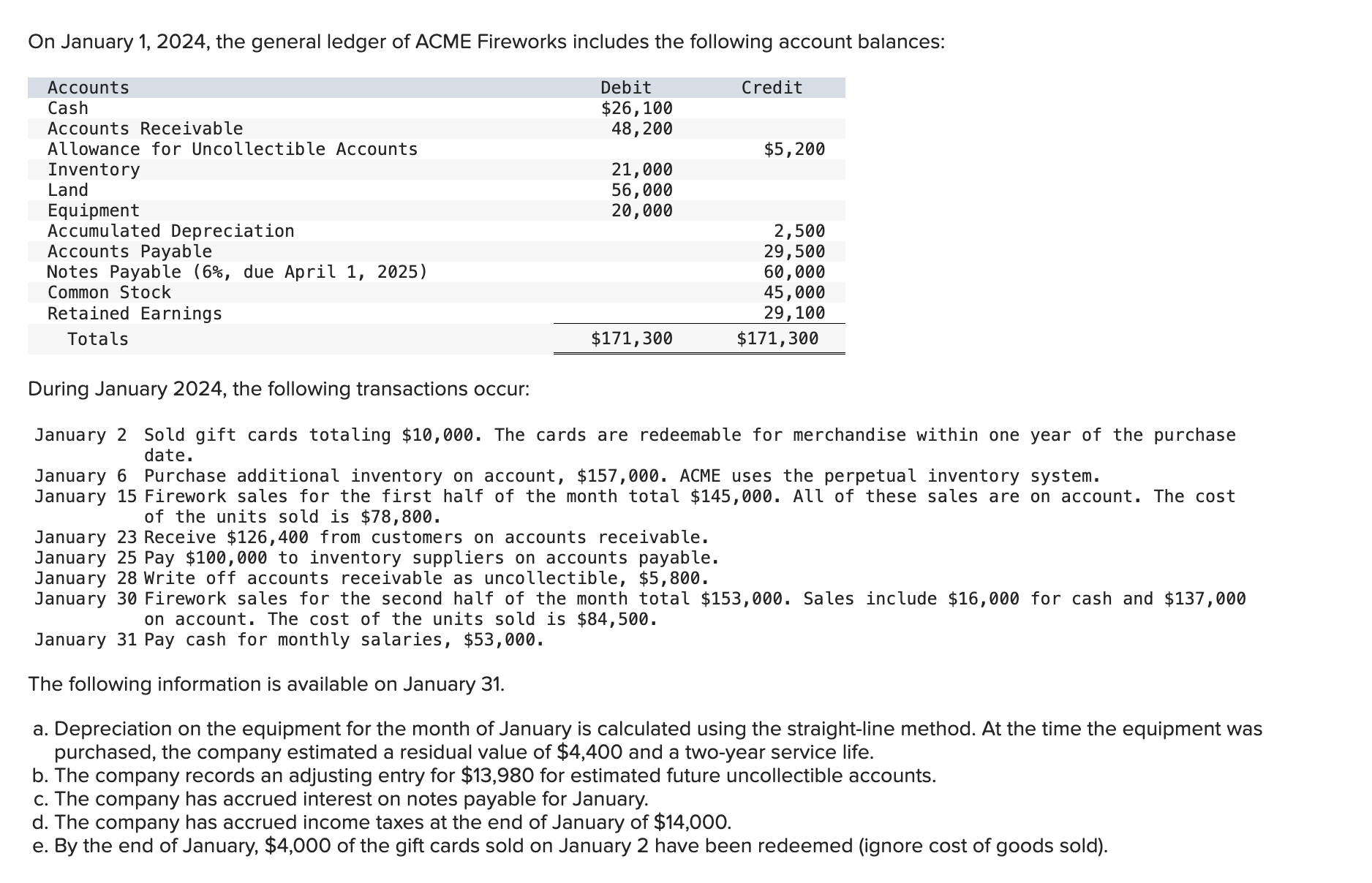

On January the general ledger of ACME Fireworks includes the following account balances:

During January the following transactions occur:

January Sold gift cards totaling $ The cards are redeemable for merchandise within one year of the purchase

date.

January Purchase additional inventory on account, $ ACME uses the perpetual inventory system.

January Firework sales for the first half of the month total $ All of these sales are on account. The cost

of the units sold is $

January Receive $ from customers on accounts receivable.

January Pay $ to inventory suppliers on accounts payable.

January Write off accounts receivable as uncollectible, $

January Firework sales for the second half of the month total $ Sales include $ for cash and $

on account. The cost of the units sold is $

January Pay cash for monthly salaries, $

The following information is available on January

a Depreciation on the equipment for the month of January is calculated using the straightline method. At the time the equipment was purchased, the company estimated a residual value of $ and a twoyear service life.

b The company records an adjusting entry for $ for estimated future uncollectible accounts.

c The company has accrued interest on notes payable for January.

d The company has accrued income taxes at the end of January of $

e By the end of January, $ of the gift cards sold on January have been redeemed ignore cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock